INCOME TAX

Income Tax Liability on Re-Development Carried from 31st March 2023

RJA 28 May, 2023

Income Tax Liability on Re-Development Carried out in Societies from 31st March 2023 Normally, housing societies Re-development are being carried out through some Developer. A Development Agreement has to be executed between the Developer and Hosing Society. By virtue of this agreement, the Housing Society transfers development rights [Floor Space Index ...

Outsourcing Services

Why Should You Use Outsourced Accounting Services from a Delhi based CA Firm?

RJA 28 May, 2023

Why Should You Use Outsourced Accounting Services from a Delhi based CA Firm? Outsourcing vs. in-house accounting management is a discussion that many early companies face today. Many business owners want to develop their company, but with growth comes growing pains, particularly in accounting. Weighing the benefits and drawbacks of ...

Valuation - Merger & acquisition

CBDT: Proposed changes to Rule 11UA for valuation of shares

RJA 28 May, 2023

CBDT: Proposed changes to Rule 11UA for valuation of shares Central Board of Direct Taxes through Press release on 19.05.2023, Has proposed amendment to Income Tax Rule 11UA for objective of Valuation of shares . In addition to the Discounted cash flow & Net Asset Value valuation methods, it is recommended to ...

INCOME TAX

Tax exemption limit of Leave Encashment increased to INR 25 Lakhs

RJA 28 May, 2023

Central Board of Direct Taxes increased limit of Leave Encashment exemption u/s 10(10AA) to Rs. 25 Lakhs for Non- Government Employees Central Board of Direct Taxes through Income tax Notification No. 31/2023 dated 24th May 2023 has notified INR 25,00,000/- as exemption limit U/s 10(10AA) with regard to Leave Encashment ...

INCOME TAX

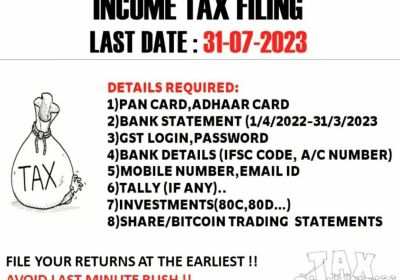

Avoid Mistakes While submitting ITR’s For AY24

RJA 27 May, 2023

Avoid Mistakes While submitting ITR’s For AY24 Despite the fact that ITR e-filing has been enabled, Income tax taxpayers are able to start filing their income tax returns for FY 2022-23 (or AY 2023-24). If you are doing the ITR on your own, there are a few pitfalls ...

INCOME TAX

Compulsory Selection of ITR’s for Complete Scrutiny during FY 2023-24

RJA 26 May, 2023

CBDT Directions on Compulsory Selection of ITR’s for Complete Scrutiny during FY 2023-24 The Central Board of Direct Taxes releases directions for the mandatory selection of Income Tax returns for Complete Scrutiny during the Fiscal Year 2023-24, as well as the method for the mandatory selection of Scrutiny. ...

INCOME TAX

How to compute ‘Net Winnings’ from online games u/s 115BBJ & 194BA

RJA 22 May, 2023

How to compute ‘Net Winnings’ from online games u/s 115BBJ & 194BA: CBDT Central Board of Direct Taxes published Notification No. 28/2023 on May 22, 2023, announcing the new Rule 133 under the Income-tax (Fifth Amendment) Rules, 2023. Above new income tax rule prescribed, How to calculate 'Net Winnings' from online games ...

GST Registration

Automated scrutiny of GST Returns set to roll out under GST law

RJA 16 May, 2023

GST Returns scrutiny via using Advanced Analytics in Indirect Taxation system Company owners will need to be extra cautious while filing GST returns because the automated GST scrutiny system is going to use advanced artificial intelligence and data analytics to check discrepancy. The new system, which is due to be ...

GST Filling

CBIC will soon have Advance Analytics in Indirect Taxation

RJA 16 May, 2023

CBIC will soon have Advance Analytics in Indirect Taxation Vivek Johri, Chairman of the Central Board of Indirect Taxes and Customs, announced in a newsletter that the Central Board of Indirect Taxes and Customs will soon have Advance Analytics in Indirect Taxation (ADVAIT). ADVAIT (Advanced Analytics in Indirect Taxation) has ...

Goods and Services Tax

GST Inspector visit at Business Premises of dealers from 16th May to 15th July 2023

RJA 15 May, 2023

GST Inspector will visit at Business Premises of all dealers during special drive from 16th May to 15th July, 2023 The issue of unscrupulous participants utilising the identities of others to obtain fake/bogus GST registration was discussed during the National Co-ordination Meeting. Fake/non-genuine registrations are being utilised to ...

Chartered Accountants

Applicability of laws of the PMLA on CA's, CS’s & CWAs

RJA 11 May, 2023

One Significant Development - PMLA will now apply to CAs CSs, & CWAs The laws of the PMLA will now apply to CAs, CSs, and CWAs, forcing them to comply with several obligations such as keeping financial transaction records, identifying and authenticating clients, and reporting suspicious transactions to ...

GST Consultancy

Highest GST Revenue collection in HP ever in the month of April 2023

RJA 10 May, 2023

Highest GST Revenue collection in Himachal Pradesh ever in the month of April 2023 Commissioner of State Taxes and Excise Yunuspur Himachal Pradesh said in a report that, the GST collection in the month of April is 19% more than the last year’s GST collected in the state of Himachal ...

IBC

IBBI invites comments from Public on Regulations notified under IBC

RJA 07 May, 2023

IBBI invites comments from Public on Regulations notified under IBC Law The public is invited to comment on the rules announced under the 2016 Insolvency and Bankruptcy Code of the Insolvency and Bankruptcy Board of India. Public consultation allows for collaborative decision-making and hence plays an important part in the regulatory ...

IBC

Circular to facilitate on GST tax due recovery from IBC Companies

RJA 07 May, 2023

The government will release a circular to facilitate the recovery of tax debts from insolvent enterprises, which may force new buyers to settle "agreed tax claims" while a resolution package is finished. Revenue Department will consult with the MCA, which administers the IBC, on any necessary changes. The ...

INCOME TAX

Is Provision for warranty allowed/ disallowed as an expense?

RJA 07 May, 2023

Is warranty expenses provision allowed/disallowed as an expense? A warranty is an official assurance provided by the manufacturer to the purchaser of a product, committing to repair or replace it if necessary within a set time frame. As a consequence, it is a future expense that a manufacturer may ...

COMPANY LAW

Tax and Statutory Compliance Calendar for May 2023

RJA 02 May, 2023

Tax and Statutory Compliance Calendar for May 2023 S. No. Under the law Objective Period of Compliance Timeline Date Details of Compliance 1 Goods and services Tax Act GSTR - 3B April 2023 20-May-23 1. Goods and services Tax Filing of returns by registered person with aggregate turnover exceeding Rs. 5 Cr. during Last ...

GST Filling

Employee from branch office to head office, & vice versa to attract 18% GST

RJA 29 Apr, 2023

Employee services from a branch office to the headquarters will be subject to an 18% GST: Profisolutions Pvt Ltd (Applicant) Services provided by employees of a company's branch office to its head office and vice versa located in different states would be subject to 18% Goods and Services Tax, the Authority ...

GST Consultancy

Why GST Registered firms are getting Notices from the GST Dept.?

RJA 26 Apr, 2023

Why Goods and Services tax Registered firms are getting Notices from the GST Dept. GST Notices for tax evasion, rate non-compliance, late filing, absent or incorrect invoices, eWay Bill inconsistency, and non-payment are frequently issued. Understanding the various notices that a company or professional could get, as well as their ...

AUDIT

Audit trail Feature is mandatory for accounting software of Company

RJA 26 Mar, 2023

Audit Trail compulsory to be installed in accounting software by Companies w.e.f. 01.04.2023 1. Every business made mandatory incorporate the audit trail capability into the accounting software with effect from 1 April, 2023, it utilizes for maintains its books of account. 2. An edit log should be included in ...

Chartered Accountants

ICAI : CA can be Director Simpliciter or Professional Director

RJA 21 Mar, 2023

ICAI Decision: CA can be Director Simpliciter/Professional Director According to a recent ruling by the Institute of Chartered Accountants of India (ICAI) Board of Discipline, a Chartered Accountant in practise is not guilty of professional misconduct if they serve as a Director Simpliciter or Professional Director. A Member of ...

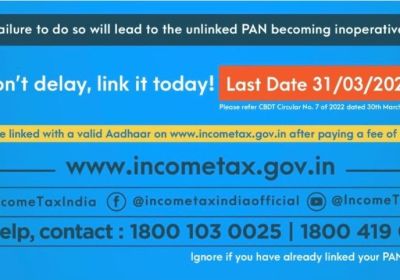

INCOME TAX

PAN become inactive if it is not connected Aadhaar till 31.03.2023

RJA 19 Mar, 2023

PAN become inactive if it is not connected Aadhaar till 31.03.2023 According to the income tax dept. The Income Tax Dept does not deactivate Assessees' PAN cards unnecessarily. But, they can avoid having his PAN deactivated by mistake. Assessees can prevent his permanent account number from getting deactivated by keeping ...

RBI

18 Nations Banks allowed to get RBI's nod to trade in INR

RJA 19 Mar, 2023

18 Countries Banks allowed to get RBI's nod to trade in INR According to the government of India, the Reserve Bank of India (RBI) has allowed banks from 18 different nations to open Special Vostro Rupee Accounts (SVRAs) in order to settle payments in rupees. Bhagwat Kishanrao Karad, the ...

INCOME TAX

Tax Collections grown up to INR 13.73 lakh Cr till 10.03.2023

RJA 13 Mar, 2023

Tax Collections (Income Tax) grown up from 16.8% to INR 13.73 lakh Cr till 10.03.2023 Indian Income tax Collections up to 10.03.2023 continue to register increase growth. Income Tax collections up to 10.03.2023 disclose that Gross India collections are at INR 16.68 lakh Cr (Provisional figures) which is INR 22.58 Percentage higher than Gross collections for the ...

Chartered Accountants

Beneficiary Schemes for the Chartered Accountants : ICAI

RJA 13 Mar, 2023

Beneficiary Schemes for the Chartered Accountants Members of ICAI: The chartered accountancy profession is regulated in India by the Institute of Chartered Accountants of India (ICAI), which also establishes accounting standards and provides professional development courses. he Institute of Chartered Accountants of India have come up with new mediclaim ...