Table of Contents

Cancellation and revocation of Registration under GST

You want to cancel your GST (Goods and Services Tax) registration because GST does not apply to you or because you are closing your business or profession. Or there is some other valid reason due to which you want to cancel your GST registration. For certain reasons, the registration granted under GST shall be cancelled. In case of death of a registered person, the cancellation can be initiated by the department or by the registered person, or by legal heirs. In the event that the registration has been cancelled by the Department, a cancellation provision will be made.

Meaning of cancellation of registration:

Cancellation of GST registration simply means that the taxpayer will not be a GST registered person any more. He will not have to pay or collect GST. GST Cancellation can be a suo motto by or against the GST Officer in reply to an application submitted by the GST Registered Individual. GST registration can be cancelled in the following circumstances:

- The enterprise has been stopped (the death of the owner, the relocation of the business in amalgamation, demerger may be the reason)

- Changes in the corporate constitution

- GST The registered person is not legally liable to be registered under the GST (the explanation could be that the turnover of the company is below the threshold)

- Where a registered GST individual violates the provisions of the Act

- If a registered GST individual does not file a GST return,

- When GST Registration has been acquired by fraud, deliberate misstatement or omission of facts

- Whenever an individual receives Voluntarily GST Registration and does not enter into activity after registration under GST within six months from the date of GST Registration, the GST Officer has the right to cancel the GST Registration.

APPLICABLE FORMS FOR GST REGISTRATION CANCELLATION

- GST REG-16 is for giving the application for cancellation of GST Registration

- GST REG-17 is for giving the show cause notice for cancellation of GST Registration

- GST REG-18 is for giving the show cause Notice issued for cancellation for GST Registration

- GST REG-19 giving the order to cancellation of GST Registration.

- GST REG-20 is for giving the order to leave the proceedings for cancellation of GST Registration

- GST REG-21 is for giving the revocation of cancellation of GST Registration

- GST REG-22 is for giving the order for revocation of cancellation of GST Registration

- GST REG-23 is for giving the show cause notice to rejection of application for revocation of cancellation of GST Registration.

- GST REG-24 is for giving the rejection of application for revocation of cancellation of GST Registration.

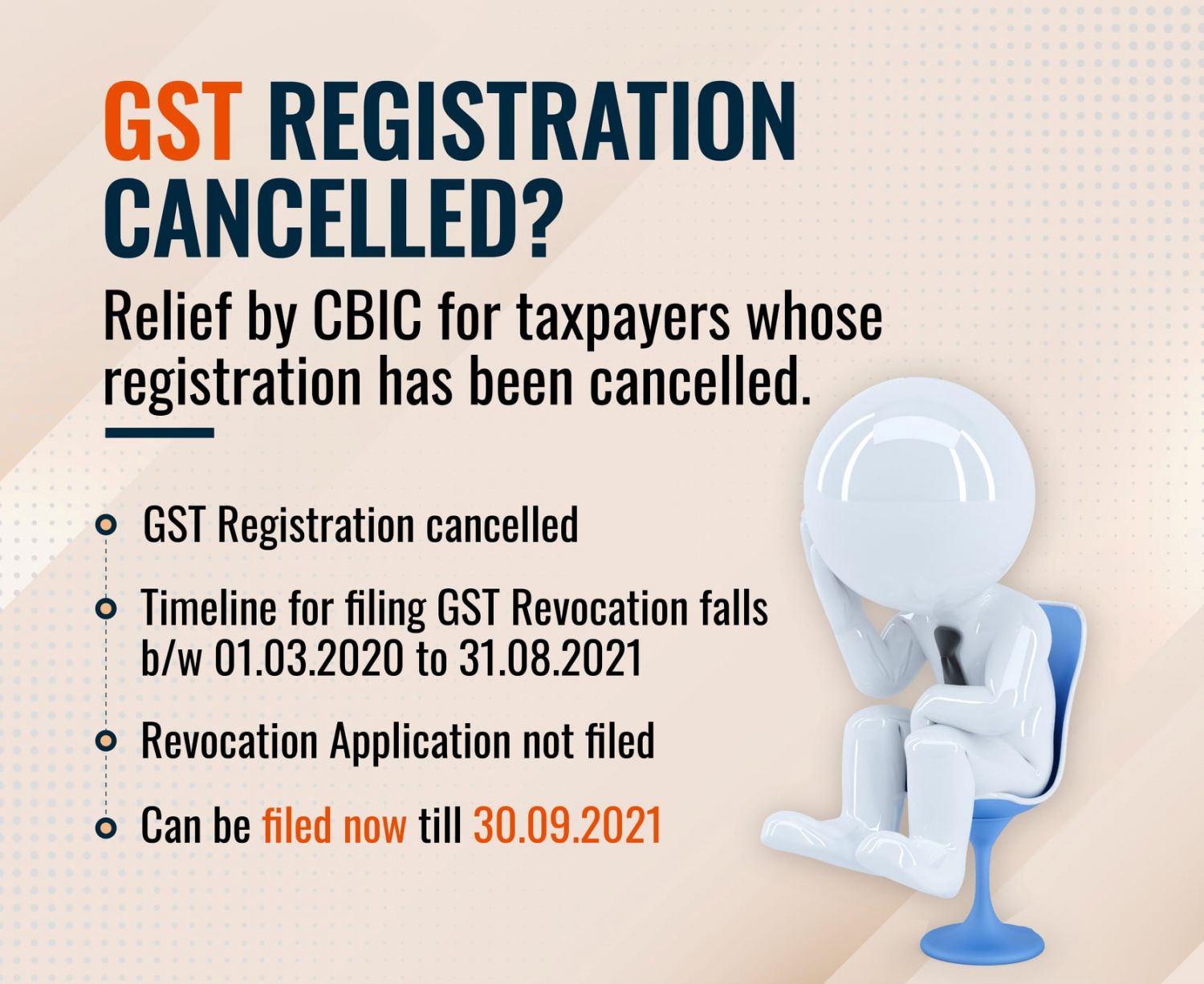

When is the cancellation revocation applicable?

It means the decision to cancel the registration under the GST act has been reversed and the registration is still valid. within thirty days from the date of the cancellation order for revocation of the cancellation registered person shall apply to the proper officer. This revocation can be done after the cancellation of registration..

Time Period (Limit) for Revocation

Any registered taxable person can apply for revocation of cancellation of Goods and Services Tax registration within a period of 30 days from the date of service of the order of cancellation of GST registration. It must be noted that the application for revocation can be done only during the situations when the registration has been cancelled by the proper officer on his own motion. Hence, revocation cannot be used when GST registration was cancelled voluntarily by a taxpayer. This happens only if, on its own motion, the tax officer has cancelled the registration of a taxable individual. Such a taxable person can apply to the cancellation officer within thirty days from the date of the cancellation order.

Application for Revocation

Application in form GST REG-21 needs to be filed by the registered person, for revocation of GST registration, either directly or through a facilitation centre notified by the Commissioner.

Steps of Online Revocation of GST Registration

- Access the GST Portal at www.gst.gov.in.

- In order to enter into the account, enter the username and appropriate password.

- In the GST Dashboard, select services, under services select registration and further under registration select application for revocation of cancelled registration option.

- Select the option of applying for revocation of cancelled registration. In the select box, enter the reason for the revocation of GST registration cancellation. Further, you need to choose an appropriate file to be attached for any supporting documents and you need to select the verification checkbox and select the name of the authorized signatory and fill up the place filed box.

- The final step would be to select submit with DSC or submit with EVC box.

Kinds of Cancellation of Registration

While a taxpayer can opt to cancel registration himself, a Proper Officer can is also authorised to do so. The provisions related to this are covered in section 29(1) of the CGST Act 2017.

- Cancellation of GST registration by a registered person (or his legal heirs)

- Cancellation of GST registration by the Proper Officer.

Cancellation of GST registration can be done by: -

- Tax Officer

- On Requisition by Taxpayer

- If Turnover is less than 20 Lakh

- But Application for cancellation (in case of voluntary registrations made under GST) can be made only after one year from the date of registration.

- Legal heirs in case of death of the taxpayer

If GST Registration has been terminated by the GST Officer in response to an application submitted by the registered person and the registered person wishes to re-open his GST Registration, he must apply for a new GST Registration.

If the GST Registration of any registered dealer is cancelled on its own motion by the GST officer, the registered individual can apply for the cancellation of registration under Section 30 of the CGST Act, 2017. If we wish to cancel the registration, we must apply our application in FORM GST REG-21 to the GST Officer within thirty days from the date of operation of the cancellation order.

Note: No appeal for revocation shall be filed if the registration has been revoked for failure of the registered individual to submit the returns, unless the returns have been filed as well as any taxes due have been paid.

Upon receiving the request for revocation, in the form GST REG-21, if the officer is comfortable with the justification/revocation of the GST Registration, the cancellation of the registration in the form FORM GST REG-22 shall be revoked.

If the reply provided by the registered individual is not acceptable, the GST Officer may issue an order for refusal of the request for revocation of the cancellation and order in FORM GST REG-22, where it is stated that the GST Officer must issue a notice of revocation in FORM GST REG-23, asking the applicant why the request submitted for revocation pursuant to sub-rule (1) of the Rule

The application would be Rejected

If a GST officer is not satisfied with to revocation application, the officer will issue a notice in form GST REG-23. On receipt of the notice, the applicant is required to furnish a suitable reply in form GST REG-24 within a period of 7 working days from the date of service of the notice. On receipt of a suitable reply from the applicant, the officer is required to pass a suitable order in form GST REG-05 within a period of 30 days from the date of receipt of a reply from the applicant.

SOP for extension of time limit to apply for revocation of cancellation of registration

- Standard Operating Procedure (SOP) for implementing section 30 of the CGST Act, 2017 and rule 23 of the CGST Rules, 2017's provision of extending the time limit to request for reversal of cancellation of registration.(CGST Circular 148/04/2021- GST)

- Caution: when you're a GST Registered individual who has a good deal and an inventory in hand and by any mistake (due to a lack of understanding of GST law) your GST number is cancelled,

- it is suggested that before continuing with the submission of any reply to the GST Officer, please ensure that you have adequate knowledge of GST law or consult with the GST Professional because, presently, the GST Department is very stringent in GST Law.

You can take help from Rajput Jain & associates for revocation of GST registration