Top Reasons for a Foreigner to Start a Business in India

India is now regarded as one of the most powerful economic forces in the world. Despite being a developing nation, India's economy has a significant impact on global trade. The majority of the world's main developed countries want to establish or strengthen connections with India. India is a popular destination for investors over other major countries, regardless of location, due to its large market base and rapidly expanding spending habits of middle-class Indians. India appreciates diversity and has a 5,000-year history of welcoming outsiders to her borders.

India is a great place to do business because it is the world's fastest growing country and the sixth fastest expanding economy. There are numerous advantages for foreigners who start businesses in India, ranging from a big pool of experienced specialists to government support for business-friendly regulations, appealing foreign policies, and a trained workforce. Let's have a look at some of the benefits of starting a business in India as a foreigner.

Advantages of doing business in india

In terms of access to a large working population, comprehensive tax systems, government initiatives, Indian work ethics, business-friendly legislation, and other factors, beginning a business in India as a foreigner provides various advantages. For international entrepreneurs, India has always been a gripping market, and it is widely considered that investing in India will be far more beneficial and promising than investing in any other country. In light of the foregoing, let us briefly address the benefits of starting a business in India as a foreigner.

1. Large Population:

One of the key advantages of beginning a business in India is that it has a large population and a large market without boundaries with well-established logistics. For years to come, India's young generation and expanding economic strength will be a magnet for global enterprises.

2. Comprehensive Tax System:

India has a vast network of tax treaties, and its tax system has recently been updated by the Direct Taxes Code and the Goods and Service Tax (GST) to make doing business easier.

3. Business-friendly legislation:

In recent years, the Indian Parliament has passed a number of major policies that benefit most industrial sectors. The Goods and Services Tax Bill has enhanced the efficiency of product movement throughout India. The Direct Taxes Code Bill is intended to clarify tax legislation. The Land Acquisition Bill, however, will be the most important (and contentious) measure. The Companies Bill, which brings India's corporate legislation up to date for the twenty-first century, was also enacted. Such business-friendly legislation makes it simple for overseas companies to carry out their intentions to enter India.

4. Low Operational Costs:

Infrastructures, phones, internet, labour, salaries, and everything else required to start a business are all available at a low cost. Furthermore, workers are willing to work for a low wage. Not only that, but India's tax policies are very mild in comparison to those of other countries, lowering the cost of doing business.

5. Indian Financial System:

India has a well-regulated financial system with access to developed markets throughout the world and the ability to raise funds from a variety of sources, subject to RBI laws and regulations.

6. Large Trade Network:

India has a large network of technical and management institutions that meet international standards and are supported by regional and bilateral free trade agreements. Furthermore, there are many trading partners with whom to conduct business. These institutions produce high-quality human resources.

7. Large English-speaking population:

For business purposes, India has a lar ge English-speaking population. Because of the historical ties between the United Kingdom and India, Indians speak English fluently. International institutions will profit greatly from graduates' language skills, as well as their knowledge of the various local Indian languages, despite the fact that Indian English has a little distinct accent & vocabulary than British or American English. For multinational companies, conducting business in India is beneficial due to limited linguistic hurdles.

8. Indian Work Ethics and Working Class:

Indians are known over the world for their work ethics. What differentiates Indians from their South Asian competitors is a combination of workaholic temperament, eagerness to learn, and a never-say-no mindset. Furthermore, the large percentage of the Indian population that is in the working age bracket, i.e. 18 to 65, extends the number of years that services are available in the Indian market. The youth have emerged from the closet and are now on the lookout for chances. Businesses may take advantage of this opportunity by creating jobs and improving performance.

9. Government initiatives:

The Indian government has taken a number of steps to encourage foreign investment in India's various industries. It has periodically introduced a lot of enticing plans and policies in order to entice investors. Individual ministries of various industries have made specific efforts to simplify the rules and regulations governing foreign investment in the industry.

10. India's Startup Movement:

The government is adopting many reforms under the 'Startup India Movement' to provide opportunities for Foreign Direct Investment (FDI) and corporate collaborations. Some steps have already been implemented to help businesses deal with outmoded policies and regulations. This reform is also in line with the specifications of the World Bank's "Ease of Doing Business" index, which will help India improve its rating.

India has abundant mineral and agricultural resources, and during the last two decades, it has seen a considerable increase in offshore outsourcing and manufacturing, which has aided India's rapid economic growth. It's fascinating to see how international corporations and investors gain out of doing business in India.

11. India's financial system

The Indian financial system is well-regulated and has international reach.

FAQ's on Foreigners Starting Businesses in India

1. Is India a favorable place to do business with other countries?

Starting a business in India is advantageous because it offers a number of benefits over other countries, including low labour costs, a long history of international trade, 80 million people who can communicate in basic English, decent technology, business opportunities, and so on. Many sectors in India are still under development, including education, health, water resources, small and medium businesses, and many others. India is regarded as one of the top places in the world for foreigners to invest and start businesses.

2. Is it necessary for a foreign national to be a resident of India in order to start a business there?

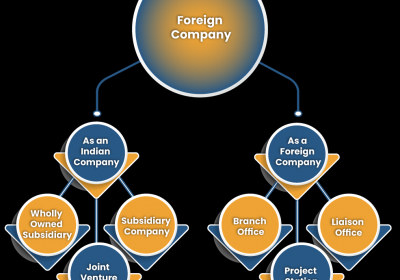

One of the benefits of establishing a business in India as a foreigner is that there is no necessity for a foreign national to be a resident in order to establish or start a business in India. A foreigner can start a business in India in a number of methods, according to Indian legislation. A Limited Company, for example, can be formed by a non-resident Indian subject to the restrictions of the Companies Act, 2013.

3. Is it possible for a foreign business to own 100 percent of a subsidiary company in India?

As previously noted, one of the key benefits of launching a business in India as a foreigner is that a corporation can become the parent company of an Indian subsidiary by owning 100% of the shares. By subscribing to the shares of an Indian company, you can keep 100 percent ownership as a foreigner under Indian law.

4. What are the legal criteria in India for starting a business?

In India, the legal conditions for starting a business are favorable and straightforward. Applying for a company license, considering taxation and accounting rules, knowing labour laws, and protecting intellectual property are just a few of the legal requirements that must be completed when beginning a business in India.

5. Can a foreign company register a company in India using a virtual address?

The virtual address cannot be used to register a corporation in India by any foreigner, non-resident, or foreign company. The physical address is necessary at the time of a company's incorporation in India.

6. Are there any significant taxes imposed on businesses in India?

In India, businesses are not required to pay a significant amount of tax. GST and income tax are the two types of taxes that businesses must pay, and the amount of tax owed is determined by the profits made during the fiscal year.

7. Can you tell me how long it takes to register a corporation in India?

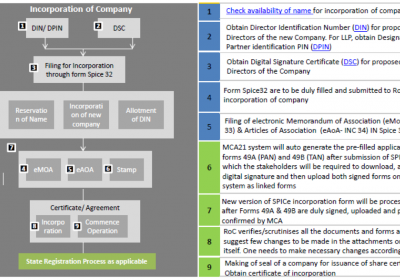

The process of forming a corporation in India typically takes 30-60 days, depending on the clearance of the relevant Ministry.

The Most Difficult Parts of Running a Business in India as a Foreigner

India, as one of the world's fastest developing economies, is brimming with opportunities for international investment and outsourcing. Foreigners are eager to get their foot in the door of India's economic world because of the numerous advantages it provides. However, due to the numerous hurdles that the country provides to westerners, India is ranked low on the ease of doing business scale. Setting up a business in India as a foreigner can be difficult if you don't have a thorough understanding of Indian business and social culture. These are the five issues that foreign-owned companies in India are likely to confront.

1. It might be intimidating to start a business.

The expense of launching a business in India is tremendous, and when you add in all of the paperwork, it may be a daunting procedure. There are twelve operations to perform in the earliest steps of a business's creation, and each activity takes about a month to accomplish. When starting a business in India, you'll need to get all of the proper approvals (which could be over 100) and this can take a year or more to complete.

2. Business Education in Indian Culture

• a. Establishing connections

In India's corporate culture, a greater emphasis is placed on developing connections and building trust rather than working actively to achieve commercial objectives. The way groupings are classified is a more difficult concept for foreigners to grasp. In India, there is a staggering amount of diversity. A system of hierarchy typically determines an Indian's identity, including but not limited to family rank, history, age, and education. All of these things can influence the types of relationships that develop in the workplace and the level of respect that each person receives.

• b. Interaction

Foreigners frequently misunderstand Indian culture. Aside from a lack of comprehension, many foreign entrepreneurs have no desire to learn about Indian culture. Because Indians do not communicate directly, but rather indirectly, using direct communication with them might be problematic for western businesspeople. Indians fear saying "no" and prefer to give positive responses in order to avoid offending others.

• c. Time Concepts

You, as a business owner, may feel insulted if employees are not informed about arriving on time, break periods, or lunch hours in advance. When it comes to punctuality, Westerners place a high importance on it, however Indian culture may not necessarily reflect the same attitude.

3. Planning for Human Resources

• a. Workplace

When it comes to skilled experts, India's job market is severely lacking. Employers in India struggle to locate employable workers from the almost 500 million available. Foreign business owners are advised not to directly participate in legal issues and labour law compliance if they do not have a sufficient understanding of how the laws function and how to apply them. Your business will not be approved in the eyes of Indian legislation if these are not carried out appropriately.

• b. Payroll services

Due to the complexity of the pay structure, laying the groundwork for and maintaining good payroll operations in India can be a difficult process. The complexity of the numerous components involved can even mislead payroll pros. In India, it is vital to choose a reputable payroll management provider.

• c. Taxes to be paid

Making the 33 tax payments required by firms operating in India currently takes roughly 245 hours per year. Dividend tax, property tax, fuel tax, sales tax, VAT, car tax, and excise duty are among the charges. If you don't have significant knowledge of the Indian tax system, you may want to outsource taxes to local Indian tax professionals, just like payroll.

4. Problems with Electricity

It is self-evident that India requires power to maintain its current economic boom. In India, around 40% of homes do not have access to power (about 400 million people). India has a high demand for electricity, but a low supply. This has a direct impact on India's corporate operations. It forces people to choose between going without electricity on a regular but unexpected basis or paying for an expensive generator power backup system. This is huge if you work in the manufacturing industry. Controlling the inconvenience isn't always possible; for example, when it impacts a business partner or a government entity with which you're seeking to conduct business. Consider the situation: you're trying to obtain an official document from a government agency. You've already spent hours trying to figure it out, and just as you think you've got it figured out, the power goes out, and they can't print the paperwork you need. In India, this is a constant battle.

5. Use of the internet

Due to a lack of demand for high-speed internet in some areas, it can be difficult to find. Most communities are content with the slow internet because they only use it to send emails on rare occasions and don't want to invest any more money to switch to fibre optic internet. Furthermore, internet service providers do not make a lot of money or invest a lot of money when communities refuse to move to faster internet rates.

Conclusion

Many foreign company owners have had years of success in India because they were ready to stick it out through the tough times and discovered creative ways to overcome some of the obstacles. Finding the correct consulting company to assist you can alleviate some of the most stressful aspects of launching a business as a foreigner in India. For international company owners who dare to dream big and are prepared to adapt to a culture that is different from their own, India offers a plethora of fantastic business chances. India is one of the top places to start a business in the globe. It is simple to enumerate the benefits that India as a country provides for foreigners who want to start a company here. Apart from the suggestions made in the essay, infrastructure ease, business-friendly policies, a steadily increasing economy, and so on are all important factors. The Narendra Modi-led Bhartiya Janta Party has committed to enhance the ease of doing business in India since taking power in 2014, and has made great progress in this regard, as FDI climbed by 20% in the Financial Year 2019.

About Carajput.com : Carajput.com is a motivated and progressive firm managed by like-minded people. It helps a variety of small, medium and large businesses to cater to all compliance requirements of Indian Laws. Get in touch for a free consultation on info@carajput.com or call 9555 555 480.