How to Surrender Your PAN Card

Page Contents

How to Surrender Your PAN Card

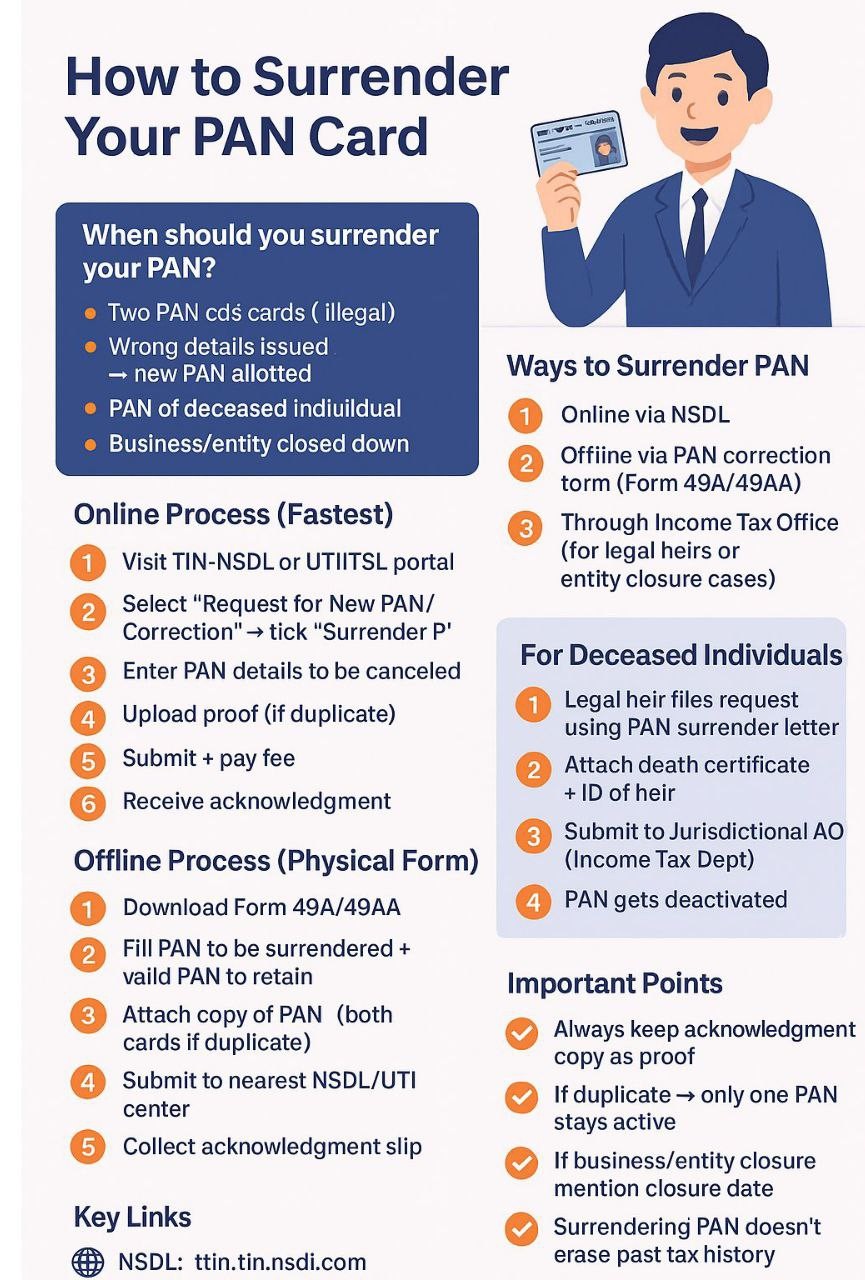

A person should hold only one PAN (Permanent Account Number) under the Income Tax Act. If you have been inadvertently allotted more than one PAN or need to cancel/surrender one, here’s the process:

A PAN card is a vital financial identity in India. Every taxpayer must ensure they hold only one PAN. If you have multiple, incorrect, or unused PANs, cancel them immediately to avoid penalties. The process is simple both online and offline options are available for individuals, companies, and legal heirs.

As per Section 139A of the Income Tax Act, 1961, every person can hold only one PAN. If you have multiple PANs, a penalty of ₹10,000 may be imposed under Section 272B. With Aadhaar linking now mandatory, it is essential to cancel duplicate / unused PANs.

When to Surrender a PAN

-

You have been allotted multiple PANs. You have two PAN cards (which is illegal).

-

PAN has been issued in the wrong name or with wrong details.

-

The PAN holder is deceased (legal heir can surrender). PAN was issued with wrong details, and a new one has been allotted

-

Change in status (e.g., from firm/company to individual, merger, closure of business, etc.).

Online Process (Fastest Method)

- Visit the TIN-NSDL or UTITSL portal.

- Select “Request for New PAN/Correction” and tick the “Surrender PAN” option.

- Enter the PAN details you want to cancel.

- Upload proof (especially if it’s a duplicate PAN).

- Submit the form and pay the applicable fee.

- You’ll receive an acknowledgment as proof.

Offline Process (Physical Submission)

- Download Form 49A or 49AA.

- Fill in the PAN to be surrendered and the valid PAN to retain.

- Attach copies of both PAN cards (if duplicate).

- Submit the form to the nearest NSDL/UTI center.

- Collect the acknowledgment slip.

Step 1: Download Form 49A/49AA (as applicable) or PAN Correction Form

Available at NSDL or UTIITSL. Use the “Request for New PAN Card or/and Changes or Correction in PAN Data” form.

Step 2: Fill in the Details

Enter the PAN card you wish to retain. In the column for “PAN(s) to be surrendered,” enter the PAN number(s) to be cancelled.

Step 3: Attach Supporting Documents

-

PAN card copy of the one being surrendered.

-

ID & Address proof (Aadhaar, Passport, Voter ID, etc.).

-

Death certificate (if surrendering due to demise).

-

Proof of merger/closure (for companies/firms).

Step 4: Submit the Application

Online: Through NSDL or UTIITSL portal → upload documents → pay fee → acknowledgement generated.

Offline: Submit the form + documents at nearest PAN service center.

Step 5: Acknowledgement & Confirmation

After verification, the Income Tax Department will cancel the surrendered PAN and send a cancellation letter/email.

The taxpayer must retain acknowledgement receipt for records. Always keep the acknowledgment copy as proof. If duplicate PANs exist, only one will remain active. For business/entity closure, mention the closure date. Surrendering a PAN does not erase past tax history,

Surrendering PAN of Deceased Person- For Deceased Individuals

- Legal heir must file a request using a PAN surrender letter. Attach the death certificate and ID proof of the heir. Submit to the Jurisdictional Assessing Officer of the Income Tax Department. Legal heir submits request with:

-

PAN surrender letter.

-

Death certificate + ID of heir.

-

Jurisdictional AO submission.

-

-

PAN is then deactivated.

Surrender of Company / Firm / LLP PAN

-

Online via NSDL (select Company/Firm/Partnership in Form 49A).

-

Enter PAN to cancel in Item 11.

-

Submit, print acknowledgement, send with documents.

-

Offline: Write to AO with dissolution deed + PAN copy.

Foreign Nationals

-

If leaving India permanently → write to AO requesting cancellation.

-

Submit reason + PAN card copy.

Check PAN Cancellation Status

-

Visit Income Tax e-Filing portal.

-

Select “Verify PAN Status”.

-

Enter PAN, name, DOB, and mobile no.

-

Validate OTP → view status.

Consequences of Holding Multiple PANs

-

INR 10,000 penalty by Income Tax Officer. Using more than one PAN is illegal and attracts a penalty of ₹10,000 under Section 272B of the Income Tax Act.

-

Legal implications, including prosecution in extreme cases.

-

Difficulty in filing ITR, banking, and financial compliance.

- Only one PAN stays active if duplicate is found. PAN cancellation does not erase past tax history. Inform banks & institutions after cancellation.

- Contact ITD Helpline: 020-27218080 for queries.