Operational Excellence > Performance Management

Human being has always been aimed at measuring and improving their performance, in breaking

records and in targeting ever higher. For business, this is reflected in performance management.

Performance management (PM) includes activities which ensure that targets are being consistently

being met in an effective and efficient manner. Performance management can focus on the

performance of an entity, a department, employee, or even the processes to build a product of

service, as well as many other areas.

How to Develop a Performance Management System

Performance management includes more than simply giving an annual review for each employee. It is

about working together with that employee to identify strengths and weaknesses in their

performance and how to help them be a more productive and effective worker. Step in the process

are below.

1. Evaluate your present performance appraisal process. Look at what type of appraisal you

are giving to your employees. Determine if there is anything you need to change or add to the

evaluation itself. You may decide to build on what you already have or to build a new system

altogether.

2. Identify organizational targets. Performance management systems help staff members

within the Entity because they help their staff by resolving their problems and align their goal

with the entity’s goal so that they get emotionally attached with the entity’s goal and achieved

it easily. Take the time to clarify what your targets are for the next year as a company.

- Identify processes or procedures that could be simplified or done more effectively.

- Declare your sales targets for the next year or new products you would like to achieve.

- Share your hope for better conversation between departments and staff members.

3. Set performance expectations. As you sit down with each employee, clearly lay out your

expectations for them.

- Recognise their rewards and appraisals for their efficient work, this can be encouraged

them.

- Share some weaknesses that you have observed in them and in their work habits, and how

overcoming those would help their performance in the company.

- Identify specific things you would like them to accomplish in the next year, or whatever

time frame works best for you. Prioritize these so the staff member knows which is most

important and make sure to give them a deadline for each task.

4. Monitor and develop their performance throughout the year. As employees starts to work

on their performance, keep surveillance on their work. If they faced any problem for meeting

your expectation then resolved it forthwith.

5. Evaluate their performance. At each performance review, let the employee know how they

are doing. It is often helpful to assign a numeric value on a scale, rating the employee from

"not meeting expectations" to "meets expectations" to "exceed expectations."

- Provide feedback on their performance. Be specific that nothing you should not give any

example to demonstrate them.

- Announce the results or rewards of their performances. Let them know if they are on

probation, are getting a raise in pay, changes in vacation days, or any other relevant

action.

- Discuss any grievances they may be provided. Listen to their worries or problems and resolve

it forthwith.

6. Set new performance expectations for the next year. Some items may be the same.

However, since these are also based on entities targets, you will need to re-examine your

targets for the upcoming year.

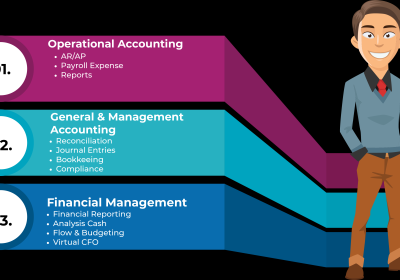

What Rajput Jain & Associates Offers

Rajput Jain & Associates provides help in formulating an effective performance system in the

entity, assistance in setting targets for future after taking strength and weakness of the

entity in consideration and use activity analysis and performance measurement, together with

proven skills in change management, to ensure successful implementation, monitoring the

performance of the entity and then finding the areas of weakness.