COMPANY LAW

Physical Verification of the Registered Office of the Company By ROC

RJA 19 Aug, 2022

MCA Amends Incorporation Rules: ROC has to prepare a Physical Verification Report of the Registered Office of the company in the given format. {MCA notifies Companies (Incorporation) Third Amendment Rules,2022.} A Registrar of Companies (RoC) is allowed under Section 12 of the Act to physically inspect a company's registered office ...

GST Compliance

CBEC Clarification on 5% GST on the ticket cancellation fee,

RJA 18 Aug, 2022

CBEC Clarification on 5% GST on the ticket cancellation fee, 5 % GST is only applicable on the cancellation of the tickets of AC class which will be subject to penalty, affirmation made by south central railways official by a statement given. GST on cancelled train tickets is one of the wide spread ...

Chartered Accountants

ICAI issue Notice to CA Firms on violate Company Law Via Chinese Co.

RJA 11 Aug, 2022

ICAI issue Notice to CA Firms on violate Company Law Via Indian subsidiaries Chinese Co. About 200 CA firms have received Disciplinary Notices from the ICAI for allegedly engaging in or assisting Chinese firms that were violating the law through Indian subsidiaries and shell entities. Considering the extensive alleged/complained by ...

Chartered Accountants

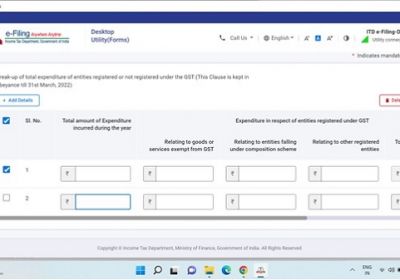

Required to fill Clause 44 of Form 3CD under Tax audit

RJA 11 Aug, 2022

Needed to fill Clause 44 of Form 3CD under Tax audit If you are subjected to an Income Tax audit provision, you must shall adhere by Clause 44 of Form 3CD. Tax Auditor Reporting under the Tax Audit Report clause No 44 under the Form 3CD of Tax Audit Report Under Income ...

GST Consultancy

CBIC examine crypto ecosystem to bring more activities on GST framework

RJA 10 Aug, 2022

CBIC examine crypto ecosystem to bring more activities on GST framework The CBIC's GST policy department is carefully analysing how to extend the reach of taxation to the cryptocurrency ecosystem. It intends to grow its activities by providing platforms for mining cryptocurrency assets and the usage of virtual digital ...

Goods and Services Tax

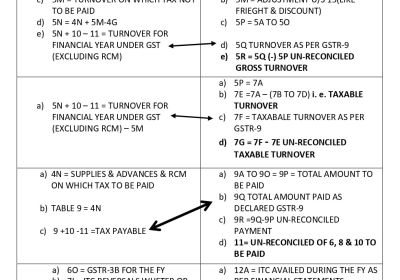

GSTR-9 and GSTR-9C(i.e GST Annual Return) are Available for filing Now

RJA 08 Aug, 2022

GSTR-9 and GSTR-9C(i.e GST Annual Return) are Available for filing Now GSTR 9C is a statement that reconciles the information from the yearly returns filed under GSTR 9 for a given financial year with the data from the taxpayer's audited annual financial statements. A cost accountant or ...

INCOME TAX

Extension of tax returns filing deadline for AY 2022–23 till 31st Aug 2022

RJA 08 Aug, 2022

Extension of the Due date of filing ITR for AY 2022–23 till 31st August 2022 A Representation from the Gujarat Federation of Tax Consultants and the Income Tax Bar Association have been submitted to the Indian Minister of Finance and the Chairman of the CBDT to extend the date for submitting ...

Goods and Services Tax

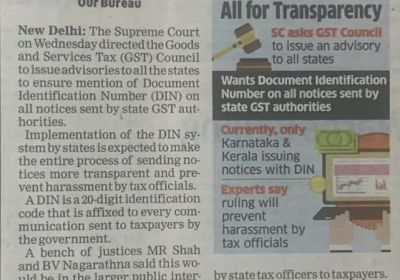

Advisory for SGST to Issue DIN While Issuing Notice

RJA 06 Aug, 2022

Advisory to Issue Document Identification Number (DIN) By SGST, While Issuing GST Notice What is Document Identification Number in GST? A DIN Number (DIN) is a unique 20-digit identification code attached to every correspondence issued by the Govt offices to GST taxpayers. With this Document Identification Number, the GST Taxpayer ...

Goods and Services Tax

Pay GST on bookings of train or air tickets hotel cancellation charges

RJA 05 Aug, 2022

Pay GST on bookings of train or air tickets hotel cancellation charges Finance ministry Tax Research Unit (TRU) issued 3 circulars along with clarifications or explanations as far as the Goods and Services tax levy is concerned. In accordance with CBDT circular, GST levy in cases where payments arise from ...

Goods and Services Tax

Impact of GST on unsold stock of pre-packaged commodities

RJA 03 Aug, 2022

Complete overview GST impact on Pre-Packaged Unsold goods The Department of Consumer Affairs addressed the impact of GST on unsold stock of pre-packaged commodities under the Legal Metrology (Packaged Commodities) Rules 2022 in a letter dated 01.08.2022, in light of the recent decision to impose a % GST on pre-packaged commodities. In ...

COMPANY LAW

Tax & Statutory Compliance Calendar for the Month of August 2022

RJA 01 Aug, 2022

Tax & Statutory Compliance Calendar for the Month of August 2022 S. No. Statue Purpose Compliance Period Month Compliance particular Timeline 1 Goods and services Tax Compliance GSTR - 3B July-22 1. Goods and services Tax Filing of returns by a registered person with aggregate turnover exceeding Rs. 5 Crores during the preceding year. 2. ...

INCOME TAX

New Income tax Rules for verification of Income tax return Filling

RJA 01 Aug, 2022

New Income tax Rules for verification of Income tax return Filling If ITR for Assessment year 2022-23 filed today or in months to come upto 31.12.2022 and not verified within 30 days Date of verification will be taken as date of filing. So interest and late fees will be levied accordingly Where ...

INCOME TAX

New Rule on e-Verification of income tax return Return

RJA 01 Aug, 2022

Overview of New E-Verification of income tax return Rule If the filed return is not verified within the provided timeline, the return filing procedure is not complete. If an Income tax return’s is filed but not verified, the ITR is deemed to be invalid and is subject to ...

INCOME TAX

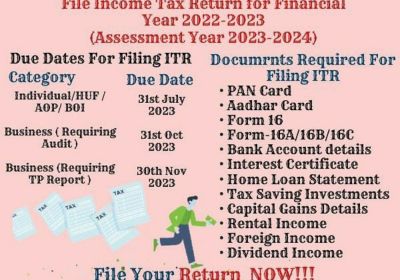

Online ITR submitting Due Dates for AY 2023-24

RJA 01 Aug, 2022

Online ITR Filing Amendment – FY 2022-23 (AY 2023-24) What is the Income Tax? · There are two Kind of tax levy one is a an indirect tax & second is direct tax. Income tax is a kind of direct tax that is mainly directly attributable to the ...

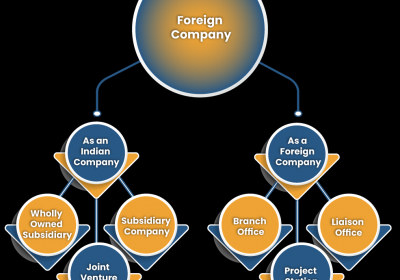

Business Setup in India

Functions & Features of Wholly Owned Subsidiary in India.

RJA 01 Aug, 2022

Wholly Owned Subsidiary in India. foreign companies may establish fully owned subsidiaries in areas that allow 100% foreign direct investment Under India's national FDI policy, For incorporation & registration, a set of applications have to be filed with Registrar of Companies (ROC). Once a company has been duly registered ...

IBC

Role of Insolvency Professional under the IBC Regulations

RJA 30 Jul, 2022

Role of Insolvency Professional under the IBC Regulations In administering the resolution outcomes, the role of the IP encompasses a wide range of functions, which include adhering to procedure of the law, as well as accounting and finance related functions. The latter include the identification of the assets and liabilities ...

GST Consultancy

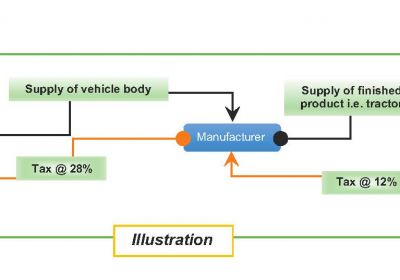

Formula Improved for claiming ITC refund in case of inverted duty structures

RJA 21 Jul, 2022

GSTN : Formula Improved for claiming ITC refund in case of inverted duty structures Following the 47th GST Council, the GOI improved the formula of inverted duty structure by issuing Central Tax Notification No. 14/2022, which was published in the Gazette and stated that in the event of a refund due to ...

GST Compliance

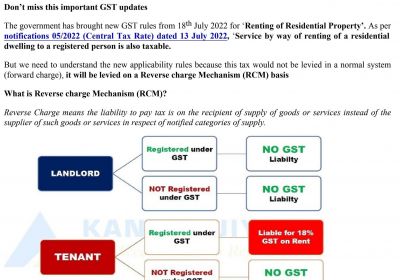

Key impact on GST on Rent of Residential Property

RJA 18 Jul, 2022

Key impact on GST on Rent of Residential Property The fundamentals of renting residential property under GST will change Starting on July 18, 2022. 47th GST Council Meeting decided to include the rental of residential properties in the tax net. Immovable property rental is regarded as a provision of services and is ...

INCOME TAX

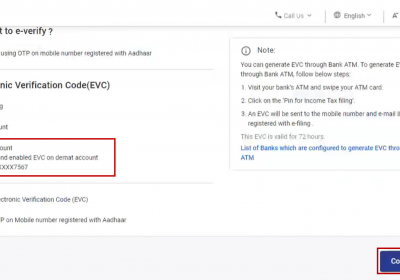

Step for Verify your Income tax return via Using your Demat Account

RJA 15 Jul, 2022

How to verify your ITR via Using your Demat Account : ITR 2021-22 Every taxpayer must verify their income tax return at income tax portal within 120 days after filing the ITR 2021-22, otherwise it would be ruled or deemed invalid. The Deadline for submitting an income tax return for the Financial ...

GST Compliance

Taxpayer compulsory submit the correct HSN codes in GSTR-1: GSTN Advisory

RJA 09 Jul, 2022

GSTN Implements Compulsory mentioning of HSN codes in GSTR-1: GST System Update The GSTN has updated its system to implement mandatory Compulsory mentioning of Harmonized System of Nomenclature codes in GSTR-1 GSTN is Compulsory for the GST taxpayers to report minimum 4 digits or 6 digits of Harmonized System of Nomenclature (HSN) ...

Chartered Accountants

Chartered to keep our Business Guide and Protector role

RJA 01 Jul, 2022

What is Chartered accountants? An internationally recognised financial expert who manages client budgets, audits, taxes, and business plans is a chartered accountant. You can work for organisations, the government, and people as a CA. Your role is to assist clients with money management and offer knowledgeable financial advise. A person ...

INCOME TAX

Last date approaching; How to file ITR For AY 2023-24

RJA 26 Jun, 2022

Last date approaching; How to file ITR For AY 2023-24 Income tax Taxpayers can e-verify his Income tax return immediately or within one hundred and twenty days of filing using the techniques outlined on the website. The ITR e-verification can be completed via pre-validated demat account, or Aadhaar OTP, pre-validated ...

INCOME TAX

CBDT: Issues Clarification on income tax Form 10CCB

RJA 25 Jun, 2022

The Income tax Dept. has issued the Clarification on income tax Form 10CCB to prevent errors in form filing and verification, clarification provides as mentioned below : After Chartered Accountants assign the appropriate Chartered Accountant complete filing of form income tax portal. Income Tax Taxpayer can reject/ accept the income tax ...

Goods and Services Tax

CBIC : GST Compensation Cess term has been extended to March 31, 2026

RJA 25 Jun, 2022

GST Compensation Cess term has been extended to March 31, 2026 GST Compensation Cess has been extended by the Central Govt for an additional four years, till June 2026. The period for levying and collecting the cess under section 8(1) of the Goods and Services Tax (Compensation to States) Act, 2017, "shall ...