Tax Regime Specific to MF Investor applicable for FY 2024-25

Page Contents

Tax Regime Specific to Mutual Fund Investors in India applicable for the FY 2024-25

Equity-Oriented Mutual Funds (EOFs)

(Excluding Equity Oriented Fund of Funds)

Condition: STT must be paid on purchase and sale.

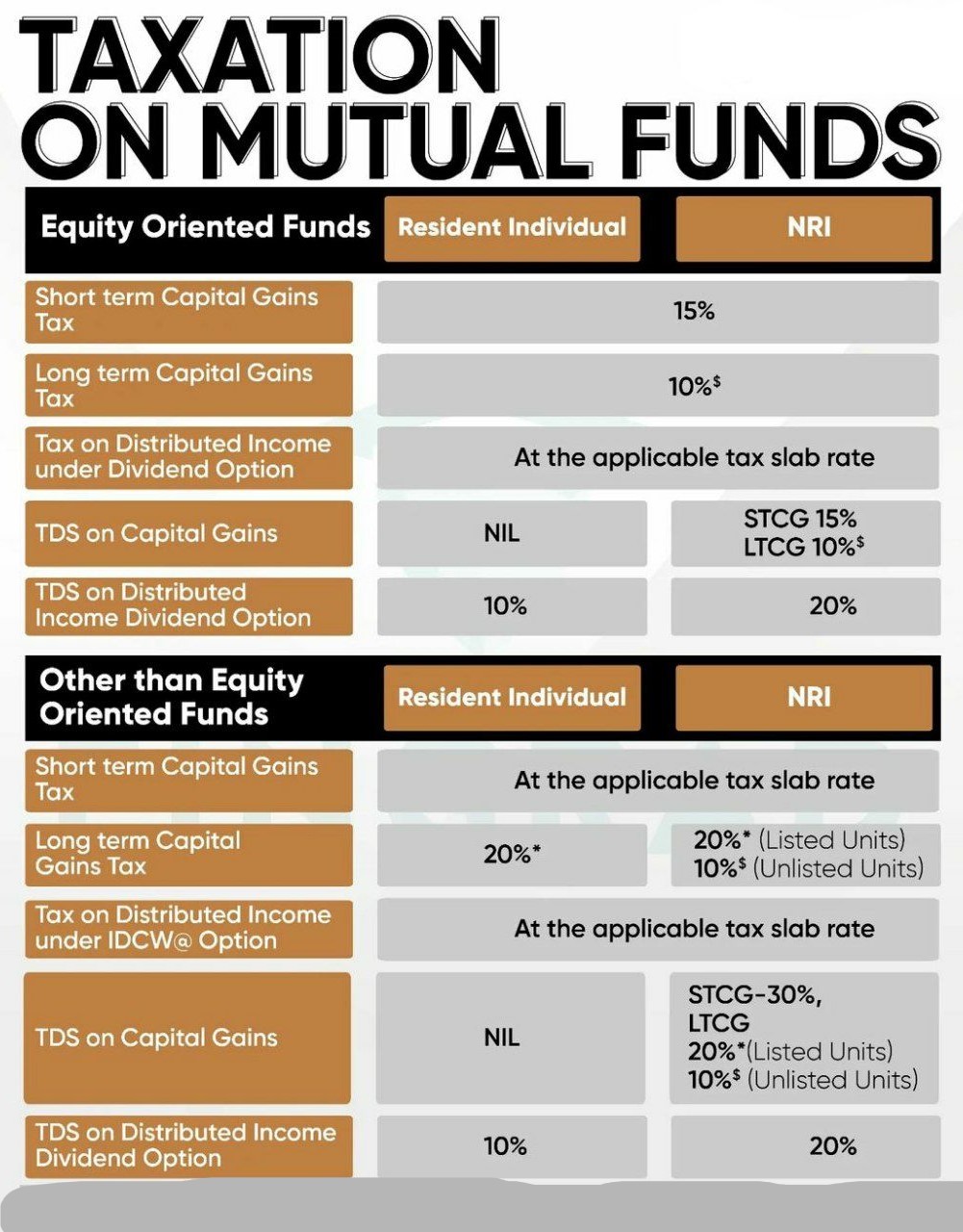

| Investor Type | STCG (≤ 12 months) | LTCG (>12 months) | Dividend Taxation | TDS on Cap Gains | TDS on Dividend |

| Resident Individual / HUF / AOP / BOI | 15% (before 23 Jul) 20% (after 23 Jul) |

10% (before 23 Jul) 12.5% (after 23 Jul; > ₹1.25 lakh) |

Taxed at applicable slab rate (if opted) | NIL | 10% |

| Domestic Companies | Same as above | Same as above | Taxed at applicable corporate rate | NIL | 10% |

| NRIs | Same as above | Same as above | Taxed at 20% | 15%/20% | 20% |

Note:

- No indexation or foreign exchange fluctuation benefit under Section 112A.

- FMV as on 31-Jan-2018 still applicable for grandfathering LTCG.

Specified Mutual Funds (as per Section 50AA)

Definition (FY 2024-25): Funds where ≤35% of proceeds are invested in domestic equity shares.

| Investor Type | STCG | LTCG | Dividend Taxation | TDS on Cap Gains | TDS on Dividend |

| Resident Individual / HUF / AOP / BOI | Taxed at applicable slab rate | Not applicable (All gains = STCG) | Taxed at applicable slab rate | NIL | 10% |

| Domestic Companies | 15%/22%/25%/30% depending on turnover/provisions | Not applicable | Taxed at applicable corporate rate | NIL | 10% |

| NRIs | 30% (as STCG only) | Not applicable | Taxed at 20% | 30% | 20% |

Examples of Specified Funds (FY 2024-25):

- Fund of Funds (including overseas)

- Debt Funds (Liquid, Gilt, Bond ETFs)

- Gold ETFs

- Infrastructure Debt Funds

Effective FY 2025-26, new definition applies (MFs with >65% in debt/money market instruments).

Other Mutual Funds (e.g., Hybrid / Non-EOFs)

| Investor Type | STCG | LTCG | Dividend Taxation | TDS on Cap Gains | TDS on Dividend |

| Resident Individual / HUF / AOP / BOI | At applicable slab rate | 20% (with indexation) or 12.5%11 | Taxed at applicable slab rate | NIL | 10% |

| Domestic Companies | 15%/22%/25%/30% | 20% or 12.5% | Taxed at corporate rate | NIL | 10% |

| NRIs | 30% (STCG) | 20% (Listed units) 10% (Unlisted units) 12.5% (Optional) |

Taxed at 20% | 30% (STCG) / 20% (LTCG) | 20% |

LTCG Indexation: Available on listed units. Optional 12.5% rate available without indexation or currency benefit. Key Notes and Amendments

- Section 50AA (effective FY 2023–24):

All gains on specified mutual funds (≤35% equity) acquired on or after 1 April 2023 are treated as STCG, regardless of holding period. - Post-23 July 2024 Tax Rates (as per Finance Act 2024):

- STCG on EOFs: Increased from 15% → 20%

- LTCG on EOFs: Increased from 10% → 12.5%, applicable on gains > ₹1.25 lakh

- TDS Threshold for Dividends:

- No TDS if dividend paid to resident < ₹5,000/year.

- For NRIs, TDS always applies @20%.

- Surcharge & Cess:

- All tax rates are subject to surcharge and 4% Health & Education Cess.

Holding Period for Capital Gains Classification

| Mutual Fund Type | Transfer Date | Listed Units | Unlisted Units |

| Non-EOF & Non-specified Mutual Fund | Before 23 July 2024 | LTCG if held > 36 months | LTCG if held > 36 months |

| On or after 23 July 2024 | LTCG if held > 12 months | LTCG if held > 24 months |

Capital Gains Tax Rates (Section 112 / 112A)

Residents

| Type of Fund | STCG | LTCG |

| Equity-Oriented Funds | 15% (before 23 Jul) 20% (after 23 Jul) |

10% (before 23 Jul) 12.5% (after 23 Jul, above ₹1.25L) |

| Non-EOF / Debt Funds | As per slab | 20% with indexation (before 23 Jul) 12.5% without indexation (after 23 Jul) |

| Specified Mutual Funds | As per slab | Deemed STCG – taxed as per slab |

NRIs

| Fund Type | STCG | LTCG |

| Equity-Oriented Funds | 15% / 20% | 10% / 12.5% on gains > ₹1.25L |

| Listed Debt Funds | 30% | 20% with indexation (before 23 Jul) 12.5% without indexation (after 23 Jul) |

| Unlisted Debt Funds | 30% | 10% without indexation or currency benefit 12.5% (after 23 Jul, no indexation) |

| Specified Mutual Funds | 30% | All gains treated as STCG – taxed at 30% |

TDS Rates

| Nature of Income | Resident Investors | Non-Resident Investors |

| Capital Gains – STCG / LTCG | No TDS | 15% / 20% / 30% (as applicable) |

| Dividends (Total > ₹5,000/year) | 10% | 20% or DTAA rate (with TRC and disclosures) |

| No PAN (NRI) – Section 206AA | Not applicable | Higher of: 20% or rates in force (unless Rule 37BC conditions are met) |

| Non-filers – Section 206AB | 2× applicable rate or 5% | Not applicable to non-residents w/o PE |

Corporate Taxation

| Type of Domestic Company | Applicable Tax Rate | Conditions |

| Regular companies (turnover ≤ ₹400 crore in FY 22-23) | 25% | Default corporate tax |

| Companies under Section 115BAA | 22% | Opt-in; no MAT; no exemptions/deductions |

| New manufacturing cos. under Section 115BAB | 15% | Only on income from manufacturing; incidental income taxed at 22% |

Surcharge & Cess

For Individuals / HUFs / AOPs

| Income Range | Surcharge |

| ₹50 lakh to ₹1 crore | 10% |

| ₹1 crore to ₹2 crore | 15% |

| ₹2 crore to ₹5 crore | 25% |

| > ₹5 crore | 37% |

Cap on surcharge:

- 15% for capital gains under Sections 111A, 112, and 112A

- 25% cap if New Tax Regime (Section 115BAC(1A)) opted

Securities Transaction Tax (STT)

| Transaction | STT Rate | Payable by |

| Purchase of EOF units | Nil | – |

| Sale of EOF units (delivery-based on exchange) | 0.001% | Seller |

| Sale of EOF units (non-delivery) | 0.025% | Seller |

| Redemption of EOF units to the AMC | 0.001% | Seller |

Special Provisions

- Bonus Stripping (Section 94(8)):

- Loss from sale of original units disallowed if:

- Acquired ≤ 3 months before record date; and

- Sold ≤ 9 months after record date.

- Disallowed loss added to cost of bonus units.

- Applies also to REITs, InvITs, and AIFs.

Exemptions from Capital Gains:

| Transaction | Exemption Applicable |

| Consolidation of 2+ schemes within same category (EOF/non-EOF) | Exempt |

| Consolidation of plans (e.g., dividend to growth) | Exempt |

| Switching between plans (growth ↔ dividend) within a scheme | Taxable transfer |

Segregated Portfolio Taxation:

- Cost apportioned between main and segregated portfolio.

- Based on NAV ratio at time of segregation.

Definition of EOF (Section 112A):

A Fund of Fund (FoF) qualifies as an Equity-Oriented Fund if:

- ≥90% in units of another fund traded on a recognised exchange

- That fund invests ≥90% in equity shares of Indian listed companies

If not met, treated as non-EOF and taxed accordingly.

NRI-Specific Provisions

- DTAA Override: Section 90(2) allows treaty benefits if TRC and supporting docs are submitted.

- No PAN Relief (Rule 37BC): NRI can avoid 206AA (higher TDS) if Provides TRC, name, address, tax ID, country of residence, etc.

- Section 206AB (Higher TDS for non-filers): Not applicable to NRIs without a PE in India.