In Budget 2017 our honourable Finance Minister, Mr Arun Jaitley introduced a new section 234F to ensure timely filing of returns of income. As per section 234F of the Income Tax Act, if a person is required to file Income Tax Return (ITR forms) as per the provisions of Income Tax Law [section 139(1)] but does not file it within the prescribed time limit then late fees have to be deposited by him while filing his ITR form. The quantum of fees shall depend upon the time of filing the return and total income.

What is section 234F in the language of the law: -

- Without prejudice to the provisions of this Act, where a person required to furnish a return of income under section 139, fails to do so within the time prescribed in sub-section (1) of said section, he shall pay, by way of fee, a sum of

- five thousand rupees, if the return is furnished on or before the 31st day of December of the assessment year;

- ten thousand rupees in any other case:

Provided that if the total income does not exceed five lakh rupees, the fee payable shall not exceed one thousand rupees.

- The provisions of this section shall apply in respect of the return of income required to be furnished for the assessment year commencing on or after the 1st day of April 2018.

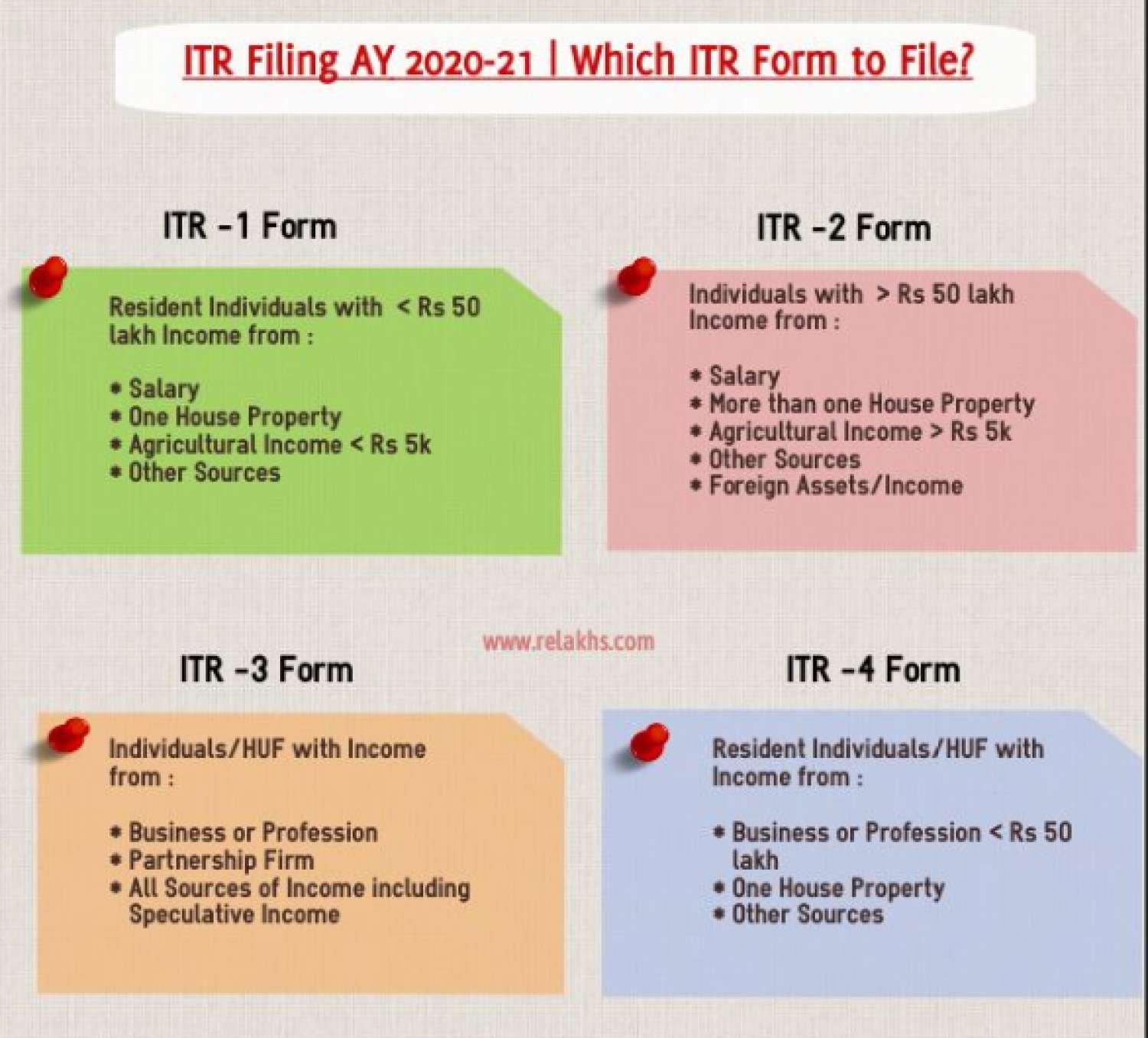

For whom it is mandatory to file ITR: -

If a person come under any of the following conditions, then he has to file the income tax returns: -

- If the gross total income (before allowing any deductions under section 80C to 80U) exceeds the basic exemption limit i.e. Rs.2,50,000 (for individuals below 60 years) or Rs. 3,00,000 (for individuals of 60 years and above but less than 80 years old) or Rs. 5,00,000 (for individuals of 80 years and above) as the case may be.

- If you hold any asset including financial interest in any entity located outside India or has signing authority in any account located outside India as a beneficial owner or otherwise.

- If you are a beneficiary of any asset located outside India.

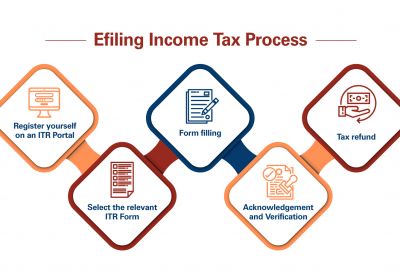

The due date of tax filing of all types of taxpayers is given below: -

| Category of Taxpayer | Due Date for Tax Filing – FY 2017-18 |

| Individual | July 31st 2018 |

| Body of Individuals (BOI) | July 31st 2018 |

| Hindu Undivided Family (HUF) | July 31st 2018 |

| Association of Persons (AOP) | July 31st 2018 |

| Businesses (Requiring Audit) | September 30th 2018 |

| Businesses (Requiring TP Report) | November 30th 2018 |

Popular Errors while filing an income tax to avoid penalties

Fees of late filing of ITR

If ITR for AY 2018-19 is filed after the due date but before 31st Dec of the Assessment year then fees of Rs.5000/- will be levied and If ITR is filed after 31st Dec, then Rs. 10000 will be levied as extra fees.

There is one exception that if your total income is below or equal to Rs. 5 lakhs then the maximum penalty is Rs. 1000.

How these fees are payable?

As per Finance Act 2017, Late fees under section 234F can be paid by the way of Self-Assessment Tax u/s 140A. Therefore, through Challan 280, under the head of Self-Assessment Tax, these fees can be paid from FY 17-18 and onwards.

| Rajput Jain & associates

Address: -P 6/90 Connaught Place, New Delhi-110001 Mob no. 9811322785/ 9555 5555 480 Website: – info@carajput.com |