2500 Cr Loss Risk from Compensation Cess Credits in GST 2.0

Page Contents

FADA : Rs. 2,500 Cr Loss Risk from Compensation Cess Credits in GST 2.0 Transition

The Federation of Automobile Dealers Associations has sounded the alarm over a potential INR 2,500 crore loss to auto dealers due to the impending removal of compensation cess without clear transitional guidelines.

These credits, currently lying in dealers’ books, are tied to taxes already paid on vehicles in inventory — particularly high-tax categories like SUVs and premium cars. With GST 2.0 set to roll out from September 22, 2025, dealers fear these credits may become unusable, creating a heavy financial burden just ahead of the festive season.

The Federation of Automobile Dealers Associations has welcomed the reforms for making vehicles more affordable and boosting demand but insists on “glitch-free implementation” so that the benefits of tax reduction seamlessly reach customers while protecting dealer interests.

Key Highlights of GST 2.0 for Auto Sector

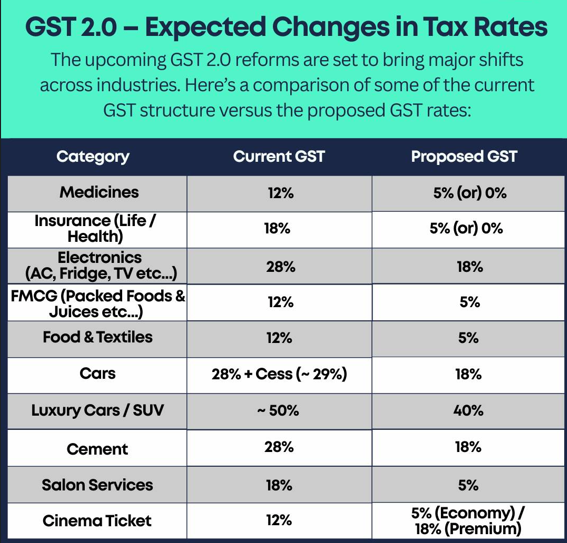

Previously, premium vehicles attracted 28% GST + 17–22% cess, totalling 45–50%. With GST 2.0, the cess is abolished, and GST is set at 40%. While this simplifies taxation and lowers rates for most segments, it leaves no mechanism to utilise existing cess credits, which may lapse unused. The following are key highlight of the change in GST 2.0 for Auto Sector are mention below :

-

Tax Shift under GST 2.0 for Auto Sector:

-

- Rate Changes: GST reduced from 28% to 18% on automobiles. Compensation Cess completely eliminated. New GST slab structure: 5%, 18%, and 40% (12% & 28% removed).

- Reduced to 18% GST: Small cars (Petrol/LPG/CNG ≤1200 cc, ≤4000 mm; Diesel ≤1500 cc, ≤4000 mm), Motorcycles ≤350 cc, Three-wheelers, commercial vehicles (buses, trucks, ambulances), All auto parts,

- Reduced to 5% GST: Tractors, tractor tyres, and tractor parts & Electric vehicles (unchanged at 5%)

- Raised to 40% GST: Mid-size & large cars (engines >1500 cc or length >4000 mm, SUVs, MUVs, MPVs, XUVs with ≥170 mm ground clearance), Motorcycles >350 cc & Luxury vehicles (helicopters, yachts, etc.)

- Petrol, CNG, LPG cars up to 1200 cc engine & 4000 mm length → now taxed at 18% (down from 28%). & Diesel cars up to 1500 cc engine & 4000 mm length → now taxed at 18% (down from 28%).

-

Industry Concerns for Auto Sector

-

- Dealers reportedly hold about 55 days’ worth of vehicle inventory (per FADA’s August 23 advisory).

- FADA President CS Vigneshwar stressed: “One area that needs earliest clarification is about levy and treatment of cess balances currently lying in dealers’ books, so that there is no ambiguity during transition.”

- Speaking to CNBC-TV18, Vigneshwar confirmed that The Federation of Automobile Dealers Associations will make a representation to the government to seek clarity and relief for dealers.

- Impact on Cess Credits: Earlier, dealers used Compensation Cess credits to offset their cess liabilities. After 22 September 2025, since cess is abolished, these credits will become non-usable. This leaves dealers holding accumulated cess balances that are effectively wasted.

- Federation of Automobile Dealers Associations (FADA) estimates that dealers will suffer a INR 2,500 crore loss due to unutilizable cess credits.

- Dealers stocked inventory for the festive season, paying cess on purchases. Now, they cannot offset it against future sales because cess no longer exists. They are urging the government to create a transition mechanism to prevent this loss.

- Other Highlights

-

From 22 Sept 2025, GST will have only 3 rates: 5%, 18%, 40%., Compensation Cess withdrawn, except for tobacco & sin goods until cess dues cleared. 12% and 28% slabs scrapped.

-

Time of supply rules apply to advances & supply. ITC allowed on goods/services received till 21 Sept 2025.

-

Refunds for inverted duty structure continue as per existing rules. NIL rate ≠ exemption → no GST but not exempt supplies.

-

Items taxable till 21 Sept but exempt after → proportionate ITC reversal required. Sin goods (tobacco, pan masala, etc.) → continue under old structure till cess dues cleared.

-

Rate Structure & Sectoral Changes

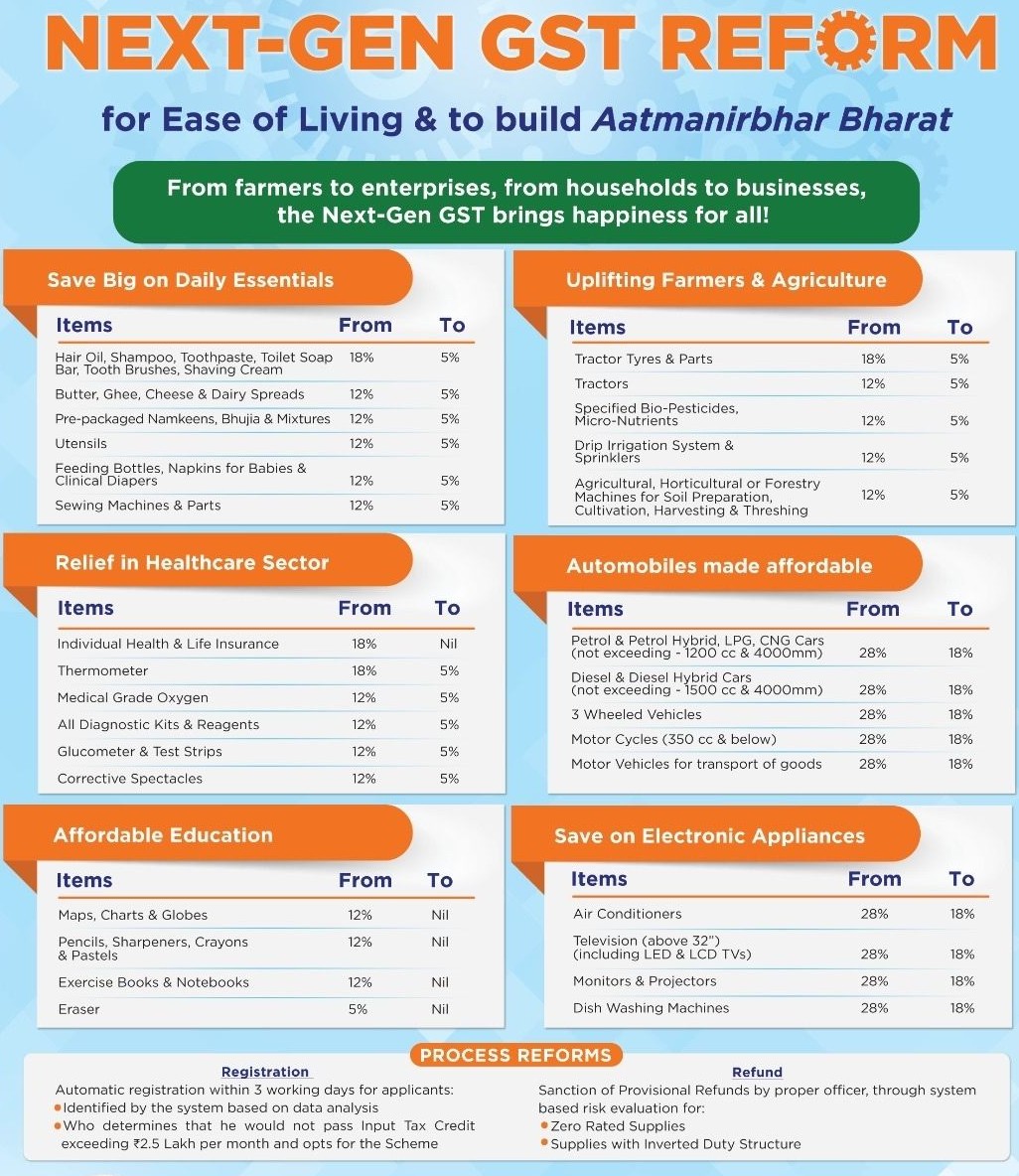

Daily-Use & Consumer Goods

-

-

Hair oil, shampoo, toothpaste, soaps, shaving creams → 18% → 5%

-

Butter, ghee, cheese, dairy spreads → 12% → 5%

-

Packaged namkeens, bhujia, mixtures → 12% → 5%

-

Utensils, sewing machines & parts, diapers, feeding bottles → 12% → 5%

-

Healthcare

-

-

Health & Life Insurance → 18% → Nil

-

Thermometers → 18% → 5%

-

Medical oxygen, diagnostic kits, glucometers, corrective spectacles → 12% → 5%

-

Education

-

-

Maps, charts, globes → 12% → Nil

-

Pencils, sharpeners, crayons, pastels → 12% → Nil

-

Notebooks & exercise books → 12% → Nil

-

Erasers → 5% → Nil

-

Agriculture & Farmers

-

-

Tractor tyres & parts → 18% → 5%

-

Tractors → 12% → 5%

-

Bio-pesticides, micro-nutrients, drip irrigation, sprinklers → 12% → 5%

-

Agricultural machinery (soil prep, cultivation, harvesting) → 12% → 5%

-

Automobiles

-

-

Petrol/LPG/CNG cars (≤1200cc & 400mm) → 28% → 18%

-

Diesel cars (≤1500cc & 400mm) → 28% → 18%

-

Three-wheelers → 28% → 18%

-

Motorcycles ≤350cc → 28% → 18%

-

Goods transport vehicles → 28% → 18%

-

Luxury & large vehicles → 40%

-

Electronics

-

-

Air conditioners → 28% → 18%

-

TVs (above 32″), LED/LCD, monitors, projectors → 28% → 18%

-

Dishwashers → 28% → 18%

-

Hospitality

-

-

Hotel rooms up to ₹7500/night → 5% (No ITC available)

-

Update on MRP Compliance Post GST Rate Restructuring

In line with the GST rate changes announced at the 56th GST Council meeting, the Ministry of Consumer Affairs has clarified compliance obligations under the Legal Metrology (Packaged Commodities) Rules, 2011: Businesses can clear pre-GST-change inventory by correcting MRP transparently, but must strictly follow the permitted methods, keep the old MRP visible, and fulfil consumer awareness and reporting obligations. (Circular dated 9 September 2025 – Department of Consumer Affairs, Weights & Measures Unit) . following are Key Provisions- Update on MRP Compliance Post GST Rate Restructuring :

-

Revised MRP Declaration : Manufacturers, packers, and importers may revise MRPs on unsold stock manufactured, packed, or imported before the GST change. Valid until 31 December 2025 or till old stock is sold, whichever is earlier.

-

Mode of Revision : Only stamping, affixing stickers, or online printing may be used to show revised MRP.The original MRP must remain visible and cannot be overwritten/obscured.

-

Consumer Communication : At least two newspaper announcements (in one or more papers) must be made to inform consumers about revised MRPs.

-

Regulatory Reporting : Entities must notify Dealers in the supply chain, Director of Legal Metrology (Central Government) & Controllers of Legal Metrology in respective States/UTs.

-

Packaging Material : Existing packaging/wrappers with old MRP may continue till 31 December 2025, subject to corrections being made (via stamping, stickers, or online printing).

Conclusion

The GST Council’s reforms are meant to simplify taxation and reduce rates for consumers, but the transition gap (unused cess credits) is creating a heavy INR 2,500 crore burden on auto dealers. Unless the government introduces a credit transfer/refund mechanism, this loss will directly impact dealer margins during the festive sales season.

While GST 2.0 simplifies the tax structure and lowers rates for most vehicles, the government’s refusal to refund or adjust cess already paid creates a INR 2,500 crore hit for auto dealers. government will not offer any relief, and the matter may have to be resolved between manufacturers and dealers. The lack of a transition mechanism shifts the burden squarely onto the dealer network, potentially straining OEM–dealer relations.