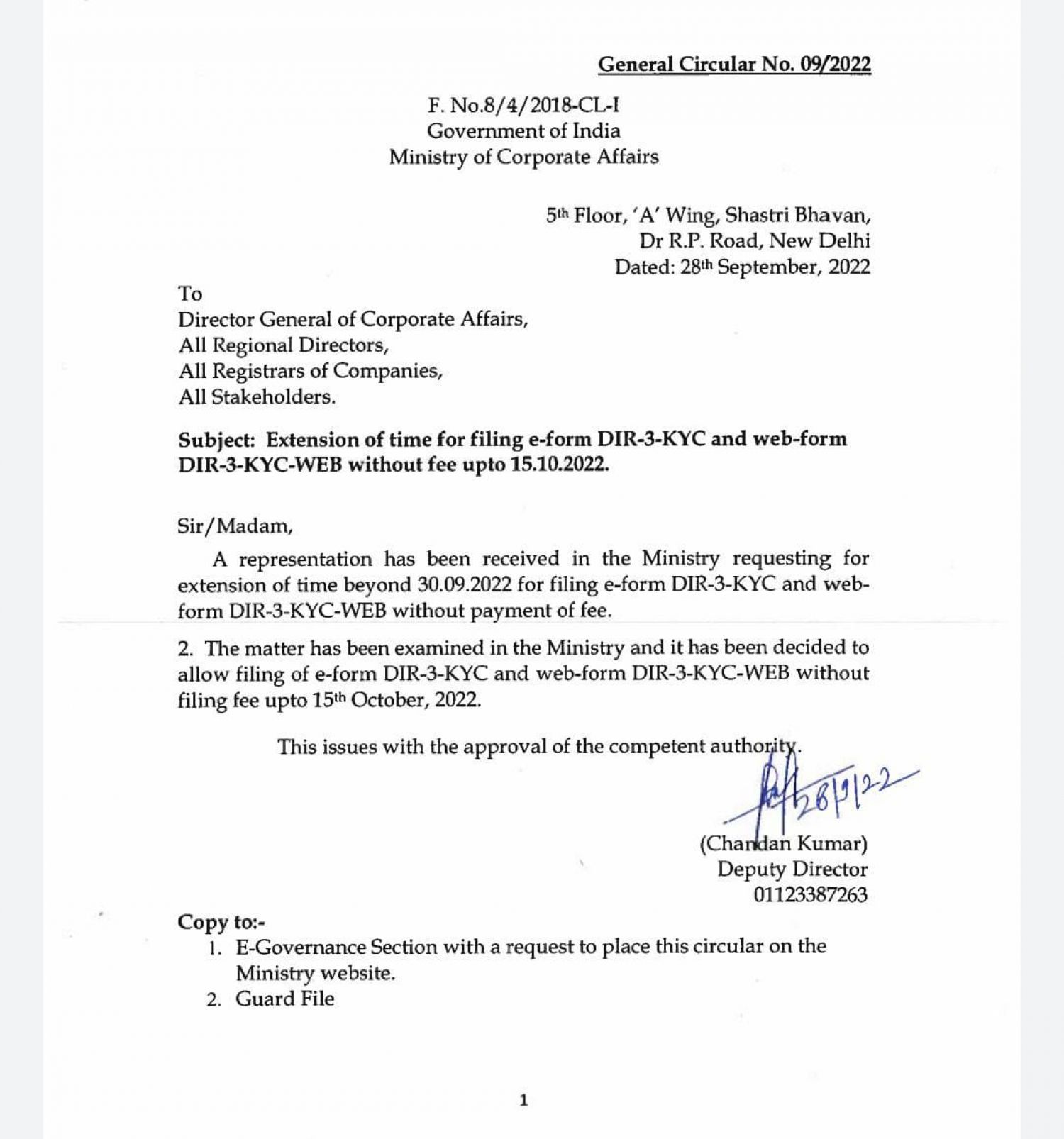

LAST DATE OF DIN KYC UPDATE HAS BEEN EXTENDED

For the purpose of KYC on ROC -Directors database on ROC, ROC has entered for updated all persons holding DIN to complete DIN KYC on or before 30/09/2022. To close DIN KYC, the Director will be required to complete a form file known as DIR 3 for DIR EKYC, The blog Will update about the ROC notification on DIN KYC due date extension.

The ROC has issued direction through the notification that the due date has been extended from 30/09/2022 to 15/10/2022. The said notification issued by MCA has been mention below: as attached

Main Requirement of E-form DIR-3 KYC

The main purpose of form DIR-3 KYC is to collect the latest update about the directors of all companies. The Documents to be provided while completing eKYC procedures include address, phone, email, Aadhar, PAN, Passport number. The Document submitted must be authenticated by completing an OTP verification and by signing with the DSC of the Director and a practicing

Applicability of DIN

All the directors having a DIN as of 15/10/2022 must file e-form DIR-3 KYC before 15th Oct 2022. For all Directors who obtained DIN after 31st March of Every Year, DIR eKYC must be filed in the upcoming year.

Documents Required For KYC Update

Below mention documents required to file E-form DIR-3 KYC:

- Personal Mobile Number and E-mail ID of director for OTP Verification

- Digital Signature Certificate of the director (DSC) must be registered on MCA Portal

- PAN Card for identity proof

- Aadhar Card for address proof

- Passport (if the person holds foreign citizenship)

- Recent passport size photographs

Certified by Certifying Authority

The e-form DIR-3 KYC must be duly certified by the CA, Practicing CS, or Practicing CMA.

Penalties on NON-filling DIR-3

In case the Director holds the DIN has not to file DIR-3, the ROC will take action and it will deactivate. If the Director holds the DIN file e-form DIR-3 KYC after 15/10/2022, a fee of Rs. 5,000 will be charged.

Filling Time Limit for DIR-3

Directors Hold the Din has been allocated before 31/032022, then e-form DIR-3 KYC required to be filed by 15/10/2022. Originally, the ROC had given the due date of 30/09/2022 which was latterly changed to 15/10/2022.