Smart Term Insurance Picks for the Self-Employed

Page Contents

Smart Term Insurance Picks for the Self-Employed

Being self-employed is like walking a tightrope; you enjoy the thrill of independence, but you also carry the weight of responsibility without the safety net of a steady salary. Entrepreneurs, freelancers, and business owners know this all too well. While your business might be thriving today, tomorrow is always uncertain. That’s exactly why you need to consider term insurance seriously. Think of it as a financial safety net you cast over your family and your dreams, ensuring they stay secure even if you are not around.

Understanding Term Life Insurance Meaning

Let’s understand the basics. The term life insurance meaning is simple. It is a contract between you and the insurer. You agree to pay premiums for a fixed “term,” and in return, the insurer ensures that your loved ones receive a lump sum (death benefit) if something unfortunate happens to you during that period.

It is the most affordable form of life insurance. No complicated investments, no confusing structures, just pure financial protection. And for the self-employed, that simplicity matters.

Why Self-Employed Professionals Need Term Insurance

Unlike salaried employees, the self-employed don’t enjoy employer-backed benefits like group insurance or pension plans. Your income may be irregular and at times, uncertain. That makes planning ahead even more important.

Here’s why a term plan should be your top priority:

- Protect Your Family’s Lifestyle – If you’re the sole breadwinner, a term plan ensures your family doesn’t struggle to make ends meet if you’re gone.

- Cover Debts & Business Loans – Many entrepreneurs take business loans, personal loans, or mortgages. A term plan makes sure these debts don’t burden your family.

- Safeguard Future Goals – Your children’s education, your spouse’s financial security, or your parents’ care should not be disrupted by income uncertainty.

Smart Features to Look for in a Term Plan

When picking the best term life insurance in India, you should look for:

- Flexible Payout Options – Lump-sum or staggered monthly payouts for your family.

- Affordable Premiums – Especially when bought early, term plans remain cost-effective.

- Add-On Riders – Such as critical illness cover, accidental death benefits, or waiver of premium.

- Long-Term Coverage – Choose coverage that lasts till retirement or until children become independent.

Tax Benefits with an Example

This is particularly interesting for self-employed taxpayers. The premium you pay for term insurance is deductible under Section 80C of the Income Tax Act, 1961. Conversely, the death benefit your family receives is exempted under Section 10(10D).

Let’s say:

Ravi, a 35-year-old self-employed graphic designer, buys a term plan with a ₹25,000 annual premium. That amount is deductible from his taxable income. Suppose Ravi earns ₹8,00,000 in a given year. So without a term plan, his taxable income will remain ₹8,00,000. Now with the term plan, his taxable income reduces to ₹7,75,000, which gives him tax savings of around ₹5,000 (depending on the slab).

Now, let’s say that Ravi never bought the term plan. Not only would he be paying more tax, but in the event that he wasn’t around anymore, his family wouldn’t have any protection. However, due to the term plan, they are assured financial security, essentially a double benefit.

When Should the Self-Employed Buy Term Insurance?

The answer is: the earlier, the better.

- In your 20s, premiums are the lowest, and you can lock in coverage at affordable rates.

- In your 30s, when responsibilities like loans or family commitments grow, term insurance becomes non-negotiable.

- Even in your 40s or 50s, it’s better late than never. Premiums might be higher, but the safety net is invaluable.

Duration Matters – Pick the Right Term

For self-employed individuals, the right coverage duration often depends on:

- Business Loans – Choose a term that lasts until the loan is repaid.

- Family’s Financial Independence – Ensure your children are independent before your coverage ends.

- Retirement Goals – Ideally, your coverage should last until you’ve built enough savings and assets.

Documents You’ll Need

The application process for a term plan requires:

- Identity proof (Aadhar, PAN, Passport)

- Address proof (Aadhar, Voter ID, utility bills)

- Proof of age (Birth certificate, Passport, School certificate)

- Income proof (Bank statement, ITRs, salary slips)

- Medical reports, photographs, and nominee details

Being self-employed, ITRs and bank statements often serve as proof of your income. Ensure you keep them updated.

Wrapping It Up – The Self-Employed Advantage

As a self-employed individual, you’ve chosen freedom, but with freedom comes responsibility. Term insurance ensures that while you’re busy building your empire, your family’s future is already protected. It’s not just an insurance policy, it’s peace of mind, a promise, and a gift of financial security.

The best term life insurance in India is one that matches your personal and professional needs, provides flexible features, and ensures tax-saving benefits. Choose wisely, compare options, and don’t delay.

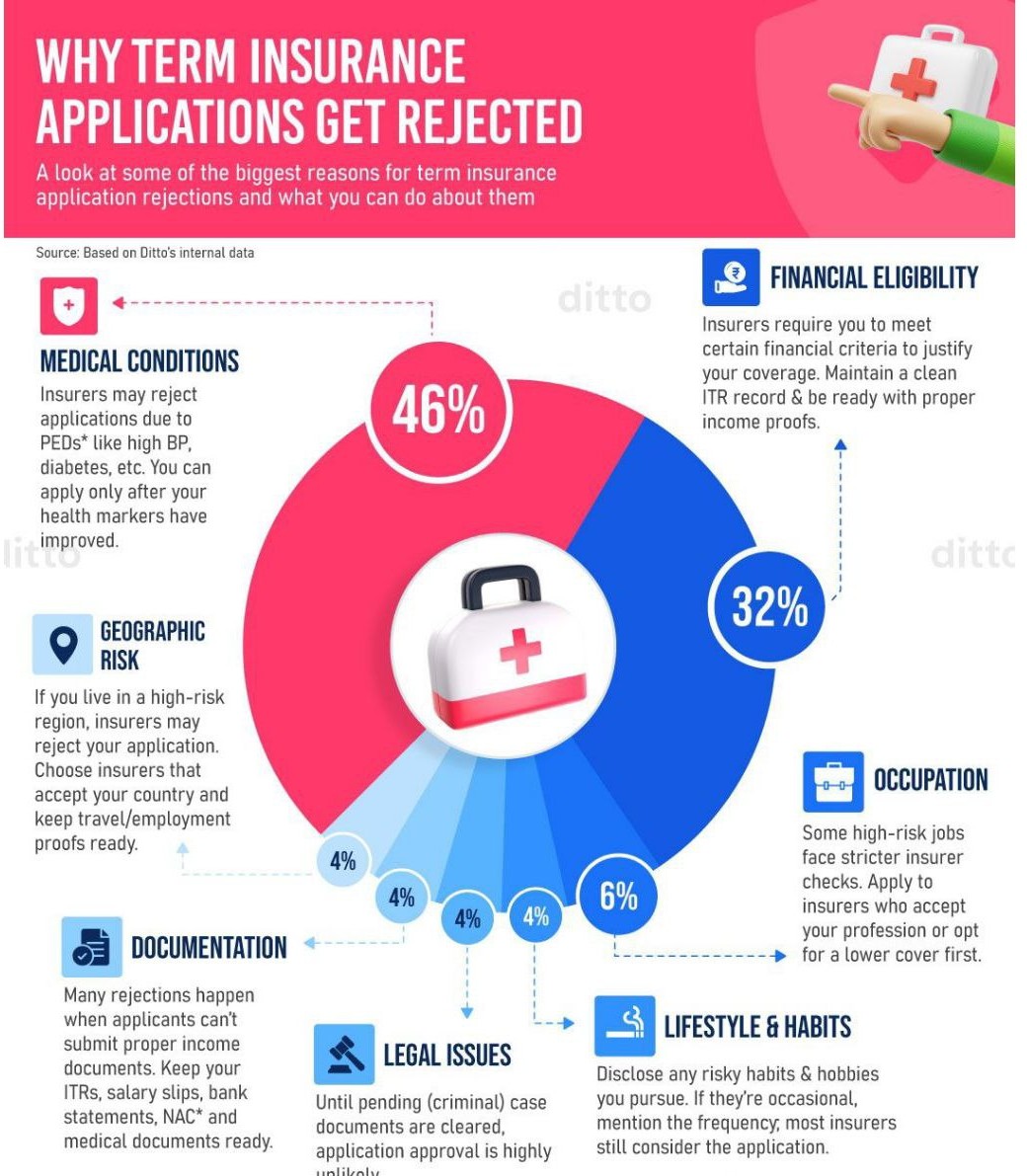

Why Term Insurance Applications Get Rejected

Term insurance is one of the simplest and most affordable ways to secure a family’s financial future. Yet, many applicants are surprised when their proposals are rejected. Unlike general insurance, life insurance underwriting is risk-based and disclosure-driven. Even small lapses can lead to rejection. Term insurance applications in India often get rejected due to issues during underwriting, where insurers assess risk based on provided details.

Top Reasons for Rejection

Below are the most common reasons why term insurance applications get rejected, explained clearly and practically.

Non-Disclosure or Misrepresentation, Documentation – 4% :

This is the most frequent and serious reason. Examples Hiding existing illnesses (diabetes, BP, heart issues), Not disclosing past surgeries or hospitalisation, Concealing smoking, tobacco, alcohol, or substance use, Incorrectly stating height, weight, or age. Insurers cross-check details through medical tests, prescription databases, hospital records, and investigation reports. Any mismatch is treated as intentional suppression of facts. Many rejections happen due to missing or incorrect documents.

Tip: Keep PAN, Aadhaar, income proofs, bank statements, and medical documents ready.

2. Adverse Medical History – Medical Conditions – 46%

Applications may be rejected if the applicant has Severe heart disease, Cancer (current or recent history), Chronic kidney or liver disease, HIV/AIDS, Serious neurological disorders. In such cases, the risk is considered uninsurable or beyond the insurer’s underwriting limits. Insurers may reject applications due to pre-existing diseases (PEDs) like high BP, diabetes, etc.

Tip: Apply only after your health markers have improved.

3. High-Risk Lifestyle or Occupation- – 6%

Certain professions and activities increase mortality risk, such as Mining, offshore drilling, construction at heights, Defence combat roles, Pilots (non-commercial), Adventure sports (skydiving, mountaineering, racing), If not disclosed properly—or if risk is extremely high—the proposal may be declined. Some high-risk jobs face stricter insurer checks.

Tip: Apply to insurers who accept your profession or opt for a lower cover first.

4. Smoking, Tobacco & Substance Use

Smokers and tobacco users are charged higher premiums. Nondisclosure of smoking is viewed as a fraudulent misstatement. & Excessive alcohol consumption or drug use often leads to rejection. Even occasional smoking must be disclosed.

5. Unfavourable Medical Test Results

Insurers may reject applications based on abnormal blood reports, high cholesterol or sugar levels, Liver function abnormalities, ECG or stress test issues. Sometimes, rejection happens even if the applicant feels “healthy.”

6. Financial Ineligibility or Financial Eligibility – 32%

Insurers assess whether the sum assured is justified based on income level, employment stability, ITRs / salary slips, Existing insurance cover. If coverage appears disproportionately high, the proposal may be rejected or scaled down. Insurers require you to meet certain financial criteria to justify coverage.

Tip: Maintain a clean ITR record and keep proper income proofs ready.

7. Incorrect or Incomplete Application

Common issues include Missing signatures, Incomplete medical questionnaire, Wrong personal details, Mismatch between proposal form and KYC documents. Insurers may reject rather than repeatedly seek clarifications.

8. Age and Late Entry- 4%

Very high entry age increases mortality risk. Applicants close to the maximum age limit face stricter scrutiny. Delays in buying insurance often result in rejection or very high premiums. Risky habits or hobbies can lead to rejection.

Tip: Disclose habits honestly; insurers may still consider the application if frequency is low.

9. Previous Policy Declines Not Disclosed- 4%

If an applicant Was earlier rejected by another insurer, and Fails to disclose it, the current insurer may treat this as material non-disclosure, leading to rejection. Pending criminal cases make approval highly unlikely.

10. Residency & Travel Concerns

-

Frequent travel to high-risk countries; Working in politically unstable regions & NRI applications with weak India linkage. These factors can negatively impact underwriting decisions.

11. Geographic Risk – 4%

Living in high-risk regions may lead to rejection.

Tip: Choose insurers that accept your area and keep travel/employment proofs ready.

Term insurance works on the principle of utmost good faith (uberrima fides). Honest and complete disclosure is more important than having a “perfect” profile. Rejection by one insurer does not automatically mean rejection by all underwriting standards vary. It is always better to disclose and pay a higher premium than risk rejection or future claim denial. Medical conditions and financial eligibility account for 78% of rejections. Proper documentation and disclosure of lifestyle habits can significantly improve approval chances. Occupation and geographic risk are smaller but notable factors.