Applicability of GST on Hotels Industry - GST Rate, ITC & GST Return

Goods and Service Tax (GST) is a destination-based consumption tax which is a levy of tax on all goods and services with the objective of expanding the tax base through a wide coverage of economic activities, mitigating the cascading effect, reduction of exemptions, enable better compliance etc. thereby resulting into formation of the common national market for goods and services.

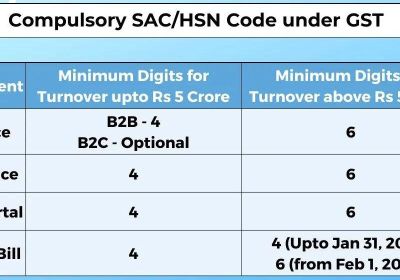

Under GST, all tax invoices raised contain an HSN Code or SAC code for the respective goods or services supplied. Hotels and restaurants would have to use SAC Code.

Time of Supply of Services of Hotels

Section 13 of the CGST, 2017 specifies that:

> The time of supply of services shall be as follows:

1. If the invoice is given within 30 days from the date of supply of service:

- the date of issue of invoice by the supplier or

- the date of receipt of payment,

Whichever is early.

2. If the invoice is not released within 30 days from the date of supply of service:

- the date of provision of service or

- the date of receipt of payment,

Whichever is early.

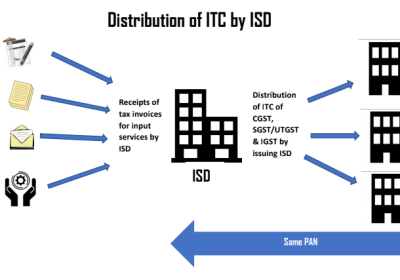

AVAILABILITY OF INPUT TAX ON HOTELS

The tourism and hospitality industry will find it easier to claim and avail input tax credit (ITC) and will get full ITC on their inputs. Before GST, the tax paid on inputs (raw edibles for food, cleaning supplies etc.) could not be adjusted against the output without any complications. However, this will become easier in the GST regime.

Basic requirements for the use of ITC

No registered person shall be entitled to the credit of any ITC in respect of any supply of goods or services to him or both, unless –

(a) it is in possession of a tax invoice or debit note issued by a supplier registered under this Act.

(b) they have earned goods or services, or both. However if the goods on the invoice are obtained in lots or instalments, the registered person shall be entitled to take credit upon receipt of the last lot or instalment:

(c) the tax charged in respect of such supplies has actually been paid to the Government, either in cash or by the use of a qualified input tax credit;

(d) required for the GST return filing pursuant to section 39:

Input tax credit relevant to hotels GST Regime.

- Many hotels still have the perception that an input tax credit cannot be used for repairs and maintenance of the immovable property. It is obvious that the ITC may be used for the repair and maintenance of the building or plant and machinery where such costs are not capitalised.

- It is also evident that ITC can be used on furniture, chillers, DG sets, HVACs, passenger lifts, decorative objects and interiors that are not in the nature of the immovable property. With respect to the restaurant, ITC can be used on crockery and cutlery, kitchen appliances, etc if the restaurant has a GST production of up to 18 per cent.

- ITC can be used for overall business expenditures such as bank charges, insurance expenses other than health and life, stationery purchases, etc.

- ITC can be used on perquisites (such as food and travel) offered to employees whenever the same is provided for in the contract between the employer and the employee and is part of the cost-to-company package.

- With regards to a few costs, such as health and life insurance for workers, renting a taxi, etc. The ITC can be used if it is a legal obligation.

- In the context of hotels under construction, the use of input tax credits on Cement, Steel, other structural materials and construction services may be examined in the light of the Orissa High Court judgement in the case of Safari Retreats Pvt Ltd, where it was held that input tax credit (ITC) for inputs and input services used for the construction of a shopping mall was to be used against GST payable on rent earning.

Apportionment of Input Tax Credit and Blocked Credit

Input tax credit depending on the use of input

Input tax credit (ITC) is permitted for all inputs used for taxable supplies, i.e. inputs for the supply of goods or services for which GST has been paid. The input tax credit shall not, however, be allowed for the supply of goods or services by outdoor catering and restaurant services where tax has been paid at a rate of 5%. (Notification No. 46/2017-Central Tax (Rate) of 15.11.2017)

Here are some inputs that will be considered blocked credit, and no Input Tax Credit will be allowed:

Blocked Input tax credits on few services on Hotels

Section 17(5) of the CGST Act 2017 provides that: Input tax credit is not valid for the specific supply of products or services or for both. there will be no credit available to hotel industry customers for the following activities:

- Food & beverage

- Membership in the hotel club, health and fitness facility.

- Spa services at the hotel, as they are in the form of personal use.

- Outdoor catering;

No Input Tax Credit available on Liquor – Liquor is usually offered by hotels and their main services either by restaurants operated by hotels or as part of room service or otherwise. Since alcohol is clearly held out of the scope of GST, it has been treated as a non-GST object and no input tax credit can be used for that reason. Hotels offering services like alcohol may therefore be needed to issue a separate invoice for liquor and a separate invoice for many other services.

INPUT TAX CREDIT ON NEWLY CONSTRUCTION OF HOTELS?

As per Section 17(5)(c) of the Central Goods and services tax act 2017, Works contract services for the development of immovable property (other than plant and machinery) except for where it is an input service for the further supply of work contract services, the input tax credit shall not be eligible.

In order no the CESTAT Mumbai. A/85880/2018, dated 3 April 2018, in the case of Lemon Tree Hotels Ltd versus CESTAT Aurangabad, held that ITC is eligible for a hotel infrastructure used for the rental of hotel services. The overall hotel infrastructure is carried out inside the common hotel building and the construction service received in connection with the construction of any section of the hotel is a common service that is connected to the total hotel business. Consequently, while some aspect of the hotel company is not taxable, it cannot be assumed that the construction service was used solely for non-taxable services.

GST RATES APPLICABLE ON GOODS AND/OR SERVICES PROVIDED ON HOTELS

The GST rate applicable for hotels, inns, guest houses, clubs, campsites or other places for temporary stay would depend on the type of facility, star rating and room rent per day charged. GST Rates Applicable on Goods and/or Services provided

|

Nature of Service |

Particulars |

Taxable Amount |

Tax Rate Applicable |

|

Hotel Accommodation (up to 30th September 2019) |

Value of Room Rent (Declared Tariff) |

Up to Rs. 1000 |

0% |

|

From Rs. 1001 to Rs. 2500 |

12% |

||

|

From Rs. 2501 to Rs. 7500 |

18% |

||

|

More than Rs. 7500 |

28% |

||

|

Hotel Accommodation (from 01st October 2019 onwards) |

Value of Room Rent (Declared Tariff) |

Up to Rs. 1000 |

0% |

|

From Rs. 1001 to Rs. 7500 |

12% |

||

|

More than Rs. 7500 |

18% |

||

|

Restaurant Service |

The restaurant is part of Specified Premises* |

Any Value |

18% |

|

The restaurant is part of other than Specified Premises |

Any Value |

5% |

|

|

Outdoor Catering |

Services Supplied by or at Specified Premises* |

Any Value |

18% |

|

Services Supplied by or at other than Specified Premises |

Any Value |

5% |

|

|

Other Services |

Supply of food or any other article of human consumption or any drink, within the premises (including hotel, convention centre, club, pandal, shamiana or any other place, specially arranged for organizing a function) together with renting of such premises |

Any Value |

18% |

*Specified premises means premises offering hotel accommodation facilities that have declared a tariff (i.e. a published tariff without any discount) for any unit of accommodation over Rs. 7,500/-

RATE OF GST ON FOOD & BEVERAGES (F&B)

- Both stand-alone restaurants, regardless of air Conditioned or otherwise, without ITC, 5 percent will be attracted. Food parcels (or take-aways) can also attract 5% GST without ITC.

- Restaurants in hotel premises with room rates of less than Rs 7500 per unit per day would attract 5 per cent GST without ITC.

- Restaurants in hotel premises with a room rate of Rs 7500 and above per unit per day (even for a single room) would attract GST of 18 per cent with maximum ITC.

Bundled service

18% GST rate is applicable on bundled service by way of supply of food or any other article of human consumption or any drink, in a premises (including hotel, convention centre, club, pandal, shamiana or any other place, specially arranged for organizing a function) together with renting of such premises.

The rate for amusement park

For entertainment events and amusement facilities – a GST rate of 18 % will be applicable.

What will be the rate – In case of the hotel provide a discount on tariff value

The GST rates applicable on all accommodation establishments (hotels, inns, guest houses, clubs, campsites or other commercial places meant for residential or lodging purposes) depends on the declared tariff per unit per day by the respective establishment. If a discount is provided, then the slab of GST rate applicable will remain the same, however, the rate would be charged on the actual tariff charged.

GST Returns required to be Compliance for Hotel industry

GST return filing is required for all organisations with GST registration, regardless of market operation or revenue or profitability, during the reporting period.

The beauty of the method is that the specifics of one monthly return – GSTR-1 – must be entered manually. The other two returns – GSTR 2 & 3 will be auto-populated by the GSTR-1 details filed by you and your vendors.

There are different returns required for special cases such as composition dealers to be filed

GSTR-1

For turnover up to Rs. 1.5 cr. (file quarterly)

Period Dates

Jul-Sep 10th January 2020

Oct-Dec 15 February 2020

Jan-Mar 30 April 2020

For the turnover of more than Rs 1.5 cr. (file monthly)

MONTH DATES

July-October 2020 10 January 2020

November 2020 10 January 2020

December 2020 10 February 2020

January 2020 10 March 2020

February 2020 10 April 2020

March 2020 10 May 2020

GSTR-3B

Filing GSTR-3B is mandatory for hotels and restaurants who fall under the GST regime. If you’ve had no transactions at your property in these two months, you need to file a nil GSTR-3B form.

GSTR-3B return will have to be filed by all taxpayers in addition to GSTR-1, GSTR-2 and GSTR-3 return. Earlier, GSTR-3B returns were to be filed for the month of July to December 2020.

IN 23rd council meeting, it has been announced that GSTR-3B return must be filed for all months from July 2020 to March 2021. The due date for GSTR-3B return will be the 20th of every month.

Late fees for GSTR-3B of July, Aug. and Sept waived. Any late fees paid for these months will be credited back in electronic cash ledger under Tax and can be utilized to make GST payments.

Composition scheme

Restaurants whose turnover is up to Rs. 100 lakhs per year are eligible to be registered under the GST composition scheme, Restaurants registered under the GST composition scheme will have to pay GST at the rate of 5% of aggregate turnover.

The GST Benefits

Administrative easing: GST would remove a variety of other taxes, leading to a decrease in procedural measures and a greater chance of streamlining the tax process.

The clarity for the Consumer: It was often difficult to distinguish between a Value Added Tax and an Entertainment Tax for a common man. However, under the GST regime, consumers will only see a single fee on their bill and will be given a clear picture of the tax they are paying.

Improved service performance: How many times did you have to wait in the hotel lobby to inquire if you'd miss your flight back home because your bill was still being prepared? With only one tax to be paid, the check-out process at hotels and restaurants is now going to be smoother – another benefit that the hotel industry can boast about.

Input Tax Availability: The tourism and hospitality industry will find it easier to assert and use input tax credits (ITCs) and will get the full ITC on their inputs.

Covid-19 related New Point to be taken care on Hotel Industry:

1. Insurance claims received:

Many hotels would have been protected for a Contingent Business interruption that would cover damages outside the control of the business. The insurance company will pay for the loss of business for that time. Situations like Covid-19 may be covered by this. There is no GST responsibility for the payments received as there is no supply of the products or services concerned. However, in the case of missing, damaged, destroyed or written off items, the rules relating to ITC restrictions need to be checked.

2. Effect of the hotels taken over by the Government on the creation of isolation centres:

Many states like Madhya Pradesh, Rajasthan, etc have ordered the conversion of a few hotels and resorts as isolation centres. This is achieved in compliance with the Disaster Management Act. Hotels give health staff a free stay. Some hotels have done this as part of Corporate Social Responsibility. In all these cases, no consideration has been paid. In the opinion of the author, the said transaction does not come under Schedule I and there is no liability under GST.

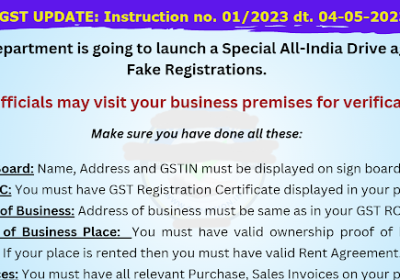

Other Compliance:

- ITC must be reversed (along with the required interest) in cases where payment is not made within 180 days of the date of invoice. The ITC may be re-available for payment to the vendor/s.

- Self-invoice to be imposed on the reverse charge liability for transactions where the supplier is not registered.

- The input tax credit must be reversed for the credit notes issued by the vendors when the credit note is issued with the GST.

- Anti-profit enforcement, as the GST rate is decreased during the fiscal year 2019-20.

- The luxury tax shall be removed after the introduction of the GST. If some other tax has been paid, it is recommended that such tax be refunded.

- Dividing the total bills for lodging, food and drinks, etc will help the consumer decide on a qualified ITC. There is no limitation on the use of ITC by the customer if the accommodation facility is connected to the company and not to the holiday of the customer's employees.

FAQ ON GST (RELATING TO HOTEL INDUSTRY) - Circular No. 27/01/2018-GST

Q1-Will GST be charged on actual tariff or declared tariff for accommodation services?

A1-Declared or published tariff is relevant only for the determination of the tax rate slab. GST will be payable on the actual amount charged (transaction value).

Q2-What will be GST rate if the cost goes up (more than declared tariff) owing to additional bed?

A2-GST rate would be determined according to the declared tariff for the room, and GST at the rate so determined would be levied on the entire amount charged from the customer. For example, if the declared tariff is Rs. 7000 per unit per day but the amount charged from the customer on account of extra bed is Rs. 8000, GST shall be charged at 18% on Rs. 8000.

Q3-Where will the declared tariff be published?

A3-Tariff declared anywhere, say on the websites through which business is being procured or printed on tariff card or displayed at the reception will be the declared tariff. In case different tariff is declared at different places, the highest of such declared tariffs shall be the declared tariff for the purpose of levy of GST

Q4-Same room may have different tariff at different times depending on the season or flow of tourists as per dynamic pricing. Which rate to be used then?

A4-. In case different tariff is declared for different seasons or periods of the year, the tariff declared for the season in which the service of accommodation is provided shall apply

Q5-If tariff changes between booking and actual usage, which rate will be used?

A5-Declared tariff at the time of supply would apply.

Q6-. GST at what rate would be levied if an upgrade is provided to the customer at a lower rate?

A6-If declared tariff of the accommodation provided by way of the upgrade is Rs 10000, but the amount charged is Rs 7000, then GST would be levied @ 28% on Rs 7000/-.

Concluding comments

GST has both negative and positive effects on the hotel industry. With the advancement of GST, hotels are in a position to enjoy the benefits of lower tax rates. Although the constraint of ITC availability remains a serious issue. GST eliminated many taxes, leading to a reduction in the system for procedural enforcement and thereby to a streamlining of the tax system. GST is a strong initiative for the tourism and travel industries. A decreased tax rate and a single tax system will undoubtedly inspire more tourists and lead to growth in the same area. However, there is still a great deal of potential for this sector to succeed at national and international level. From the front, the hotel sector is leading the hospitality industry. The Government Of India is innovating things from scratch so that positive results for the hospitality sector can be achieved and also bearing in view that every business person associated with this industry must be fully familiar with new GST regimes and adopt the same trends for the proper implementation of national plans.