It is a tactful process and it includes a step by step process. LLP is an emerging small business entity practised in India under a certain act known as LLP Act, 2008. The relaxation of the FDI rules which concern LLP has drastically increased the interest amongst certain NRIs and Foreign Nationals.

Essential documents required for LLP Registration

There are certain essential documents that are required for Indian Nationals to register. These include the –

- Pan Card

A copy of the Pan card is essential in the registration process because the pan card number has a unique value.

- Address Proof

An address proof stands to be an essential document. The name of the person should be the same which was seen in the Pan card. The current address of the person should be present in it.

Other documents can also be accepted as address proofs. They are the passport, Election Card, Ration Card, Driving License, Electricity Bill, Telephone Bill and Aadhaar card.

- Residential proof

Along with the address proof, it is required for one to give the residential proof which helps to validate the current address of the Partner. One can accept the Bank Statement, Electricity bill, Telephone bill and Mobile bill as residential proof.

- Foreign nationals who are Partner in LLP

It is required for foreign nationals to present certain essential documents. They are a passport, address proof. The driving license, residence card, bank statement and a form issued by the government which contains your address can be presented as address proof. As residential proof, the bank statement, electricity bill, telephone bill and the mobile bill is accepted.

- Registered office proof

There must be some proof that can be used to prove your office address of the LLP.

- Subscriber sheet

After getting the approval of the name from the Ministry of Corporate Affairs there is a need for preparing the incorporation documents. They also need to fill by the R.O.C.

The Duties And Rights Of The Partner In LLP

There are certain rights and duties of a partner which need to be fulfilled by him/her.

- General Duties of Partners in LLP

It is essential for the partners to maintain their business with the LLP. This helps the partner to maintain a just and faithful relationship.

- Duty to Indemnify for Fraud-

If one makes any loss that is the result of fraud he is required to indemnify for it.

- Rights of Partners in an LLP

- Right to conduct the business.

- Right to maintain the duties which relate to the conduct of his/her business.

- The majority of partners have the right to settle disputes after hearing the opinion of every partner.

- Right to inspect and copy accounts of the book if any of the partners dies.

- Implied authority of partner-

The partner has the authority to bind the LLP in case his business way is carried out by the LLP.

- Property that belongs to the LLP-

The property of the LLP includes all the interests and rights. These were originally brought by the LLP Duties and Partner in LLP. The LLP owns all the money which are got by the developed property and assets of the LLP.

- LLP Compliance Post-Incorporation

There are some compliance and also procedural matters that are to be finished after the incorporation of a Limited Liability partnership. The post-incorporation of all the compliance required for the company is much lesser than the overall compliance requirement.

Filing of an LLP Agreement

The rights and the duties of the partners in the LLP are rightfully governed by the LLP Agreement. It is required to file the LLP agreement within 30 days after the incorporation of the LLP has been done. If one fails to file the LLP agreement within the specified time he has to pay a penalty of Rupees 100 every day. One can be charged a fine up to any limits.

LLP stationery

LLP Seal: The LLP seal is necessary for opening an account in the bank of a definite company. It is also required for applying for PAN.

Letterhead- A letterhead is created along with the name and the registered office of the particular LLP.

Book of accounts- A book of accounts is an essential requirement. It can be maintained both manually and through electronic devices.

LLP Pan Application- The PAN application to apply for getting the PAN through an online process.

LLP Bank Account Opening

There are certain documents that are essential to open an LLP bank account-

A copy of the agreement of the LLP, the incorporation document, LLP registration certificate, LLP-IN which is issued by the ROC and Pan Allotment letter is required.

Certain advantages and the creation of the Limited Liability Partnership

- Limited Liability-

It is seen that all the partners are equally responsible for the development of the firm. No partner alone is responsible alone for the total profit. There tends to arise a dispute when it comes to sharing the profit. This is why many people hesitate to become partners.

- Separate Entity-

The LLP is considered a completely separate entity. It can have a personal name and is liable for his actions.

Right to sued and be sued-

It can both sue or be sued in turn.

- Simplicity-

The process of forming the LLP and maintain it is very simple. The definite meeting, resolution are not essential to carry this out.

Other advantages include its perpetual existence, the limited number of members and a large number of partners.

Creation of the Limited Liability Partnership

2 people are the minimum requirement to form an LLP, whereas no limitations are put when it comes to the maximum number of partners who can participate.

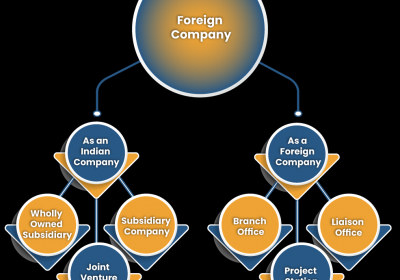

There are certain people like individuals, limited liability partnerships, companies, Foreign Limited Liability Partnerships and foreign companies who can participate.

Conversion of Partnership Firm into LLP

The partnership can be converted into LLP. This is done due to the following reasons-

- Limited Liability for PARTNERS-

This accounts to be one of the most important drawbacks. This is why most people are scared to participate in it. On the other hand in the LLP it is seen the partners to be responsible or liable for their contribution to the firm, They are not awarded individually.

- Perpetual Existence-

There stands to be a perpetual existence of the partners. The existence of the partner is not at all dependent on other partners. There occurs a change in the partners who participate in the LLP. Therefore the conversion of the partnership is essential which helps to maintain individualism.

- Unlimited partners-

This is another major cause of conversion. The minimum number is always fixed the participation can exceed to any level.

- Better credit access-

Easier bank loans are provided to the partners. They are given their assets are credits equally and they get their awards for their contribution. They also have a much efficient system of management which is essential in a Limited Liability Partnership. Therefore is always preferred.

- Potential Growth-

The amalgamation and merger of the business greatly help to unlock many business strategies. The LLP, in turn, can also easily merge with other LLP which helps in a notable amount of growth in the business profits.