Table of Contents

Effect of GST on the Real Estate Sector

The indirect taxes which are received from the Real Estate Sector are to be soon combined together under the GST regime. There are several reasons as to why the Real estate Sector is to be made a part of the tax base for the GST rates. They are as follows:

1: By not including this sector, the tax base is reduced to a great extent which in turn would lead to an increase in the GST rate for other sectors.

2: Our total personal consumption includes a significantly large proportion of our net personal consumption expenditure in India. As a result, the non-inclusion of the housing sector would destroy the consumption pattern.

3: There is the existence of multiple taxation systems in the Real estate which is at the Central as well as the State level. For this reason, the Central government introduced a service tax on the housing and commercial services and permitted credit for inputs that are used for the supply of such services.

Besides all the input tax credit, there is the availability of the State level ‘sales tax on works contracts and State level VAT on the various inputs which are utilized in the construction and the stamp duty. No incentives to the person who purchases things are provided to get an invoice.

As a result, the audit trail of such transactions is absent and the producers, in turn, are also motivated to not engage in such transactions.

Such activity, in turn, evolves the act of tax evasion and several other criminal activities. The production of black is the result of a cumulative effect.

There are several benefits that can be yielded by rationalizing the tax regime of this sector. They are as follows:

1: Making improvements in the property tax compliances.

2: Curbing availability of back money

3: Preventing any kind of criminal element to exist in society

4: Collective living can also lead to a reduction of the net cost

There are several sectors that are included in this sector. They form a basic and significant part of GDP. They are industries such as cement, steel, brick, timber, fittings, building material, and many others. By including this sector in the GST there will be a chain of several transactions that will improve the tax and will promote transparency.

New Regime for Real Estate Sector Under GST:

A lot of sectors are included under GST in order to widen the base of the indirect taxation and to drive the investment. It also leads to growth and development in the industry which in turn helps in the growth of a large number of ancillary industries in the country.

There are several new regimes suggested for the real estate sector in GST as referred to by the Report of Taskforce on GST Thirteenth Finance Commission is:

- There is the Stamp duty which is levied by the state on transferring immovable property which is referred to in the GST. This step is taken in order to allow input tax credit (IPC) and prevent the cascading effect.

- There should be the application of GST to both the residential and commercial property which is newly created.

- All the rental charges which are received excluding the imputed rental values are also chargeable by the GST. These include the immovable property used for both residential and commercial purposes. The input tax is also allowed in respect of the goods and services that are used for maintenance.

- The new regime will be applied to land transactions because the immovable property will also include land and other resources. The land will be treated as input when used in the construction process.

Conclusion

If we do not include GST in the regime then:

- There will be an increase in the real price: Due to the non-availability of the input tax credit, there is a possibility to increase the real estate prices.

- Ambiguity on the taxability of TDR: There remains ambiguity on the taxability of transfer of development rights (TDR). This case might continue henceforth.

- Requirement of reconstructing of contracts : There remains a place of provision for services that are in relation to the immovable property. There would be a fixed location of the immovable property.

You can enter into a contract of immovable property which might take place between two or more states. While dealing with this you can take the example of facility management services that are provided to vendors. There might be a consolidated invoice that is raised for the vendors at a different location.

Immovable property can be located in one or more states. Hence, under GST, the place where we get the supply from remains to be each state where you locate the immovable property. You might require a vendor to raise separate invoices.

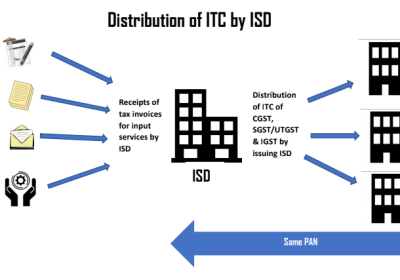

- Input service distributor concept (ISD): While dealing with the act of transferring credit of input services between two or more locations a new concept is proposed. This is known as ISD. It refers to all types of transfer credits GST (CSGT, SGST or IGST). It can also refer to any person who supplies goods and services.

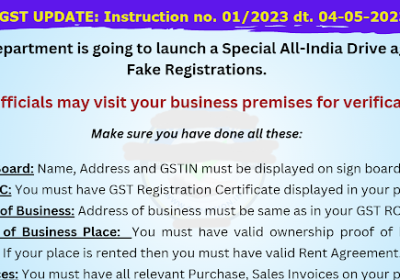

- Compliance requirement : You might refer to this concept while dealing with registration which might be required in each state where there is a premise from where supplies are being made.