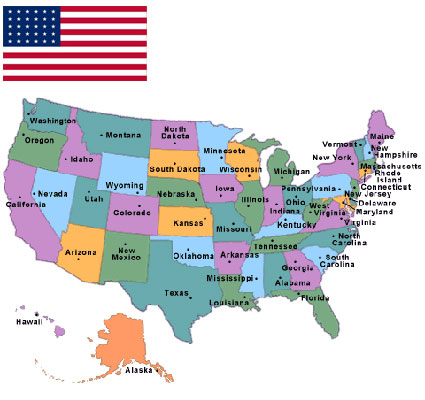

The United States of America (commonly called the United States, the U.S., the USA, America, and the States) is a federal constitutional republic consisting of fifty states and a federal district.

Land Area: 9.827 million square kms

Coastline: 19,924 kms

Capital: Washington, D.C.

Population: 314.69(approx.) millions

Climate: The United States includes a wide variety of climate types due to its large size, range of geographic features, and non-contiguous arrangement. In the contiguous United States to the east of the 100th meridian, the climate ranges from humid continental in the north to humid subtropical in the south. The southern tip of Florida is tropical. The Great Plains west of the 100th meridian are semi-arid. Much of the Rocky Mountains, the Sierra Nevada, and the Cascade Range are alpine. The climate is arid in the Great Basin, desert in the Southwest, Mediterranean in coastal California, and oceanic in coastal Oregon and Washington. The state of Alaska—on the northwestern corner of the North American continent—is largely subarctic, with an oceanic climate in its southern edge and a polar climate in the north. The archipelago state of Hawaii, in the middle of the Pacific Ocean, is tropical.

GDP: 15.09 trillion USD(2011)

Time Zone: GMT – 8:00 (Washington)

Literacy: The literacy rates stands at 99% for both males and females.

Environmental- Current Issues: Climate Change, conservation, pollution, invasive species, nuclear, waste etc.

Environmental- International Agreements:

- Long Range Transboundary Air Pollution,

- Partnership for Clean Fuels and Vehicles,

- Partnership for Clean Indoor Air,

- Sustainable Developments Partnership,

- United Nations Framework Convention on Climate Change,

- Clean Air Initiative in Latin America ,

- Sub- Saharan Africa and Asia.

International Airports: There are as many as 20341 airports in USA, out of these 5221 are for public use. Only 565 are certified airports.

Ports of Entry: There are 149 ranked ports and various other unranked airports in USA. Major ports in USA include LOS Angeles, Detroit, New York & New Jersey, Laredo and Houston.

- Financial Year : January 1 to December 31

- Tax rates for Year 2012

Tax rates for Year 2012-13

| Nature of Assessee |

|

||||

| Individuals |

|

||||

| LLP / Partnership Firm | Any Income | ||||

| Company |

|

1. Ascertain the legal configuration of your business:

You need to organize your business as a legal entity. There are numerous options to account for, and all have various legal, financial and tax considerations. The right legal configuration for your business depends on a number of things. These include the level of control you want to have, your business’ vulnerability to lawsuits and financing needs. The legal structure chosen by you will determine additional registration requirements. You may have to file registration forms with your state and/or local government, after you have chosen a legal structure. The various considerations which need to be taken into account change from state to state. Some firms / businesses need to be registered with your state government:

- A corporation

- A nonprofit organization

- A limited-liability company or partnership

You won’t need to register your business at the state level, if you set up your business as a sole proprietorship (also known as sole trader – a business entity owned and run by one individual). For many states, it is necessary that sole proprietors use their own name for the company / business name unless they formally register another name. This is referred to as your Doing Business As (DBA) name, trade name or a fictitious name.

Your first choice of a business type is not permanent. You can initially register as a sole proprietorship, and if your business expands and your personal liability risk goes up, you can change your business to an LLC.

2. Register your business / firm name:

"Doing Business As," "DBA," "Assumed Name," and "Fictitious Name" are references that are used when describing the procedure of registering a legal name for your business.

The legal name of a firm / business by default is the name of the person or organization that owns a business. The legal name will be your full name, if you are the exclusive proprietor of your firm / business. However, if your business is a partnership, the legal name is the name outlined in your partnership agreement / the last names of the partners. The business’ legal name is the one that was registered with the state government, for limited liability corporations (LLCs) and corporations.

Your business' legal name is a prerequisite on all government documents. Forms include your application form for employer tax identifications, licenses and permits. If you decide to set up a shop or sell your products under a separate name, then you might need to file an “assumed name” registration form with your state and local government.

The legal name of firm / business is the name of the owner/s. For example:

- The legal name is your full name, if you are the sole proprietor of your business

- The legal name is the name provided in your partnership confirmation or the last names of the partners, if your business is a partnership

- The business' legal name is the one that was given to the state government, for limited liability corporations (LLCs) and corporations

Your legal business name is needed on all government documents, such as your application for employer tax IDs, licenses and permits. You may have to file a "fictitious name" on registration forms with your government agency, if you wish to set up a shop or sell your products under a different name.

An assumed name (or fictitious name, trade name or DBA (doing business as) name is a business name that is not the same as your personal name, the names of your partners or the formally registered name of your LLC or company.

For example, if Tom Johnson the sole owner of a catering company he runs from his home, and he wants to change his business name to Seaside Catering instead of using his business’ legal name, which is Tom Johnson. Tom will need to register the new name as a fictitious business name (DBA ) with a government agency, in order to start using that name. The relevant government agency to register with depends on where she lives. You have to register fictitious names with the relevant state government or with the county clerk’s office in some states, but there are also some states that you do not have to register the fictitious business names.

3. Acquire your federal tax ID:

Employers with employees, business partnerships and corporations, and other categories of organizations, are required to acquire an Employer Identification Number (EIN) from the U.S. Internal Revenue Service. This number is also known as an Employer Tax ID and Form SS-4:

U.S. Internal Revenue Service Phone: 1-800-829-4933

An Employer Identification Number (EIN) / Federal Tax Identification Number is needed to distinguish a business entity. Companies / businesses normally need an EIN. There are a number of ways in which you can put through an application for an EIN, including applying online. This service is free. It is offered by the Internal Revenue Service. You are required to check with your state to see if you need a state number / charter.

4. Register with your state revenue agency:

In addition, you are required to obtain Tax IDs and permits from your state’s revenue agency, just as you are required to have a Federal Tax ID.

If you decide to sell products and you need to compile sales taxes, you will probably be required to acquire a Sales Tax Permit or Vendor’s License. This can be obtained from your state or local government (or both).

As well as business taxes which are needed by the federal government, you will need to pay some state and local taxes, with every state and locality having its own tax laws. The following links allow access to essential resources. These resources will help you learn about your state tax requirements. By acquiring knowledge of your state tax requirement, this can help you avoid problems and also help your business save money. The most frequent types of tax obligations for small businesses / firms include the following:

Tax Permit:

In the majority of states, business / company owners need to register their business with a state tax agency and apply for the relevant tax permits. It is a requirement in most states require for businesses to apply for a state sales tax permit, in order to collect sales tax from customers.

Income Taxes:

Almost all states place a levy on business or corporate income tax. Your tax obligation is dependent on the legal configuration of your business. The LLC gets taxed independently from the owners, if your business is a Limited Liability Company (LLC), while sole owners report their personal & business income taxes using the same form. For specific requirements, contact the General Tax Information link under your state.

Employment Taxes:

Business owners with employees are also accountable for paying the appropriate taxes required by the state, as well as federal employment taxes. Payment of state workers’ compensation insurance and unemployment insurance taxes is required by all states.

Additionally, the states / territories listed below require a business to pay for temporary disability insurance:

- California

- Hawaii

- New Jersey

- New York

- Rhode Island

- Puerto Rico

5. Acquire licenses and permits:

The majority of businesses need to acquire some category of business license or permit to formally operate. Most small businesses are required to acquire a general business license / industry-specific operating permits from state and local government agencies. You may be required to be licensed at the federal, state and/or local level, depending on your business. As well as a basic operating license, you might need specific permits, including an environmental permit.

It's vitally important to understand the licensing rules where your business is based, as regulations change by industry, state and locality. Not adhering to the regulations for licensing and permitting can result in costly fines, as well as placing your business / company at serious risk. You might be required to acquire a federal license, if your business is taking part in activities that are supervised and controlled by a federal agency.