Overview on Tax Treatment on Gratuity in India

Page Contents

Overview on Tax Treatment on Gratuity in India

What is Gratuity?

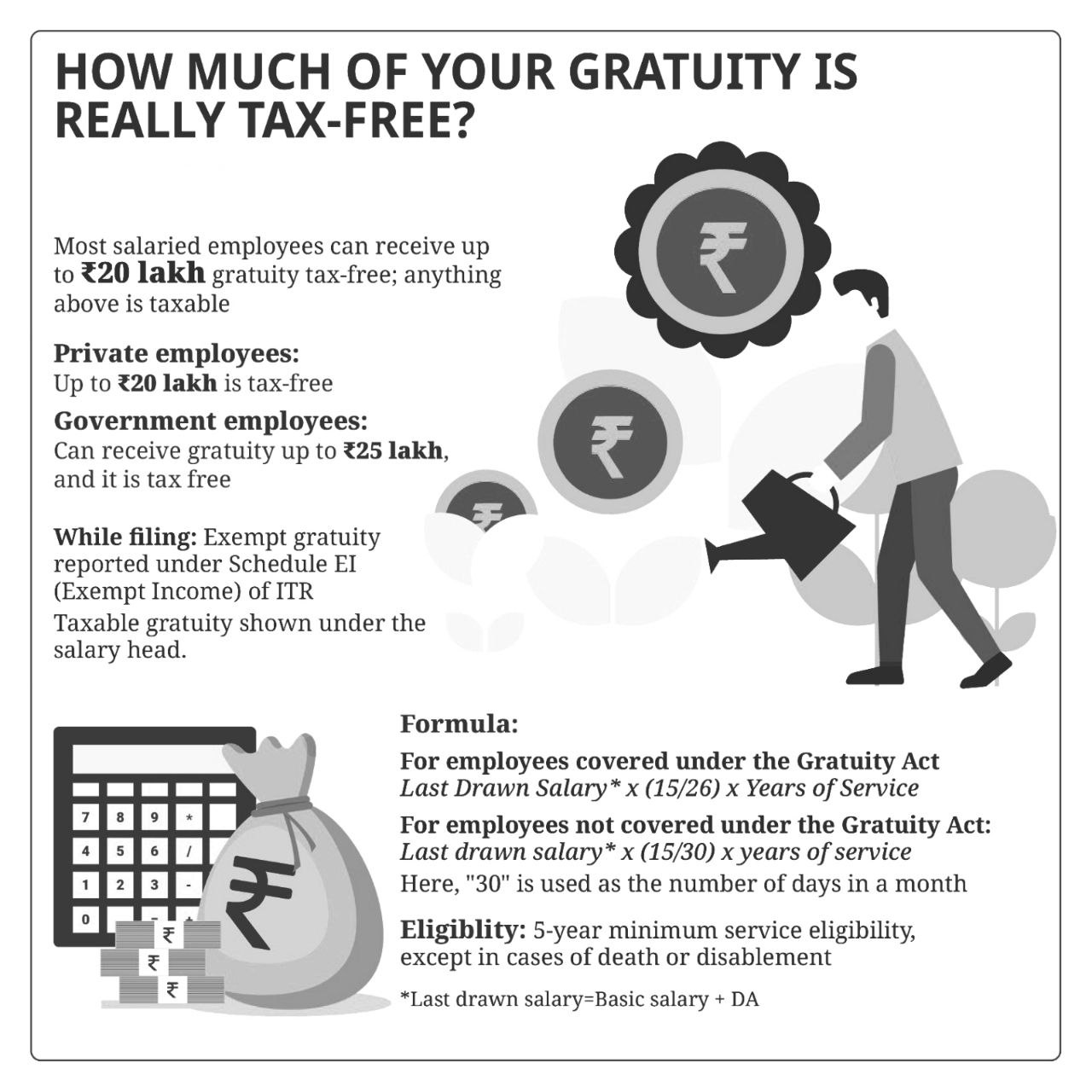

Gratuity is a lump sum paid by an employer to an employee in recognition of long-term service, governed by the Payment of Gratuity Act, 1972. It becomes payable on retirement, resignation, death, or disablement after at least 5 years of continuous service (not needed in case of death/disablement). Following are the Tax-Free Gratuity Limits

- Private Sector Employees: Up to INR 20 lakh is tax-free.

- Government Employees: Up to INR 25 lakh is tax-free.

- The INR 20 lakh exemption limit is per lifetime, not per employer. If you change jobs and get gratuity multiple times, the cumulative tax-free portion across your career cannot exceed INR 20 lakh. Any excess over the exempt limit is fully taxable. Relief under Section 89 may be available to reduce tax burden on taxable gratuity.

- Applicability of INR 20 Lakh Limit : Raised from INR 10 lakh to INR 20 lakh via CBDT Notification (effective 29 March 2018). Applies on gratuity due to retirement, resignation, death, or disablement. The INR 20 lakh is a lifetime ceiling across all employers combined. INR 20 lakh is a one-time lifetime exemption, not per employer. For Act-covered employees : service > 6 months is counted as full year.For non-covered : only completed years are considered. Section 89 relief can be claimed on taxable gratuity.

- Gratuity Eligibility come after completion Minimum 5 years of continuous service required. How ever there is Exception i.e. No minimum service required in case of death or disablement.

Tax treatment on gratuity:

Scenario I – Gratuity received during service – Fully taxable under the head Income from Salary.

Scenario II – Gratuity received on retirement/resignation/death/disablement – Government Employees – Gratuity is 100% exempt, no upper limit.

If you are covered under the Gratuity Act (mostly employees in companies with 10+ employees)

The least of the following three is exempt from tax:

- INR 20,00,000 (lifetime limit – raised from INR 10 lakh in March 2018).

- Actual gratuity received.

- 15 days’ salary × number of years of service (salary = last drawn basic + DA; service > 6 months is rounded up to the next year).

Anything above this exemption is taxable under “Income from Salary.”

If you are NOT covered under the Gratuity Act

The least of the following three is exempt from tax:

- INR 20,00,000 (lifetime limit).

- Actual gratuity received.

- ½ month’s average salary × number of years of service (salary = average of last 10 months’ basic + DA; service is counted in completed years only).

- For Government Employees- Gratuity is fully exempt from tax.

- Special Case – Death of Employee : If gratuity is paid to nominee/heir : fully exempt (not taxable as salary, not even “other sources”).

Gratuity Calculation Formulas

- Covered under Gratuity Act: Gratuity=Last Drawn Salary×1526×Years of Service\text{Gratuity} = \text{Last Drawn Salary} \times \frac{15}{26} \times \text{Years of Service}Gratuity=Last Drawn Salary×2615×Years of Service

- Not Covered under Gratuity Act: Gratuity=Last Drawn Salary×1530×Years of Service\text{Gratuity} = \text{Last Drawn Salary} \times \frac{15}{30} \times \text{Years of Service}Gratuity=Last Drawn Salary×3015×Years of Service (Here, 30 is considered as the number of days in a month)

- Last Drawn Salary = Basic Salary + Dearness Allowance (DA)

Income Tax Filing Guidance

- Exempt Gratuity: Report under Schedule EI (Exempt Income) in the ITR.

- Taxable Gratuity: Report under the Salary Head. If your gratuity becomes taxable, you may claim relief under Section 89 to reduce the tax burden.

Tax on Gratuity – Comparison Table under the Different Scenario

| Category | Tax Exemption | Exemption Limit | Calculation Method | Taxable Portion |

| Government Employees (Central/State Govt., Defence, Local Authority) | Fully exempt | No limit | Not applicable | Nil |

| Private Employees – Covered under Payment of Gratuity Act, 1972 | Least of the following: 1️⃣ Actual gratuity received 2️⃣ 15 days’ salary × years of service (service > 6 months rounded up) 3️⃣ INR 20,00,000 |

INR 20 lakh (lifetime cap across employers) | Salary = Last drawn Basic + DA | Excess over exempt limit taxable as Salary Income |

| Private Employees – Not covered under Gratuity Act | Least of the following: 1️⃣ Actual gratuity received 2️⃣ ½ month’s average salary × completed years of service 3️⃣ INR 20,00,000 |

INR 20 lakh (lifetime cap across employers) | Salary = Average of last 10 months’ Basic + DA | Excess over exempt limit taxable as Salary Income |

| On Death of Employee (Nominee/Heir receives gratuity) | Fully exempt | No limit | Not applicable | Nil |