Table of Contents

- Pre Compliances

- Required Conditions Of A Foreign Company Open A Branch Office In India,

- Procedures For Setting Up A Branch Office In India By A Foreign Company:

- ï‚· Procedure For Approval From Rbi:

- Things Required To Be Done Along With Approval From Rbi:

- Procedure After Getting The Rbi Approval:

- Post Incorporation Of Other Business Licenses Applicable For A Foreign Company;

- Audit Of Accounts Of Foreign Company

Pre Compliances

REQUIRED CONDITIONS OF A FOREIGN COMPANY OPEN A BRANCH OFFICE IN INDIA,

- The name of the Indian Branch office shall be the same as the parent company.

- The Branch office does not have any ownership, it is just an extension of the existing company in a foreign country.

- All the expenses of the BRANCH office are met by the head office if it does not have the revenue from Indian operations.

- The foreign parent company looking to start a Branch office in India shall have a profitable track record during the immediately preceding five years in the home country.

- The Net Worth i.e. total of paid-up capital and free reserves, less intangible assets as per the latest Audited Balance Sheet or Account Statement certified by a Certified Public Accountant or any Registered Accounts Practitioner by whatever name shall be not less than or equal to USD 100,000.

- A branch office is suitable for foreign companies looking to set up a temporary office in India and not interested or not planning to have long term plans for the Indian operations; except banking, shipping and airlines, etc. mentioned above.

PROCEDURES FOR SETTING UP A BRANCH OFFICE IN INDIA BY A FOREIGN COMPANY:

- Approval from RBI– Permission for setting up branch offices is granted by the Foreign Exchange Department, Reserve Bank of India, Central Office, Mumbai (note – Not by the RBI offices in respective state capitals)

- Track Record of the company -Reserve Bank of India considers the track record of the applicant company, the activity of the company proposing to set up an office in India as well as the financial position of the company while scrutinizing the application. (note – for setting up a company, there are no criteria for checking the track record or financial position of the parent company)

- The applications from such entities in Form FNC (Annex-1) will be considered by Reserve Bank under two routes: The application in the prescribed form (Form FNC)should be submitted to the RBI through the Authorized Dealer bank.

- Reserve Bank Route— where principal business of the foreign entity falls under sectors where 100 percent Foreign Direct Investment (FDI) is permissible under the automatic route.

- Government Route— where principal business of the foreign entity falls under the sectors where 100 per cent FDI is not permissible under the automatic route. Applications from entities falling under this category and those from Non – Government Organizations / Non – Profit Organizations / Government Bodies / Departments are considered by the Reserve Bank in consultation with the Ministry of Finance, Government of India.

ï‚· Procedure for Approval from RBI:

- Currently, as per the RBI Requirement, the application for the branch office and BRANCH office is submitted through the Authorized dealer. The authorized dealer means the various institution having banking licenses.

- The application in the prescribed form (Form FNC) should be submitted to the RBI.

- Documents required for Foreign Company Open a Branch Office in India

The following filings are required to open a branch office in India:

- Form FNC 1 (Three copies)

- Letter from the principal officer of the Parent company to RBI.

- Letter of authority from the parent company in favour of a Local Representative.

- Letter of authority/ Resolution from the parent company for setting up the BRANCH office in India.

- Comfort letter from the parent company intending to support the operation in India.

- Two copies of the English version of the Certificate of Incorporation, Memorandum & Articles of association (Charter Document) of the parent company duly attested by the Indian embassy or notary public in the country of registration.

- Certification of Incorporation - Translated & duly notarized and properly authenticated.

- The Latest audited Balance sheet and annual accounts of the parent company duly Translated notarized for the past three years and properly authenticated

- Name, Address, email ID, and telephone number of the authorized person in the Home Country.

- Details of Bankers of the Organization the Country of Origin along with the bank account number

- Commitment from the Organization to the effect that it will be open to report / opinion sought from its banker by the Government of India / Reserve Bank of India

- The expected funding level for operations in India.

- Details Relating to address of the proposed local office, number of persons likely to be employed, number of Foreigners among such employees, and address of the head of the local office, if decided

- Details of Activity carried out in Home Country by the applicant organization in brief about the product and services of the company in Brief.

- Bankers Certificate

- Latest Proof of identity of all the Directors - Properly Certified by Banker in Home Country and duly authenticated

- Latest Proof of address all of the Directors - Properly Certified by Banker in Home Country and duly authenticated

- Details of the Individuals / Company holding more than 10% of Equity

- Structure of the Organization and its Shareholding pattern

- Complete KYC of Shareholders holding more than 10% Equity in the Applicant Company

- Resolution for Opening up Bank Account with the Banker

- Duly Signed Bank Account Opening Form for Indian Bank

Note:

- We can assist in getting all these documents, wherever required prepared and advice on various issues relating to this. Please feel free for clarification, if any is required in this regard.

- The above list is not exhaustive and may differ depending upon the requirement from the authorized dealer.

THINGS REQUIRED TO BE DONE ALONG WITH APPROVAL FROM RBI:

- Acquiring property in India

- Branch Offices of a foreign entity are permitted to acquire property for their own use and to carry out permitted/incidental activities but not allowed to buy for the purpose of renting it out

- Entities from Pakistan, Bangladesh, Sri Lanka, Afghanistan, Iran, Bhutan, or China are not allowed to acquire immovable property in India even for a Branch Office. These entities are allowed to lease such property for a period not exceeding five years

PROCEDURE AFTER GETTING THE RBI APPROVAL:

Every BRANCH office registered with RBI shall get itself

registered with the Ministry of Corporate Affairs; it is a registration by the BRANCH office as an establishment of a foreign company in India. On such registration, a CIN i.e. Corporate Identity Number is allotted by the Registrar of Companies.

The following documents shall be filed with the Registrar of Companies:-

- Form FC-1

- Charter, statutes or memorandum and articles of association or other Instrument constituting or defining the constitution of the company

- If the above documents are not in English then the translated version of the documents.

- Director(s) details – individuals

- Director(s) details – bodies corporate

- Reserve bank of India approval letter

- Secretary(s) details

- Power of attorney or board resolution in favour of the authorized representative(s).

- Companies have to file annually and periodically documents as mention above.

POST INCORPORATION OF OTHER BUSINESS LICENSES APPLICABLE FOR A FOREIGN COMPANY;

A BRANCH OFFICE: After Incorporation, the following requirements are also necessary for a branch office:

1. Permanent account number – pan number

2. Tax deduction number – tan number Shop & establishment

3. Registration Service Tax Registration – if the

4. Branch provides any services in India

5. GST Registration – If the Branch carries out trading activities in India

Post Compliances

Requirements of Annual Corporate Filings in India for a foreign Company while Open Branch offices in India

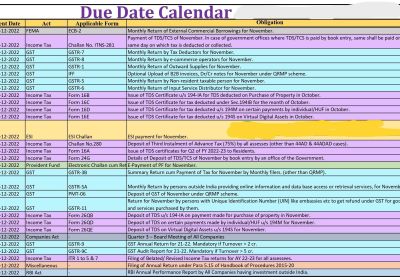

Annual Reporting by Branch Office to Various Departments:

Annual Compliance Activities required for a Branch Office:

Every year a branch office is required to undertake the following activities:

- Maintenance of Books of Account

- Getting Annual Accounts audited

- File return and pay applicable taxes along with AAC with the Income Tax department.

- Filling of Annual Activity Certificate with RBI

- Filling of Annual Return and Balance sheet with Registrar of Companies

- No additional place of business can be started unless approval is taken from RBI.

- File an Annual Activity Certificate (AACs) with RBI from the Auditors, as at end of March 31, along with the audited Balance Sheet on or before September 30THof that year, stating that the Branch Office has undertaken only those activities permitted by the Reserve Bank of India.

- (In case the annual accounts of the BO are finalized with reference to a date other than March 31, the AAC along with the audited Balance Sheet may be submitted within six months from the due date of the Balance Sheet.)

- Filling of accounts along with the list of all principal places of business in India established by a foreign company- Inform FC-3

- File annual return with Registrar of Companies (ROC) – Inform FC-4- Normal ROC Fees Rs. 6,000/-(Rupees Six Thousand)( appx )

Repatriation of funds

Profits earned by the Branch Offices are freely remittable from India, subject to payment of applicable taxes

Financial Statements

- All foreign companies registered in India are required to organize financial statements of their Indian business operations in agreement with Schedule III of the Companies Act, 2013. Thus foreign companies are required to furnish the following information/statements together with the financial statements of the company to be filed with the Registrar of Companies:

- Statement of associated party transaction,

- Statement of repatriation of profits

- Statement of transfer of funds (including dividends if any) which shall, in the relation to any fund transfer between the place of business of the foreign company in India and any other related party of the foreign company

- The documents that are referred to above in this rule must be delivered to the Registrar of Companies within a period of six months from the end of the financial year of the foreign company.

Audit of Accounts of Foreign Company

All foreign companies must get their accounts, pertaining to the Indian business operations organized in agreement with the necessities of clause (a) of sub-section (1) of section 381 and rule 4 and audited by a practising Chartered Accountant in India or a firm or LLP of practising Chartered Accountants.

Form FC-3

All foreign companies are required to file with the Registrar of Companies, Form FC-3 detailing the list of places of business of the foreign company along with the financial statements of the company.

Annual Return

The foreign companies must prepare and file the annual return of the company in Form FC-4 within a period of sixty days from the final day of its financial year. Any document which should be delivered from a foreign company can be delivered to the Registrar of Companies with jurisdiction over New Delhi.

Authentication of Translated Documents

Documents necessary to be filed with the Registrar of Companies by the foreign company must be in the English language.

If any translation is made out of India, it must be authenticated by the signature and the seal of the official with custody of

the original or a Notary of the country where the company has been incorporated. Where such translation is made in India, it shall be authenticated by an Advocate, attorney, or pleader entitled to appear facing any High Court and an affidavit, of a competent person having, in the estimation of the Registrar. Periodic Reporting by Branch Office: It will also need to inform ROC of certain changes as and when there is made.

In form FC-2

- Intimating any change in the constitution of Foreign Company to RBI & ROC

- Intimating any change in Directors of Foreign Company to RBI & ROC

- Intimating each and every change in the BRANCH office to RBI & ROC

- No additional place of business can be started unless approval is taken from RBI.

- No additional activity can be started unless approval is taken from RBI.

- A copy of the report as per the prescribed format to the DGP of the concerned state.