GST Changes Coming in GST from October 2025

Page Contents

GST Changes Coming in GST from October 2025

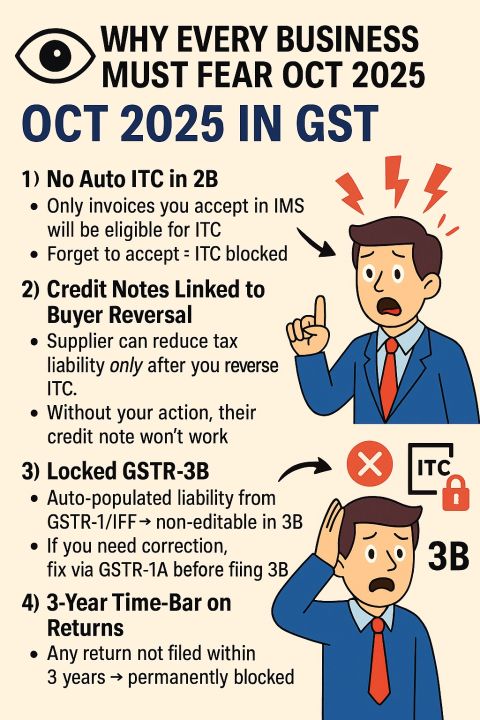

- No Auto ITC in GSTR-2B : Until now: Input Tax Credit (ITC) auto-appeared in GSTR-2B (based on suppliers’ filing). From Oct 2025: ITC won’t auto-flow. This is to be noted that as per New Rule: Only invoices that you accept in IMS (Invoice Management System) will count for ITC. If you forget to accept, your ITC is blocked : higher tax outflow. This Impact: Businesses must check and accept invoices every month, without fail.

- Credit Notes Tied to Buyer’s Action : Supplier can issue a credit note to reduce their tax liability. But from Oct 2025, they can’t use it unless the buyer first reverses ITC on that invoice. If buyer delays or forgets : supplier stuck with tax liability. Its Impact: Coordination between buyer and supplier becomes critical.

- Locked GSTR-3B : Currently: GSTR-3B allows manual adjustments to match liabilities. From Oct 2025: Liability will be auto-populated from GSTR-1/IFF. GSTR-3B will become non-editable. If there’s a mistake : correction must be made in GSTR-1A (not in 3B). its Impact: Businesses must get invoices 100% correct in GSTR-1/IFF upfront.

- 3-Year Time-Bar on Returns: New restriction: Any GST return (GSTR-1, GSTR-3B, etc.) cannot be filed after 3 years from its due date. If missed : permanently blocked. Pending backlog (older than 3 years) : gone forever. Impact: All businesses must clear pending returns immediately before the cutoff.

Why This GSTR Rule is Serious with respect to ITC:

- ITC gets stuck or lost : working capital crunch. Locked liabilities = less flexibility to fix errors. Missed returns : permanent non-compliance, penalties, and no chance to file later. Even a small lapse : notices + cash outflow.

- What Businesses Must Do Right Now : Reconcile monthly: Accept/reject invoices in IMS timely. Clear backlogs: File all pending returns (esp. pre-2022 ones). Train staff: GST will allow zero mistakes. Vendor management: Choose reliable vendors; their compliance now directly impacts your ITC.

GSTN Advisory – Clarification on IMS Implementation (Effective October 1, 2025)

To address false information circulating about changes in GST return filing and Input Tax Credit (ITC) processing due to the introduction of the Invoice Management System (IMS). Key Clarifications issued by GSTN Advisory – Clarification on IMS Implementation :

-

No Change in ITC Auto-Population Mechanism : The current system of auto-populating ITC from GSTR-2B to GSTR-3B remains unchanged. & IMS implementation does not affect this process in any manner.

-

GSTR-2B Generation Continues as Usual : GSTR-2B will continue to be generated automatically on the 14th of every month. & Taxpayers will receive ITC details as before, based on suppliers’ filed GSTR-1, IFF, and other data sources.

-

Flexibility to Act in IMS : Taxpayers can take actions within IMS (accept, reject, or keep invoices pending) even after GSTR-2B is generated, up until they file GSTR-3B. & If any changes are made, GSTR-2B can be regenerated to reflect the updated status.

-

Credit Note Handling – Major Change from October 2025 : Recipients will now have the option to keep a Credit Note pending for a specified duration. & Upon acceptance : The system allows manual adjustment of ITC reversal. & Taxpayers can reduce ITC only to the extent of its availability, ensuring smoother reconciliation.

Summary Impact – GST change & Clarification on IMS Implementation

- ITC via IMS only – No auto 2B credits. Accept invoice = claim ITC. Miss = blocked.Credit Notes – Supplier relief only after buyer reverses ITC.Locked 3B – Liability auto-populated from GSTR-1/IFF. Corrections only via 1A.3-Year Return Bar – File within 3 yrs or forever lapsed.

| Aspect | Status Post-October 2025 |

|---|---|

| ITC Auto-Population | Unchanged (from 2B → 3B) |

| GSTR-2B Generation | Continues on 14th of each month |

| IMS Actions | Permitted until GSTR-3B filing |

| Credit Note Treatment | Recipient-level control, manual reversal flexibility |

The IMS is designed to enhance invoice-level transparency and reconciliation but does not alter the existing ITC auto-population or filing workflow. Taxpayers should disregard any misleading information suggesting otherwise. From Oct 2025, GST becomes stricter, more automated, and leaves no room for manual fixes. Compliance discipline becomes the only way to survive.

Most Expensive GST Errors & How to Fix Them Today

Most Expensive GST Errors It is divided into two main columns:

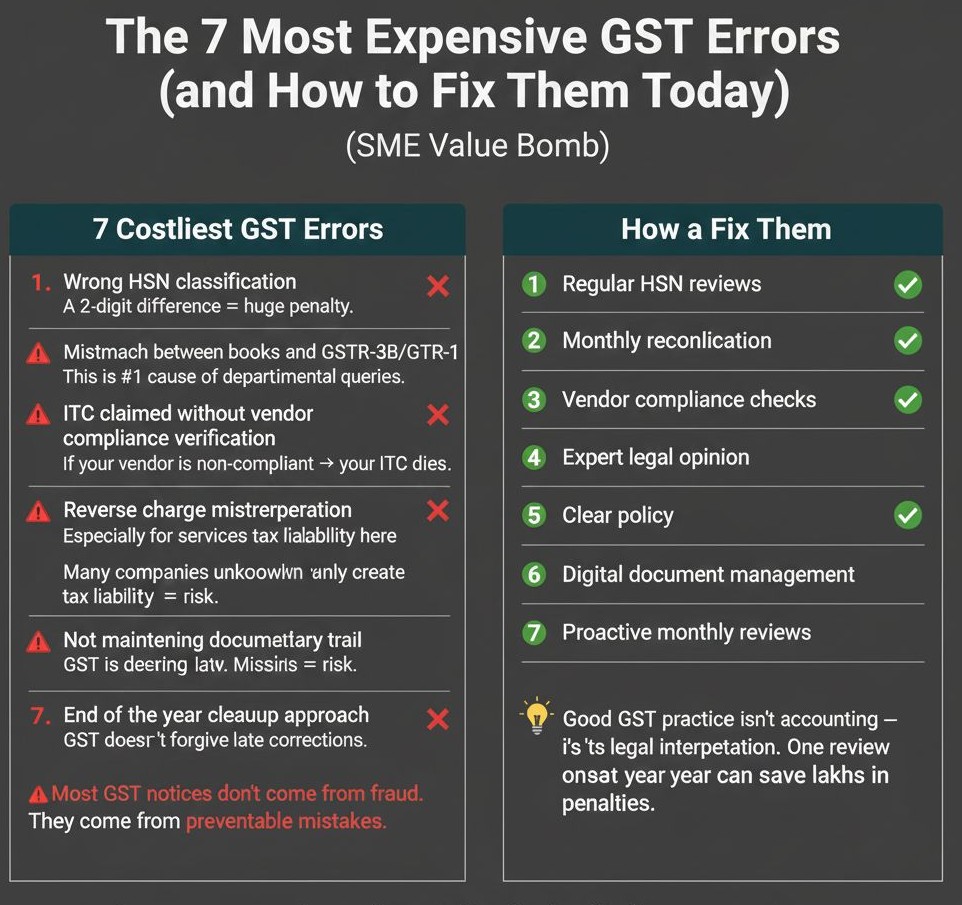

Left Column: 7 Costliest GST Errors

- Wrong HSN classification- A 2-digit difference = huge penalty. – Wrong HSN classification → Use CBIC’s HSN finder + cross-check with industry peers before filing.

- Mismatch between books and GSTR-3B/GSTR-1: This is the #1 cause of departmental queries.

- ITC claimed without vendor compliance verification—if your vendor is non-compliant → your ITC dies.

- Reverse charge misinterpretation—especially for services; tax liability here.

- Expense reimbursements treated incorrectly—many companies unknowingly create tax liability = risk.

- Not maintaining a documentary trail—GST is a documentation-heavy law. Missing links = risk.

- End-of-the-year cleanup approach—GST doesn’t forgive late corrections.

Most GST notices don’t come from fraud. They come from preventable mistakes.

Right Column: How to Fix Them

- Regular HSN reviews

- Monthly reconciliation – Monthly reconciliation of GSTR-1 & GSTR-3B

- Vendor compliance checks – Vendor compliance verification via GSTR-2A/2B

- Expert legal opinion

- Clear policy

- Digital document management

- Proactive monthly reviews—maintain invoice + payment trail for all ITC claims

Good GST practice isn’t accounting : it’s legal interpretation. One review onsite per year can save lakhs in penalties.

GST LAWS—MYTHS vs TRUTH (Every Business Should Know)

Many GST disputes arise not due to mala fide intent, but because of misinterpretation of law.

Let’s break some common GST myths with legal clarity

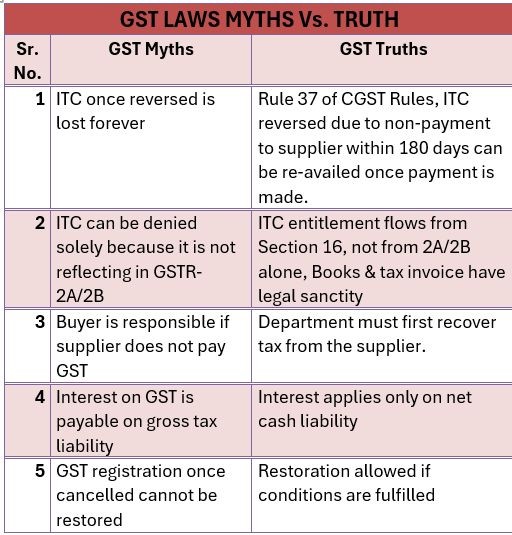

MYTH #1 : ITC, once reversed, is lost forever

TRUTH : As per Rule 37 of the CGST Rules, ITC reversed due to non-payment to the supplier within 180 days can be re-availed once payment is made. Reversal is temporary, not permanent.

MYTH #2 : ITC can be denied solely because it is not reflecting in GSTR-2A / GSTR-2B

TRUTH : ITC eligibility flows from Section 16 of the CGST Act, not merely from auto-generated statements. Books of accounts and valid tax invoices have legal sanctity. GSTR-2A/2B are compliance and reconciliation tools, not charging or disallowance provisions.

MYTH #3 : Buyer is responsible if the supplier does not pay GST

TRUTH : Judicial precedents have consistently held that the department must first recover tax from the supplier. A bona-fide buyer cannot be penalized for the supplier’s default, provided due diligence is exercised.

MYTH #4 : Interest on GST is payable on gross tax liability

TRUTH : As per Section 50 of the CGST Act (retrospectively amended), interest is payable only on net cash liability, Not on the ITC portion.

MYTH #5 : GST registration, once cancelled, cannot be restored

TRUTH : GST registration can be restored upon fulfillment of prescribed conditions.

Courts have repeatedly emphasized principles of natural justice over mere procedural lapses.