Guidance on Taxability of GST on GTA Services

Page Contents

Guidance on Taxability of GST on Goods Transport Agency (GTA) Services

Goods Transport Agency (GTA):

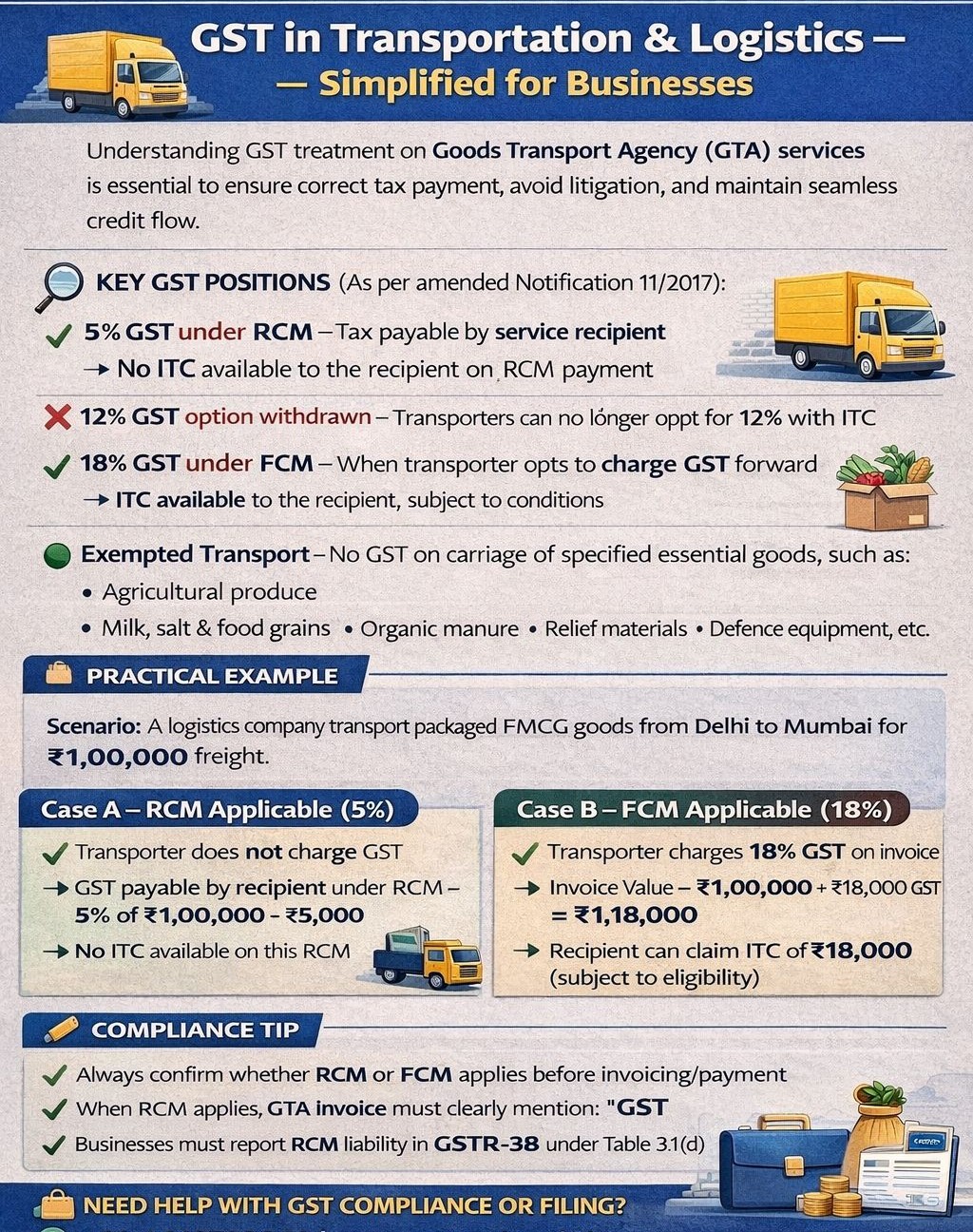

A Goods Transport Agency is a backbone of India’s logistics ecosystem. Under GST, Goods Transport Agency services involve unique tax treatment, frequent RCM vs FCM confusion, and sector-specific exemptions. Proper understanding is essential to avoid tax disputes, interest, and INPUT TAX CREDIT blockage.

Services Covered under GTA :

Goods Transport Agency service includes composite services, such as transportation of goods, loading/unloading, packing/unpacking, transshipment, & temporary warehousing. However, if these are part of transport service, GST applies as Goods Transport Agency service

GST Rates on GTA Services

| Nature of Service | GST Rate |

| Agricultural produce, milk, salt, food grains, organic manure, newspapers, relief material, defence equipment | 0% (Exempt) |

| Single consignment ≤ INR 1,500 | 0% (Exempt) |

| Consignment per consignee ≤ INR 750 | 0% (Exempt) |

| Used household goods (personal use) | 0% |

| Any other goods | 5% (No INPUT TAX CREDIT) or 18% (With INPUT TAX CREDIT) |

| Hiring of vehicle to a GTA | 0% |

The 12% option with INPUT TAX CREDIT is withdrawn—no longer applicable.

GST Rates for Goods Transport Agency

| Option | GST Rate | INPUT TAX CREDIT |

| Forward Charge | 18% | INPUT TAX CREDIT Available |

| Forward Charge | 5% | INPUT TAX CREDIT is Not available |

| Reverse Charge | 5% | INPUT TAX CREDIT to recipient |

Goods Transport Agency Option must be chosen at the start of the FY

Goods Transport Agency Invoicing & Compliance Checklist

Goods Transport Agency under GST is simple once fundamentals are clear, but errors are costly. Goods Transport Agency RCM vs FCM decision, consignment note issuance, and exemption checks must be done before invoicing

The Goods Transport Agency must mention “GST payable under RCM” on the invoice and also quote the correct HSN/SAC (9965). However, RCM liability is reported in GSTR-3B Table 3.1(d). and the Goods Transport Agency is required to maintain consignment notes & freight records. The Goods Transport Agency must file returns on time to avoid interest & penalties.

Why Correct Goods Transport Agency Classification Matters

In case Goods Transport Agency made any incorrect treatment that leads to tax short payment, interest u/s 50, penalties u/s 73/74 & blocked INPUT TAX CREDIT & working capital loss.

GST liability depends on who pays the freight and their registration status, not merely on the consignor/consignee. Reverse charge applies when the service recipient belongs to the notified category and pays freight. Notified people under RCM (Section 9(3)) like the factory. Society, cooperative society, registered person under GST, Body corporate, partnership firm (including LLP), casual taxable person. If freight is paid by any of the above, then RCM applies

Key Scenarios under the Goods Transport Agency

| Freight Paid By | Recipient Status | GST Liability |

| Company / LLP / Registered Dealer | Registered | Recipient (RCM) |

| Partnership Firm | Registered | Firm (RCM) |

| Co-operative Society | Registered | Society (RCM) |

| Unregistered Person | Unregistered | GTA liable (FCM) |

| Household shifting (individual) | Unregistered | GTA liable (FCM) |

Earlier exemption for services to unregistered persons was withdrawn. However, RCM applies only for notified supplies for the Goods Transport Agency; liability still follows Section 9(3).

The Consignment Note is the Heart of the Goods Transport Agency :

- Without a consignment note, we cannot say it is a Goods Transport Agency, and GST rules for Goods Transport Agencies don’t apply.

- A valid consignment note confirms the transfer of the lien of goods to the transporter, and the transporter is responsible till delivery. The consignment note must contain the consignor & consignee details, Vehicle number, Origin & destination, Goods description & weight, and Person liable to pay GST

- Goods Transport Agency always identifies who pays freight; GTA must check if a consignment note exists; RCM applies irrespective of turnover. In case composition dealers are still covered under RCM. And it ito be noted that in case of Goods Transport Agency, Place of Supply errors = wrong tax = litigation

Place of Supply (Section 12(8)) in the case of Goods Transport Agency

| Recipient | Place of Supply |

| Registered person | Location of recipient |

| Unregistered person | Place where goods handed over |

Examples:

- Registered Bangalore dealer and delivery to Mumbai then Place of Supply = Bangalore

- Unregistered Gujarat trader and Rajasthan delivery, then Place of Supply = Gujarat

Input Tax Credit available in case Goods Transport Agency

- RCM paid by the recipient, and then Input Tax Credit fully available

- GTA under 5% FCM → No Input Tax Credit

- GTA under 18% FCM → Full Input Tax Credit

Invoicing Requirements for Goods Transport Agency : A GST-compliant invoice must include the Goods Transport Agency & recipient GSTIN, consignment note reference, freight amount, GST rate & tax breakup, & clear mention: “Tax payable under RCM” (if applicable).

Registration & returns & compliance for Goods Transport Agency

- Goods Transport Agency Registration is not required if: Entire liability falls under RCM

- If Goods Transport Agency is registered, then Goods Transport Agency must returns required GSTR-1, GSTR-3B, & GSTR-9

As per Notification No. 16/2025–CT (Rate) dated 16 July 2025, a Goods Transport Agency is any person who provides service in relation to the transport of goods by road and issues a consignment note, by whatever name called, excluding:

- E-commerce operators providing local delivery

- E-commerce operators through whom local delivery services are provided

Issuance of a consignment note is mandatory. Without it, the transporter is not a goods transport agency.

GST law exempts transport of goods by road, except for services of a goods transport agency & courier agency services. Therefore, Goods Transport Agency services are taxable, while transport by individuals without a consignment note remains exempt. In case the transporter provides the following exempted transport services, including agricultural produce, milk, salt & food grains, organic manure, relief materials, and defense equipment. Then no GST will be charged on these services.

Reverse Charge vs Forward Charge (RCM vs FCM)

- Reverse Charge (5%) : GTA does not charge GST; the recipient pays GST at 5%, and No INPUT TAX CREDIT available. GTA may remain unregistered

- Forward Charge (18%) : GTA charges GST at 18%. The recipient can claim INPUT TAX CREDIT. GTA must Be registered and Give annual declaration (Annexure V) by 15 March

Who Pays GST under RCM?

- As per Notification No. 13/2017–CT (Rate), GST under RCM is payable by the recipient if services are provided to a factory registered under the Factories Act, a society/cooperative society, a GST-registered person, a body corporate, a partnership firm/LLP/AOP, and a casual taxable person.

- It is to be notes that the person paying freight = recipient for RCM purposes

- Goods Transport Agency transports goods by road and issues a consignment note. GST is 5% (RCM / no INPUT TAX CREDIT) or 18% (FCM / INPUT TAX CREDIT allowed). Many essential goods & low-value consignments are fully exempt. Goods Transport Agency registration is not required if exclusively under RCM. Correct invoicing, RCM reporting & HSN disclosure are critical

Freight Payment Scenarios and Goods Transport Agency

- Freight Paid by Sender (Consignor) : In this case sender becomes recipient & Pays GST under RCM (if covered entity)

- Freight Paid by Receiver (Consignee) : In this case receiver becomes recipient & Pays GST under RCM (if covered entity)

Is a Goods Transport Agency Required to Register under GST?

- A Goods Transport Agency is not required if the Goods Transport Agency exclusively provides services under RCM & even if the turnover exceeds the threshold.

- Goods Transport Agency registration is mandatory if the Goods Transport Agency opts for forward charge (18%) & provides any taxable service under FCM. (Supported by Notification No. 5/2017–CT)

Penalties & Risks covered under GTA

- In case GTA Late gst return filing : INR 200 per day (max INR 5,000)

- If GTA made wrong HSN/PoS/RCM reporting : then a penalty of up to INR 10,000 or the evaded tax

- In case GTA made non-payment of RCM : then Interest + penalty + INPUT TAX CREDIT denial