Revised Definition of Small Company (w.e.f. 01-12-2025)

Page Contents

Revised Definition of Small Company (w.e.f. 01-12-2025)

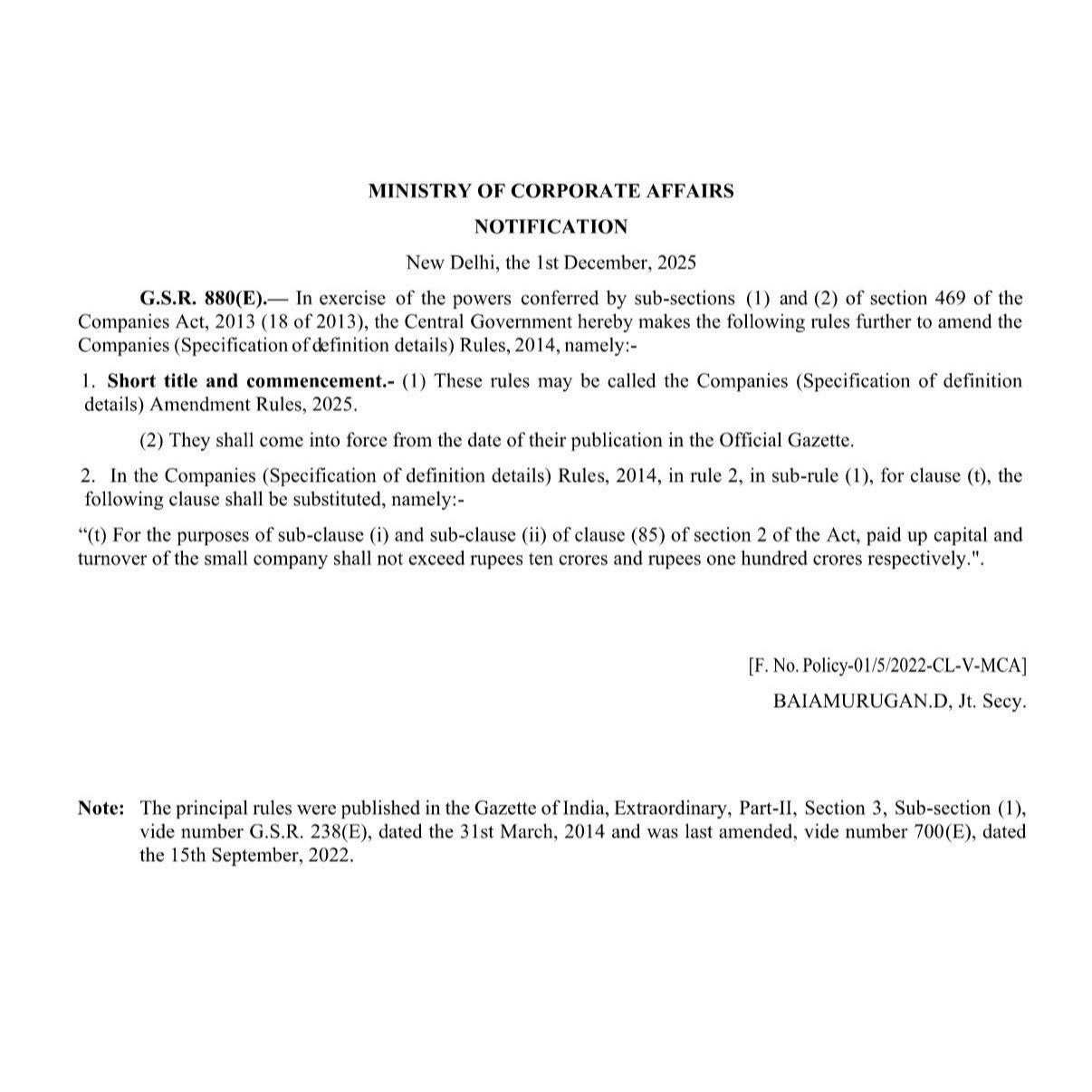

The Central Government of India, through the Ministry of Corporate Affairs (MCA), has revised the definition of a small company under Section 2(85) of the Companies Act, 2013, effective December 1, 2025. The revision via the Companies (Specification of Definition Details) Amendment Rules, 2025 doubles the limits to ease compliance for MSMEs and startups. It expands eligibility for benefits like simplified filings and fewer board meetings

Revised Definition of Small Company (w.e.f. 01-12-2025)

A company will qualify as a “small company” under Section 2(85) of the Companies Act, 2013 only if BOTH of the following criteria are satisfied:

- Paid-up share capital: Not exceeding INR10 crore (previously INR4 crore), and

- Annual turnover: Not exceeding INR100 crore (previously INR40 crore).

The amendment enhances the financial thresholds as under:

| Criteria | Earlier Limits (15.09.2022 – 30.11.2025) | Revised Limits (w.e.f. 01.12.2025) |

|---|---|---|

| Paid-up Share Capital | ≤ INR 4 Crores | ≤ INR 10 Crores |

| Turnover (preceding FY) | ≤ INR 40 Crores | ≤ INR 100 Crores |

This liberalisation significantly expands the number of companies qualifying as small companies, entitling them to reduced compliances and statutory exemptions. These revised thresholds came into effect on 1 December 2025, the date of notification in the Official Gazette.

Evolution of Small Company Thresholds

New Criteria : A company qualifies as small if its paid-up share capital does not exceed INR10 crore and turnover (from the immediately preceding financial year) does not exceed INR100 crore. Both conditions must be met simultaneously.

Previous Limits : Earlier thresholds were paid-up share capital ≤ INR4 crore and turnover ≤ INR40 crore.

| Effective Date | Paid-up Capital Limit | Turnover Limit |

| 01.04.2014 | INR 50 lakh | INR 2 crore |

| 01.04.2021 | INR 2 crore | INR 20 crore |

| 15.09.2022 | INR 4 crore | INR 40 crore |

| 01.12.2025 | INR 10 crore | INR 100 crore |

Other Conditions (unchanged) : The following companies cannot be classified as small companies even if they meet the capital and turnover tests. Under small company Important Exclusions : The following cannot be treated as Small Companies, even if limits are satisfied Public Companies, Section 8 Companies, Holding or Subsidiary Companies

This change cover the Automatic Conversion rule : No form is required to convert from small to non-small company. Once the prescribed limits are crossed, the company automatically ceases to be a small company.

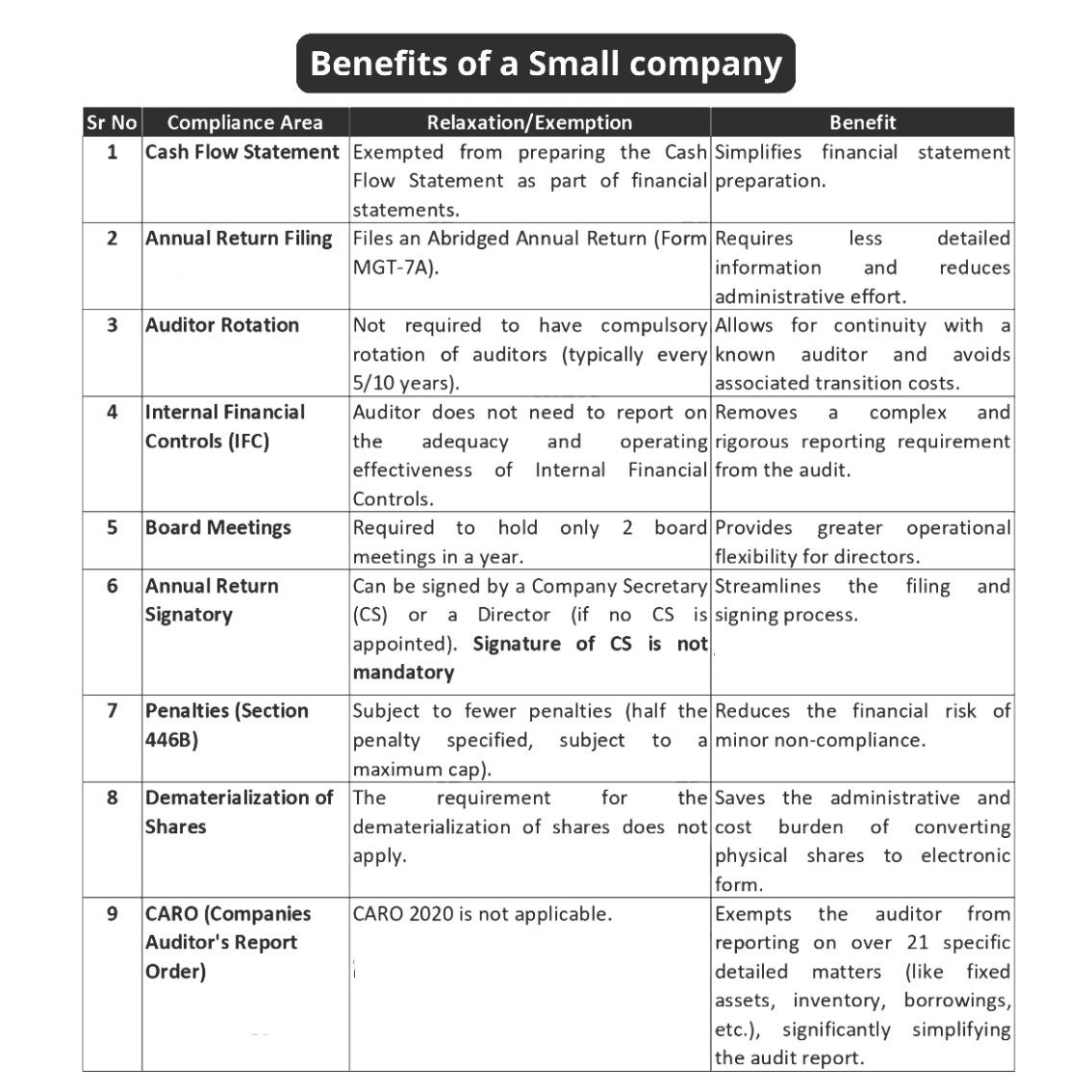

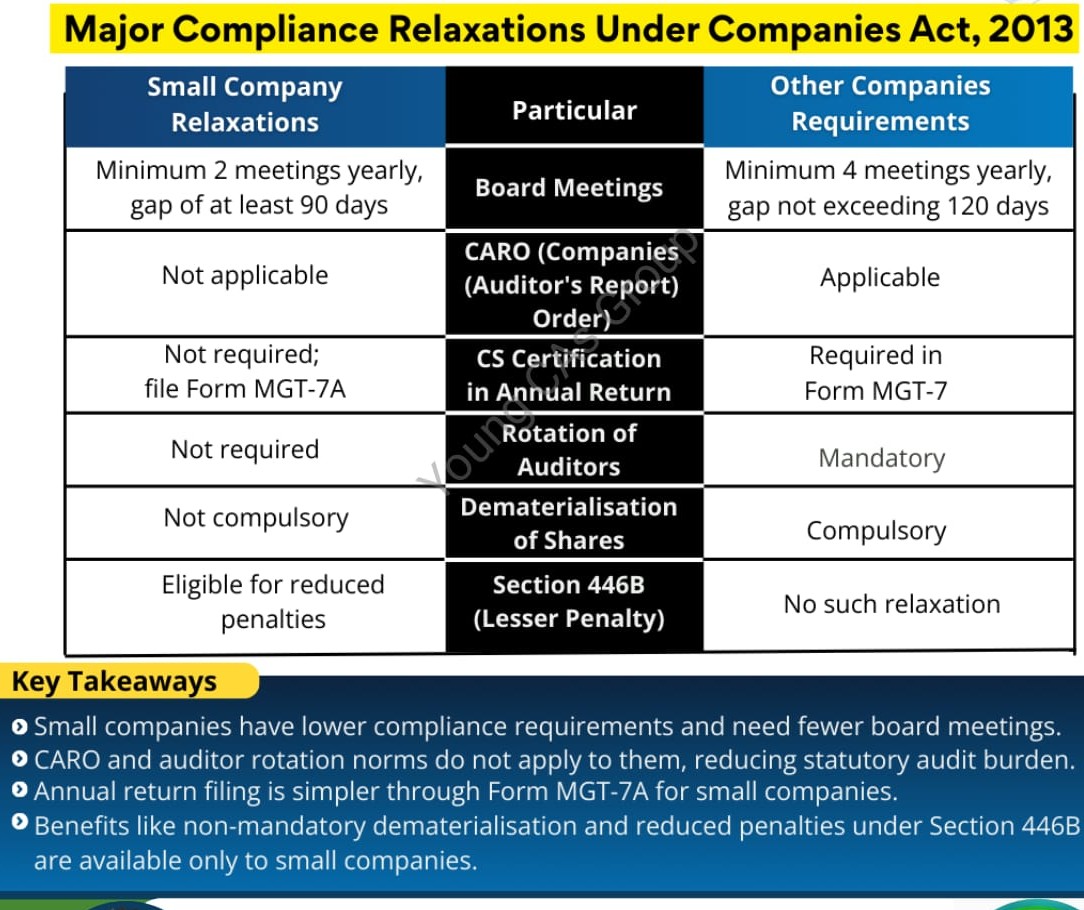

Key Advantages of Small Company Status :

Qualifying as a small company gives access to various compliance relaxations under the Companies Act, such as Exemption from preparing a cash flow statement, Simplified board report and annual return filing, Lesser number of board meetings required, & Lower penalties and relaxed audit requirements for certain provisions.

- Only 2 Board Meetings per year (Section 173)

- CARO not applicable

- Cash Flow Statement not required

- No IFC reporting in Audit Report

- Abridged Directors’ Report (Rule 8A of Section 134)

- Lower penalties under Section 446B (50% of normal penalty)

- Auditor rotation not applicable (Section 139(2))

- Demat / ISIN provisions not applicable (Section 29 & Rule 9B)

- No professional certification required for certain e-forms

The enhancement of thresholds for Small Companies reflects a progressive, growth-oriented policy approach of the Government. By reducing compliance requirements and easing regulatory pressure, this amendment strengthens India’s business ecosystem and supports entrepreneurship, innovation, and employment generation.

Compliance Ambiguities

For FY 2024-25 filings (extended to December 31, 2025), uncertainties persist on status determination (as of March 31, 2025, or post-amendment), MGT-7 vs. MGT-7A eligibility, MGT-8 certification needs, and retroactive application of exemptions like cash flow and auditor rotation. MCA clarification is awaited for uniform practice.

Interpretational Issues Due to Mid-Year Amendment

Although the amendment is beneficial, its effective date of 01 December 2025, coupled with the extension of FY 2024-25 Annual Return filing deadline to 31 December 2025, has created practical compliance ambiguities, particularly for companies newly qualifying as Small Companies.

Status Determination

Small company status is typically assessed based on paid-up capital and turnover from the immediately preceding financial year, ending March 31, 2025, when old thresholds (₹4 crore capital, ₹40 crore turnover) applied. No official MCA clarification exists yet on whether companies should use FY-end figures or the law prevailing at filing time post-December 1, 2025.

Form and Certification Dilemmas

Companies qualifying under new limits (₹10 crore capital, ₹100 crore turnover) but not under old ones face uncertainty in choosing MGT-7 (full return for non-small) versus MGT-7A (abridged for small), and whether PCS certification via MGT-8 remains mandatory. Filing MGT-7A prematurely risks rejection if status is deemed FY-specific.

Exemption Applicability

Exemptions from cash flow statements (Section 2(40)) and auditor rotation (Section 139(2)) likely apply prospectively to financial years starting after the amendment, not retroactively to FY 2024-25 statements prepared under prior rules. Auditor cycles ongoing as of March 31, 2025, may still require rotation unless clarified otherwise