Arun Jaitley recalls the measures — like GST, FDI, demonetisation, etc. — taken by the NDA government in the past four years that have impacted the economy of the country.

The government estimates 7.2-7.5% GDP growth in the second half of the current FY18.

Fiscal deficit for 2017-18 at 3.5% and projected for 2018-19 at 3.3%

Divestment target for 2018-19 has been set at Rs 80,000 crore

Proposed spending on rural infra is Rs 14.34 lakh crore.

Rs 5 lakh per family annually to be given for medical reimbursement under the National Health Protection Scheme.

Impact on Taxation in Budget 2018

- No change in Tax Rate. All persons including individuals, HUF, Firms and Companies to pay the same tax. However, the Education cess is being increased from 3 to 4 % to be known as Education and Health cess.

- However for Domestic Companies having total turnover or gross receipts not exceeding Rs 250 crores in the Financial year 2016-17 shall be liable to pay tax at 25% as against the present ceiling of Rs 50 crore in the Financial year 2015-16.

- Long term Capital gain exemption under section 10(38) in respect of listed STT paid shares being withdrawn.

- However, capital gain up to 31.1.2018 shall not be taxed as the cost of acquisition will be taken as Fair Market Value as of 31.1.2018.

- Tax on STT paid long term capital Gain will be 10% under Section 112A. Further such tax will be liable for TDS.

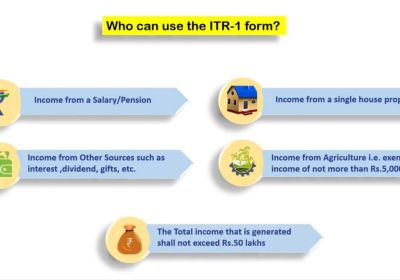

- Standard Deduction of Rs 40,000 for salaried employees. However, the benefit of transport allowance of Rs 19,200 and Medical Reimbursement of Rs 15,000 under Section 17(2) is being withdrawn. Thus net benefit to the salaries class is only Rs 5,800.

- Provision of Section 43CA, 50C and 56(2) (x) being amended to allow 5% of sale consideration in variation vis a Vis stamp duty value. On account of location, disadvantage etc.

- Provision of sections 40(IA) and 40A (3) and 40A (3A) are being made applicable to Charitable Trust. Hence expenditure incurred without deduction of tax and in cash will not be eligible as the application of income under section 10(23C) and section 11(1) (a).

- Agriculture Commodity Derivative income /loss is also not to be considered as speculative under section 43(5).

- Income Computation and Disclosure Standards (ICDS) being given statutory backing in view of the decision of Delhi High Court decision.

- Marked to market loss computed as per ICDS to be allowed under section 36.

- Gain or loss in Foreign Exchange as per ICDS to be allowed under new section 43AA.

- Construction Contract income to be computed on percentage completion method as per ICDS.

- Valuation of Inventory including Securities to be as per ICDS.

- Interest on compensation, enhanced compensation. Claim or enhancement claim and subsidy, incentives to be taxed in the year of receipt only as per new Section 145B.

- Conversion of stock in trade to a capital asset to be charged as business income in the year of conversion on Fair Market value on the date of conversion.

- 54EC benefit of investment in Bonds to be restricted to Capital gain on land and building only. A further period of holding being increased from 3 years to 5 years.

- PAN to be obtained by all entities including HUF other than individuals in case aggregate of financial transaction in a year is Rs 2, 50,000 or more. All directors, partners, members of such entities also obtain PAN.

- All companies irrespective of income to file returns and in case it is not filed, companies will be liable for prosecution irrespective of the fact whether it has a tax liability of Rs 3,000 or not.

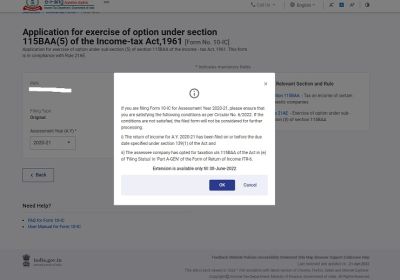

- Assessments to be E assessment under new section 143(3A).

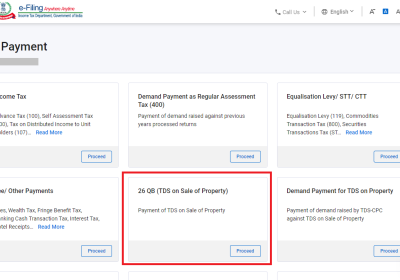

- No adjustment under section 143(1) while processing on account of mismatch with 26AS and 16A.

- Deemed dividend to be taxed in the hands of the company itself as Dividend Distribution of tax @ 30%.

- Penalty for non-filing financial return as required under section 285BA being increased to Rs 500 per day.

- PAN to be used as Unique Entity Number for non-individuals from April 1.

- Govt makes PAN mandatory for any entity entering into a financial transaction of Rs 2.5 lakh or more.

INDUSTRIAL IMPACT ANALYSIS

- This budget will accelerate economic growth, it is focused on all sectors: PM Modi

- Prime Minister Narendra Modi praises his finance minister Arun Jaitley for delivering a budget that is “farmer-friendly, common citizen-friendly, business environment-friendly and development-friendly.”

- Govt’s health scheme to cover 10 crore poor families is the world’s largest government-funded health protection scheme.

- Arun Jaitley proposed to tax long term capital gains exceeding Rs 1 lakh at 10 per cent without indexation.

- Electronic IT assessment will be rolled out across the country, leading to greater efficiency and transparency: FM

- Mobile phones are set to become costlier as custom duty on them has been increased to 20 per cent.

- Health and education cess has been increased to 4 per cent.

- For senior citizens, exemption of interest income on bank deposits raised to Rs 50,000: FM Jaitley

- FM Jaitley proposes to introduce a tax on distributed income by equity-oriented mutual funds at 10 per cent.

- Standard deduction of Rs 40,000 for salaried employees in lieu of transport and medical expenses: FM Jaitley

- Companies with turnover of up to Rs 250 crore to be taxed at 25 per cent: FM

- Arun Jaitley says that the government does not propose any changes in tax slabs for the salaried class this year.

- FM proposes a fiscal deficit of 3.3% of GDP for 2018-19.

- Finance Minister Arun Jaitley proposes revising emoluments as per the following structure:– Rs 5 lakh for the President of India

— Rs 4 lakh for the Vice President

— Rs 3.5 lakh for the Governors - Jaitley also proposes the automatic revision of emoluments of Parliamentarians every five years, indexed to inflation.

- We have already exceeded our disinvestment target, announces Arun Jaitley.

The disinvestment target for 2017-18 has been exceeded and will reach Rs 1 lakh crore. Target for 2018-19 is Rs 80,000 crore. - 5 lakh WiFi hotspots will be set up in rural areas to provide easy internet access.

- The government will take all steps to eliminate the use of cryptocurrencies that are funding illegitimate transactions.

- Govt announces Amrut program to focus on the water supply to all households in 500 cities. Water supply contracts for 494 projects worth Rs 19,428 crore will be awarded: FM

- NITI Aayog will establish a national programme to direct our efforts in the area of Artificial Intelligence towards national development: FM

- Airport capacity to be hiked to handle 1 billion trips every year.

- Arun Jaitley says that 4,000 km of new railway track will be laid down by 2019.

- All railways stations with footfall of more than 25,000 to have escalators, says the Finance Minister.

- Mumbai transport receives Rs 40,000 crore.

- The government will undertake redevelopment of 600 major railway stations across the country.

- Arun Jaitley announces a capital expenditure of Rs 1,48,528 crore for Indian Railways in 2018-19.

- National Heritage City Development Augmentation Scheme has been undertaken to preserve and protect heritage cities in the country, announces the Finance Minister.

- Government to contribute 12 per cent of EPF contribution for new employees in all sectors: FM

- Infrastructure is the growth driver of the economy: Jaitley

- The target of 3 lakh crore for lending under PM Mudra Yojana: FM

- MSME enterprises are a major element for growth, says Jaitley. He also added that mass formalization of the MSME sector is happening after demonetization and GST.

- Govt will launch a health scheme to cover 10 crores, poor families, Arun Jaitley says.

- The Government is slowly but steadily progressing towards universal health coverage

- The government aims to bring 60 crore bank accounts under the Jan Dhan Yojana.

- Eklavya schools to be started for Scheduled Tribe populations: Finance Minister

- Rs 600 crore allocated to Tuberculosis patients undergoing treatment.

- Govt will set up two new Schools of Planning and Architecture, says Finance Minister Jaitley.

- To tackle brain drain, Jaitley announces a scheme to identify bright students pursuing B Tech in premiere engineering institutes, and providing them higher-education opportunities in the IITs and IISc. These students will receive handsome fellowships and will be expected to dedicate a few hours to teach in higher education institutions weekly.

- Specialized railway university to be set up at Vadodara.

- Jaitley proposed integrated BEd programmed for teachers: “training of teachers during service is essential.” Technology will be the biggest driver in improving the quality of education.

- The budget allocates money for social security and protection programme for all widows and orphaned children.

- We have a target to provide all Indians with their own homes by 2022, says Jaitley.

- Ujjwala scheme to amplify targets will now provide 8 crore, rural women, free LPG connections.

- Air pollution in Delhi-NCR has been a cause of concern, govt has proposed subsidized machinery for in-situ management of crop residue in Punjab, Haryana, Uttar Pradesh and NCT Delhi.

- Govt of India will take necessary measures to put in place measures for the state government to purchase surplus solar power produced by local farmers at suitable prices.

- Arun Jaitley proposes a sum of Rs 500 crore for ‘Operation Green’ on the lines of ‘Operation Flood’.

- The food processing sector is going at an average of 8 per cent per annum.

- We have been saying it for years that India is primarily an agricultural country: Jaitley

- Arun Jaitley on Minimum Support Price of agricultural products: Only increasing the MSP is not enough, the government will fix the MSP of agricultural products at 1.5 times the market rate.

- Our emphasis is on generating higher benefits and productive employment for the farmers: Jaitley while addressing the agricultural sector in his Budget speech 2018.

- Our government has worked sincerely, and without weighing the political costs, hoping that benefits are delivered to people at their doorsteps. The Direct Benefit Transfer system of India is a success story that is reiterated across the world: Jaitley.

- This year’s Budget will particularly focus on agriculture, says Jaitley.

- The finance minister also pointed out that India is one of the fastest-growing economies in the world.

- The Indian economy has performed very well since our government took over in May 2014, says Arun Jaitley.

SECTOR-WISE ANALYSIS IN BUDGET 2018

budget impact on Banking and Financial Sector

The government’s decision to impose long-term capital gains tax on equity investments may dent investor sentiment for financial services companies, life insurers and providers of mutual fund products including IDFC Ltd., Reliance Capital Ltd., Aditya Birla Capital Ltd., ICICI Prudential Life Insurance Co Ltd., HDFC Standard Life Insurance Co Ltd., General Insurance Corp of India

budget impact on Defense Sector

Jaitley praised the armed forces and promised an industry-friendly policy to promote defence production as he addressed parliament. But there was no indication of a huge boost to defence spending. Companies such as Bharat Forge Ltd. may not see a boost.

Impact of budget on the agriculture sector

Farmers have been protesting across the country. This budget promises to raise the minimum price offered to farmers for crops while investing heavily in agricultural markets across India. It also delivers more money for rural areas, including irrigation projects and aquaculture projects, and directs state governments to purchase extra solar power generated by farmers using solar-powered pumps. Agriculture-focused companies such as Shakti Pumps India Ltd., Jain Irrigation Systems Ltd., KSB Pumps Ltd., Kirloskar Brothers Ltd., Avanti Feeds Ltd., Waterbase Ltd., JK Agri Genetics Ltd., PI Industries Ltd. could benefit.

Health Care Providers

The government’s new flagship National Health Protection Scheme, which aims to ensure as much as 500 million people for up to 500,000 rupees a year of care, could benefit companies such as Apollo Hospitals Enterprise Ltd., India’s largest hospital company, as well as Fortis Healthcare Ltd.

Effect of budget on Transport Companies

With Jaitley promising record infrastructure spending on roads and railways, construction and engineering firms, as well as train wagon producers, could benefit. That includes Larsen & Toubro Ltd., Hindustan Construction Co Ltd., NCC Ltd., IRB Infrastructure Developers Ltd., Dilip Buildcon Ltd., Titagarh Wagons Ltd., and Cimmco Ltd.

FOR Consumer Companies in budget

With boosted spending on India’s vast hinterland, fast-moving consumer goods companies such as Hindustan Unilever Ltd., Britannia Industries Ltd. and Marico Ltd. could benefit as day labourers get jobs and disposable income. Other companies with rural exposure include Hero MotoCorp Ltd., Mahindra & Mahindra Ltd., Larsen & Toubro Ltd.

Budget effect on Jewelers

Gold necklaces hang on display at a jewellery store in Pune. With 60 percent of gold demand coming from rural India, the budget’s focus on boosting rural and farm incomes could benefit companies such as Titan Co Ltd., Tribhovandas Bhimji Zaveri Ltd., PC Jeweller Ltd.

Impact of budget on Airports

With the government pledging to expand regional airport construction, firms such as GMR Infrastructure Ltd. and GVK Power & Infrastructure Ltd. could benefit.