If you are registering a startup or a new business in India then first and foremost, there are some official procedures of startup or a company has to follow in order to register them in Indian official records, MCA (ministry of Corporate Affairs) will charge registration fees given as follows:-

Registration fees for One Person Company and Small Companies according to nominal share capital are as follows: -

| Nominal share capital | Registration fees |

| Limited to Rs 10,00,000 | 2,000 |

| Rs 10,00,000 to Rs 50,00,000 | Rs 2000. Rs.200 will be added for every increase of Rs. 10,000 of nominal share capital. |

| Rs 50,00,000 to Rs one crore | Rs 1,56,000. Rs.100 will be added for every increase of Rs. 10,000 of nominal share capital. |

| More than Rs one crore | Rs 2,06,000. Rs.75 will be added for every increase of Rs. 10,000 of nominal share capital subject to a maximum of Rs. 250 crore. |

Registration fees for companies other than one person company and small companies according to nominal share capital are as follows: -

| Nominal share capital | Registration fees |

| limited to Rs. 1,00,000 | Rs 5,000 |

| Rs. 1,00,000 to Rs. 5,00,000 | Rs. 5,000. Rs. 400 will be added for every increase of Rs. 10,000 of nominal share capital. |

| Rs. 5,00,000 to Rs. 50,00,000 | Rs 21,000. Rs. 300 will be added for every increase of Rs. 10,000 of nominal share capital. |

| Rs. 50,00,000 to Rs. one crore | Rs 2,06,000. Rs. 100 will be added for every increase of Rs. 10,000 of nominal share capital. |

| More than Rs one crore | Rs 2,06,000. Rs. 75 will be added for every increase of Rs. 10,000 of nominal share capital subject to a maximum of Rs. 250 crores. |

Registration fees for companies without share capital according to the members stated in MOA and AOA are as follows: -

| Members | Registration fees |

| Limited to 20 members declared in MOA | Rs 2,000 |

| 20 to 200 members declared in MOA | Rs 5,000 |

| Exceeds 200 members declared in MOA on the condition that the number of members stated in the AOA isn’t unlimited | Rs 5,000. Extra Rs 10 will be added for every member increase after the first 200, subject to a maximum of Rs 10,000. |

Recording Fee for submitting the Documents with ROC

For Companies with Share Capital recording fees for submitting the documents with ROC are as follows: -

| Nominal share capital | Recording fees |

| limited to Rs 1,00,000 | Rs 200 |

| Rs 1,00,000 to Rs 5,00,000 | Rs 300 |

| Rs 5,00,000 to Rs 25,00,000 | Rs 400 |

| Rs 25,00,000 to Rs 1,00,00,000 | Rs 500 |

| More than Rs 1,00,00,000 | Rs 600 |

The registration fee for companies without share capital is fixed at Rs 200.

Application fees paid to Central Government

| Authorized share capital | Application fees |

| limited to Rs 25,00,000 | Rs 1,000 in case of OPC’s and Small Companies, and Rs 2000 in case of other companies. |

| Rs 25,00,000 to Rs 50,00,000 | Rs 2500 in case of OPC’s and Small Companies, and Rs 5,000 in case of other companies. |

| Rs 50,00,000 to Rs 10,00,00,000 | No fee for OPC’s and Small Companies, and Rs 5,000 in the case of other companies. |

| More than Rs 10,00,00,000 | No fee for OPC’s and Small companies, and Rs 20,000 for other companies |

|

Company Limited by Guarantee but without a Share Capital

|

OPC’s and Small Companies will not be charged any fee, and other companies will be levied a fee of Rs 2,000.

|

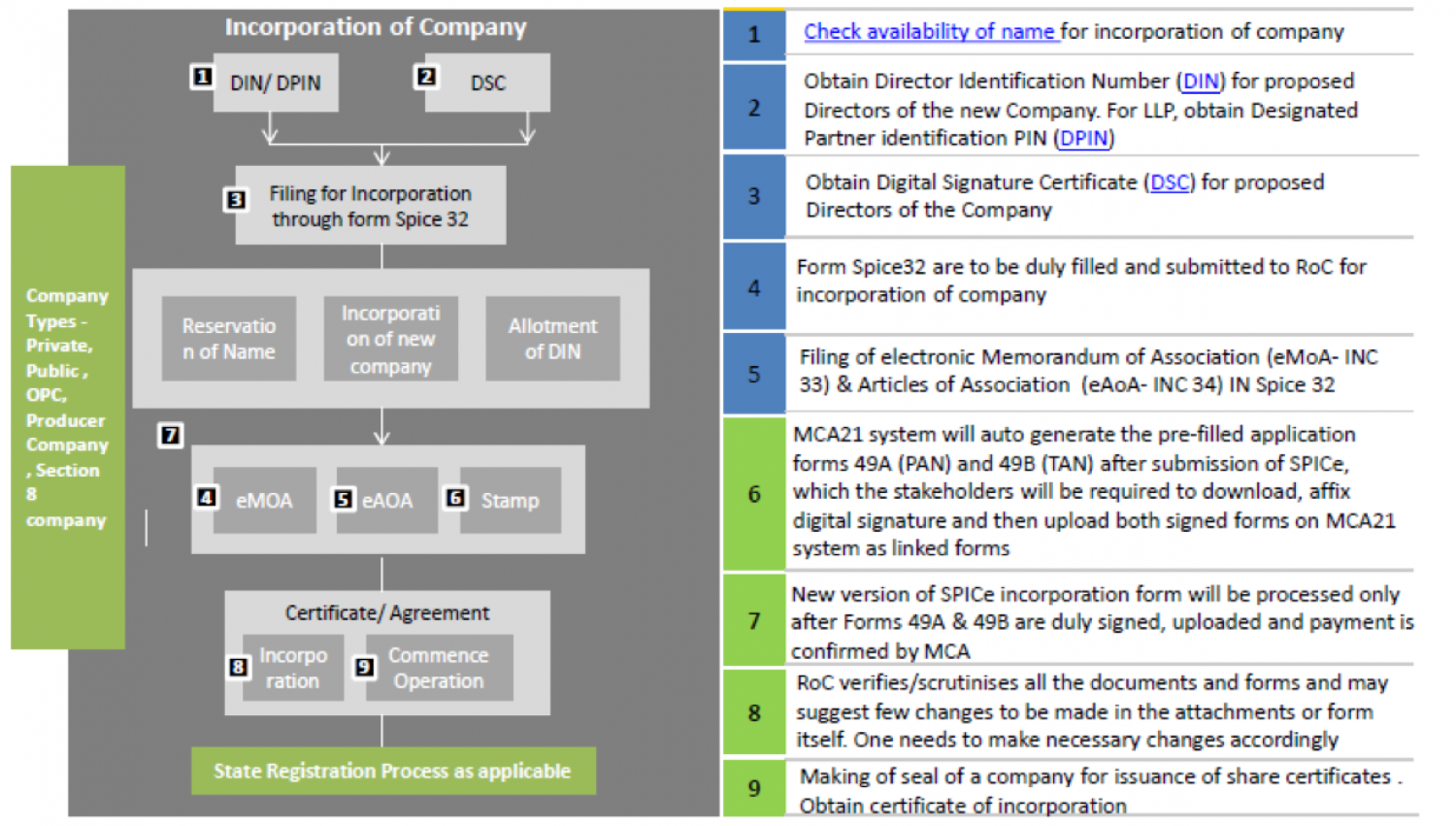

GET ONLINE REGISTRATION

Enter a company in three easy steps

1. Answer Simple Question

- Choose a package that best fits your needs.

- Please fill in our questionnaire, which takes less than ten minutes.

- Provide the basic information and documents needed for registration

- Payment by secured payment gateways

2. Experts are available for support

- Assigned Manager of Partnership

- Digital Signature Procurement (DSC)

- Request for Registration of Business Name

- Documents drawing up, like MOA and AOA

- Incorporation Certificate

- Application to PAN and TAN

3. Your company has been registered

- It only takes 10 – 12 working days*

* Subject to the Government's processing period