Tax Deduction at Source (TDS)

What is TDS?

TDS is among the tax collecting methods in which a individual making or crediting a charge to another needs to subtract a certain proportion of the value from that sum. TDS is like a cash tax charge to the state. It's in preparation. The sum of the TDS shall be paid by the Deductors to the Treasury. Account up until the 7th of the next month in which the balance is withdrawn. As the TDS is being paid by the Deductors to the Treasury. The Accountant shall ensure the daily inflow of cash capital to the State at appropriate intervals.

What is liable for the exclusion of root tax (TDS)?

The Income Tax Act allows defined individuals to subtract tax for some forms of payments made by them. The list of these individuals needing the development of TDS is specified in the TDS section set out below. The following are the specified person who is liable to deduct TDS.

- An Individuals or an H.U.F. is not liable to deduct TDS on such payment except where the individual or H.U.F. is carrying on a business/profession where accounts are enforce to be audited u/s 44AB, in the immediately preceding financial year.

- . An individual is responsible to have audited his or her accounts 44AB if, throughout the applicable financial year, his or her gross sales, turnover or gross receipts exceed Rs. 2 crore (Rs.60 Lacs for A.Y.2012-) in the case of a business or Rs. 50 Lacs (Rs. 15 Lacs for A.Y. 2012-) in the case of a profession.

TAX DEDUCTION AND COLLECTION ACCOUNT NUMBER (TAN)

TAN is an alpha numeric 10 digits number. Every person who is accountable to deduct tax at source must obtain TAN no. from the department in form no. 49B within one month from end of the month in which tax was deducted. TAN is needed to be mention on every transaction related to TDS. There is a penalty of Rs. 10000 on failure to apply TAN

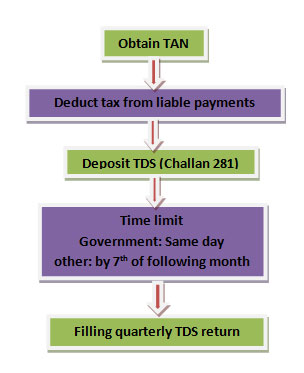

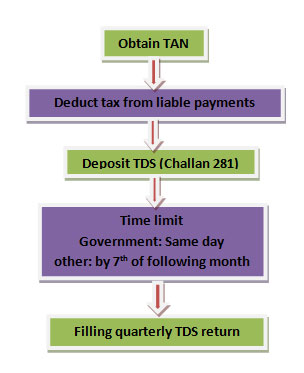

Procedure to pay TDS

Due Date of deposit of Challan 281 and filling quarterly return of TDS

Every person who is accountable to deduct TDS shall deposit the TDS deducted by him by 7th of following month in which TDS is deducted however Due date of deposit of TDS for the month of March is 30th April

The deadline of the quarterly TDS return is 15th of the next month in each year, although this deadline could be 15th in the case of the quarter ended March 20XX

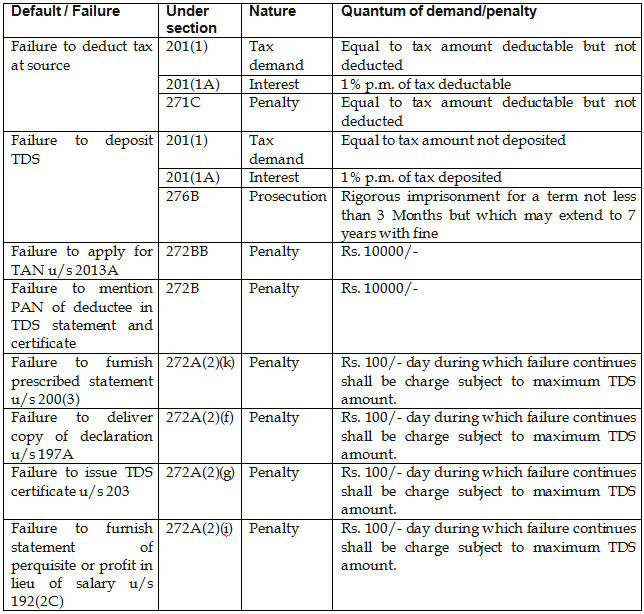

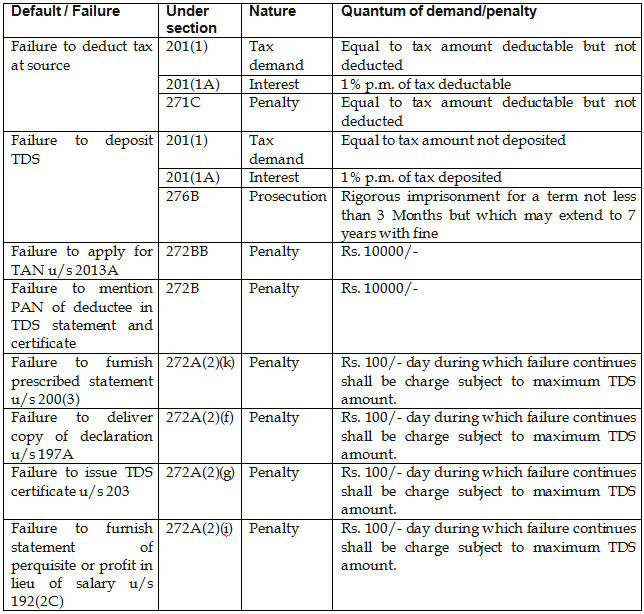

TDS Defaults

- Failure to deduct whole or part of TDS

- Failure to deposit whole or part of TDS

- Failure to apply TAN within prescribed time

- Failure to furnish various certificates/forms/return within prescribed time

- Failure to mention PAN no. of the deductee

- Variation between amounts mentioned in TDS return and amount as per TDS Challan u/s 281.

Penalties and interest in the event of non-filling / non-deduction and late deposit of the TDS sum.

What Rajput Jain & Associates Offers

Are you searching for TDS Specialists in Delhi capable of providing TDS return filling services; we provide TDS return filling services at an reasonable price that totally fulfill the customer's requirements and demands. Rajput Jain & Associates provide total Solutions under one roof regarding preparing of E-TDS Returns & Electronic Furnishing of TDS returns & relevant consultancy work to our clients. We provide the details of following services:

- We provide End-to-end Online Filing of e-TDS Forms 24, 26, 27 & 27A as per NSDL guidelines

- New Payroll and database is created and Form 16/ 16A can be issued

- Proper care is taken to wipe out all errors of data re-entry & validation issues ( As per NSDL the digital format can only be accepted when it is error proof )

- Advisory Services.

- Outsourcing of TDS jobs for salaries and other than compensation

- TDS arbitration

- Aid with other administrative cases relating to accordance with TDS / TCS regulations

- Help with requests for TDS reimbursement.

- Standard TDS clearance

- Assistance in securing TAN no. u / s 203A

- Computation of TDS u / s 192, management of TDS workers declaration on behalf of the client.

- Forming of Form 16 & Form 12BA for specific Workers and 16A for non-employees

- Help in securing a limited deduction of TDS certificate u / s 197 of income tax act 1961

- Preparation and submission of quarterly / annual TDS Pay return (Form 24Q) and other than compensation (Form 26Q) As per Income Tax Act 1961

- Assistance in building operating procedure for TDS

- TDS review as per client's condition i.e. salary and other than salary

- Seller reconciliation for TDS