OTHERS

THE BENAMI TRANSACTIONS (PROHIBITION) AMENDMENT ACT, 2016

RJA 25 Jan, 2018

INTRODUCTION Benami property means any property which is the subject matter of a Benami transaction and also includes the proceeds from such property Benami transaction As par section 2(9) "benami transaction" means,— (A) A transaction or an arrangement— (a) Where a property ...

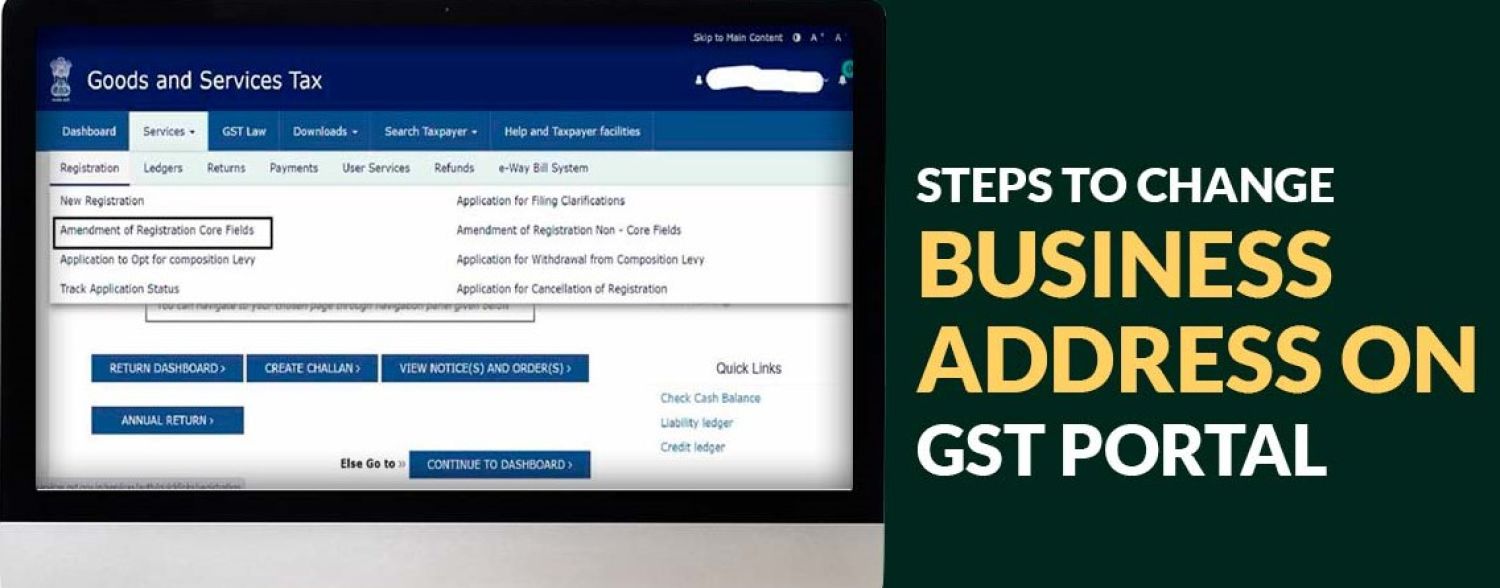

Goods and Services Tax

DETAILS OF VALUE ADDED TAX (VAT) OF UAE

RJA 22 Jan, 2018

VALUE-ADDED TAX IN UAE REGISTRATION All the businesses who have a place of residence in the state of UAE and whose value of supplies in the member states in the previous 12 months has exceeded AED 375,000 should mandatorily register under UAE VAT. Also, if the businesses anticipate that the total value ...

Goods and Services Tax

Resident Welfare Association/ Housing Society under GST

RJA 19 Jan, 2018

Registration requirement If the aggregate turnover of such RWA is up to Rs.20 Lakh in a financial year, then such supplies would be exempted from GST even if charges per member are more than Rs. 7500 Exemption Limit RWA shall be required to pay GST on monthly subscription/contribution charged from ...

FEMA

Reporting of Form FC-GPR to RBI

RJA 16 Jan, 2018

The Form FC-GPR comes into use whenever there is new issue of shares. The onus to submit the form or comply with the laws is on the resident entity. Any Company or Organization receiving foreign investment must report the transaction to the RBI within a stipulated timeline. Similar to the ...

Goods and Services Tax

QUICK REVIEW ON UAE VALUE ADDED TAX

RJA 13 Jan, 2018

UAE VAT Registration Threshold If the Annual Turnover of the company is more than AED 375,000/, it is mandatory for the company to register under UAE VAT If the Annual Turnover is between AED 187,500 & AED 375,000/, it is optional for the company to be registered under UAE VAT law. Further, ...

Goods and Services Tax

Everything You Need to Know About Continuous Supply of Goods Under GST

RJA 11 Jan, 2018

When certain goods are being supplied on a recurrent basis, it comes under a continuous supply of goods scheme which can be under a contract of three months or more. Certain types of supplies can be mentioned by the Government to be continuous. The GST invoices therefore for such services ...

INCOME TAX

VALUATION OF UNQUOTED SHARES AN ANALYSIS

RJA 11 Jan, 2018

VALUATION OF UNQUOTED SHARES –AN ANALYSIS OF SECTION 56 ALONG WITH RULE 11UA Finance Act, 2017 inserted two new provisions under the Act- clause (x) under Section 56(2) and section 50CA. The said sections were inserted to deal with a situation where the property, including unquoted shares, is being transacted ...

GST Registration

How GST registration works for service providers

RJA 10 Jan, 2018

Registration of GST has been made easier for service providers by implementing modified rules in the 23rd GST Council Meeting. Turn Over limit remains the same for service providers as well Service providers to register for GST must have a turnover of Rs.20 lakhs or more per annum in all ...

INCOME TAX

ELECTORAL BOND SCHEME 2018 UNDER INCOME TAX

RJA 09 Jan, 2018

ELECTORAL BOND SCHEME 2018 UNDER INCOME TAX Electoral Bond is a financial instrument for making donations to political parties. These are issued by Scheduled Commercial banks upon authorization from the Central Government to intending donors, but only against cheque and digital payments (it cannot be purchased by paying cash). These bonds ...

GST Compliance

Tax Invoice in goods and services tax (GST)

RJA 07 Jan, 2018

TAX INVOICE IN GOODS AND SERVICE TAX An invoice is a commercial instrument issued by a seller to a buyer. It identifies both the trading parties and lists, describes, and quantifies the items sold, shows the date of shipment and mode of transport, prices and discounts, if any, and delivery ...

Goods and Services Tax

DON'T GET CONFUSE WITH UAE VAT TRANSITIONAL ISSUES

RJA 07 Jan, 2018

Value Added Tax (VAT) is an indirect tax. It is a type of general consumption tax that is collected incrementally, based on the value-added, at each stage of production or distribution/sales. It is usually implemented as a destination-based tax. UAE is among the first GCC member states ...

Goods and Services Tax

Goods and Services Tax Registration Made Easier

RJA 06 Jan, 2018

GST or General Sales Tax takes care of all intermediate taxes like service tax, sales tax, excise duty and so on into a composite whole tax so that paying taxes at each level can be avoided. GST registration is mandatory for all whose annual sales are more ...

Goods and Services Tax

E-COMMERCE PLATFORMS UNDER GST

RJA 06 Jan, 2018

E-commerce (electronic commerce) is the buying and selling of goods and services, or the transmitting of funds or data, over an electronic network, internet or online social networks. MEANING OF E-COMMERCE IN GST The Chapter defines an ‘electronic commerce operator’ to mean a person who owns, operates or ...

ROC Compliance

MCA proposes change in process of obtaining fresh Director Identification Number

RJA 05 Jan, 2018

MCA proposes change in process of obtaining fresh Director Identification Number MCA has proposed to re-engineer the process of allotment of Director Identification Number (DIN) by allotting DIN to individuals only at the time of their appointment as Directors (If they do NOT possess a DIN) in companies. DIR-3 (Application ...

Goods and Services Tax

Applicability of GST on Hotels Industry - GST Rate, ITC & GST Return

RJA 04 Jan, 2018

Applicability of GST on Hotels Industry - GST Rate, ITC & GST Return Goods and Service Tax (GST) is a destination-based consumption tax which is a levy of tax on all goods and services with the objective of expanding the tax base through a wide coverage of economic activities, ...

Goods and Services Tax

Quick review on GST E-Way Bill

RJA 03 Jan, 2018

QUICK REVIEW ON GST E-WAY BILL What is the E -waybill system? The E-way bill is an electronic waybill for the movement of goods that can be generated on the GSTN portal. The E-way bill contains the details of transported goods besides the name of the consignor and ...

Goods and Services Tax

NOW UAE IS THE PART OF VAT IMPLEMENTED GROUP OF COUNTRIES

RJA 01 Jan, 2018

Compliance requirements under UAE VAT VAT (Value Added Tax) is an indirect tax, which is imposed on most supplies of goods and services that are bought and sold. UAE is one of the Member States of the GCC. All GCC countries have agreed to implement the VAT latest w.e....

GST Registration

REGISTRATION OF GST MADE EASIER FOR SERVICE PROVIDERS

RJA 01 Jan, 2018

GST Registration for Service Providers Registration of GST has been made easier for service providers by implementing modified rules in the 23rd GST Council Meeting. Turn Over limit remains the same for service providers as well Service providers to register for GST must have a turnover of Rs.20 lakhs ...

OTHERS

Quick Review on RERA Act: Registration Requirement & Process

RJA 28 Dec, 2017

Quick Review on RERA Act: Registration Requirement & Process Who is a Real Estate Agent? Section 2 (zm) of RERA defines real estate agents. According to the definition, a “real estate agent” means any person, who negotiates or represents other persons for transfer of a real estate property by ...

GST Filling

THRESHOLDS AND ELIGIBILITY CRITERIA OF MONTHLY GST RETURN IS TURNOVER EXCEEDED 1.5 CR

RJA 12 Dec, 2017

GST RETURN FILLING: GST Return filling means return prescribed or required to furnished by or under GST Acts or by the rules made thereunder. A GST return is a completed document that has details of sale/revenue which a taxpayer is required to file with the GSTN authorities. This is ...

INCOME TAX

LEGAL STATUS OF BITCOINS IN INDIA

RJA 12 Dec, 2017

What's Cryptocurrencies-Bitcoin? Bitcoin is a cryptocurrency invented by a few unknown groups of people. You can buy or sell bitcoins on a bitcoin exchange. The currency is not controlled by any bank or government. Blockchain is the leading technique behind bitcoin and other cryptocurrencies. It's a public ...

ROC Compliance

Common mandatorily annual compliance of Private Limited company

RJA 11 Sep, 2017

COMPLETE FILING OF YOUR COMPANY ROC ANNUAL COMPLIANCE- COMMON COMPLIANCE’S WHICH A PRIVATE LIMITED COMPANY HAS TO MANDATORILY ENSURE- TIME IS RUNNING OUT-: - While you are busy planning the business strategies, there are various compliance’s which are required to be followed ...

Goods and Services Tax

SAC CODES FOR LEGAL AND ACCOUNTING SERVICES

RJA 27 Jul, 2017

Heading no. 9982 Legal and accounting services Group 99821 Legal services 998212 Legal advisory and representation services concerning other fields of law. 998213 Legal documentation and certification services concerning patents, copyrights and other intellectual property rights. 998214 Legal documentation and certification services concerning other documents. 998215 ...

Goods and Services Tax

GOODS AND SERVICES TAX IMPACT ON REAL ESTATE

RJA 07 Jul, 2017

GST IMPACT ON REAL ESTATE The new Goods and Services Tax regime charges under-construction properties at 12% with reducing logistic costs. It also provides for a simplified tax structure for buyers and input tax credits that allow builders to increase profit margins as well as transfer benefits of the same to ...