IBC

What are the key factors to an effective Section 29A Due Diligence

RJA 20 Nov, 2022

IBC Section 29A - Due Diligence of Resolution Applicants IBC 2016 Section 29A has establishing as one of the key essential laws in determining the eligibility of Resolution Applicants in the CIRP. The IBC, in its initial form had not inserted any regulations to prevent defaulting promoters via repurchasing or buying-back ...

Goods and Services Tax

GST applicability on compensation, liquidated damages, & penalties for contract violations etc

RJA 15 Nov, 2022

GST applicability on compensation, liquidated damages, & penalties for contract violations, among other things. The taxability of liquidity damages, cancellation fees, late payment fees, etc. arising from contract breaches is a very frequent query under GST. The issue is raised by Central Goods and Service Tax Act, 2017, Schedule II, Paragraph ...

COMPANY LAW

Tax & Statutory Compliance Calendar for Nov 2022

RJA 01 Nov, 2022

Tax & Statutory Compliance Calendar for Nov 2022 S. No. Statue Purpose Compliance Period Deadline Compliance Details 1 Income Tax tax deducted at source Certificate October -22 14- November -22 Deadline for issue of tax deducted at source Certificate for tax deducted U/s 194-IB, 194-IA, & 194M in ...

Goods and Services Tax

Haryana jurisdiction Govt 373 GST registrations cancelled of all non-filers of GSTR-3B

RJA 01 Nov, 2022

Haryana jurisdiction Govt 373 GST registrations cancelled of all non-filers of GSTR-3B upto March 2021 Gst Dept. Govt of Haryana had identified 373 active GST registered taxpayers of State jurisdiction who had not submitted FORM GSTR-3B up till March 2021. These GST taxpayers were liable to be cancelled under the provisions ...

GST Consultancy

GSTN added a new Federal Bank, total No of banks accepting GST payments to 20

RJA 01 Nov, 2022

20 Banks now Accept GST payments because to the addition of a new Federal Bank to the GSTN. A dealer who has registered for GST can generate a GST Challan on the GST Portal to pay tax, fees, penalties, interest, and other amounts. The payment methods include OTC, NEFT, RTGS, and ...

NGO

Documents to be maintenance by NGO or Trust as per New Rule 17AA

RJA 01 Nov, 2022

NGO’s Books of account & other documents to be kept and maintained- New IT Rule 17AA Central Board of Direct Taxes established new rule 17AA via income tax Notification No. 94/2022 dated August 10, 2022, which specifies the books of account and other documents that must be kept by each ...

TDS

Deadline of TDS Return filing for second QTR of FY 2022-23 Extended

RJA 27 Oct, 2022

Deadline of submitting TDS Return(Form 26Q) for second quarter of Financial Year 2022-23 extended till to 30th Nov 2022. CBDT has extended the Timeline of filing of TDS Return in Form 26Q for 2nd QTR of FY 2022-23 from 31st Oct 2022 to 30th Nov 2022. Central Board of Direct Taxes issue ...

INCOME TAX

Easy way of checking status of your Income tax refund

RJA 22 Oct, 2022

Checking status of your Income tax refund The Income Tax Department gives taxpayers the option to track the progress of their ITR refund after 10 days from the day the ITR was filed. Income Tax e-filing platform now allows taxpayers who filed their ITR more than 10 days ago to monitor the ...

INCOME TAX

Verification of Undisclosed income under 'Operation Clean Money'

RJA 21 Oct, 2022

Verification of cash deposits & other Undisclosed income under 'Operation Clean Money' On January 31, 2017 the Income Tax Department initiated Operation Clean Money to investigate the sizable cash deposits made between November 9 and December 30, 2016. This operation was started with the intention of checking the taxpayer's cash transaction history, namely if ...

GST Registration

OIDAR Service Providers GST Registration in India

RJA 21 Oct, 2022

OIDAR Service Providers GST Registration: What is an OIDAR service as per GST Act? Any company or originations giving online information & database retrieval services (OIDAR services) is needed to compulsory take GST registration in India, irrespective of the threshold for aggregate turnover, online information & database retrieval services providers ...

TDS

Equalization Levy for Online Google Ads not attached, If it does not accrue in India

RJA 17 Oct, 2022

Equalization Levy for Google Ads Online Not attached Because, If it does not accrue in India: ITAT The Equalisation Levy version 1.0 will not be applicable on Google Ads Due to Foreign Audience if recipient of service is located outside India & advertisement income is not accruing in India ...

GST Consultancy

AO not to imposed penalty without giving him the opportunity of being heard

RJA 13 Oct, 2022

A person cannot be imposed penalty under GST without giving him the opportunity of being heard What is issue: Whether or not the Petitioner is GST liable to pay GST tax along with penalty equal to 100% of tax? An e-way bill was created with a validity date of September 28, 2020. By ...

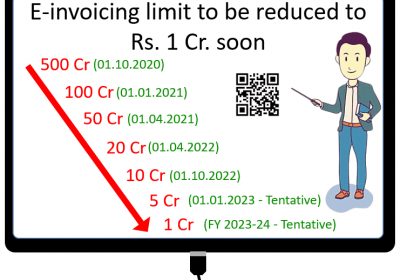

GST Consultancy

GST E-invoicing threshold limit to be decrease to INR. 1 Crore very soon

RJA 10 Oct, 2022

GST E-invoicing threshold limit to be decrease to INR. 1 Crore Very soon. Companies/Firm business with yearly Sales or annual turnover of over INR Five Cr. will have to move to e-invoicing under Goods and services tax from 1 January 2023. The Goods and Services Tax Network has asked its technology ...

ROC Compliance

Key changes in Schedule-III of the Companies Act wef FY 2021-22

RJA 30 Sep, 2022

Key changes in Schedule-III of the Companies Act which is applicable from 1-april- 2021 the MCA revised Schedule III of the Companies Act 2013 with the goal of increasing openness and giving users of financial statements more disclosures with effect from On March 24, 2021. These changes will be in effect as ...

COMPANY LAW

Tax & Statutory Compliance Calendar for Oct 2022

RJA 30 Sep, 2022

Tax & Statutory Compliance Calendar for Oct 2022 S. No. Statue Purpose Compliance Period Due Date Compliance Details 1 Goods and Services Tax GSTR -5 Sep-2022 20-Oct-22 GSTR-5 is to be filed by a Non-Resident Taxable Person for the previous month. 2 Goods and Services Tax GSTR-7- TDS ...

GST Filling

Continuous Non-Filling of GSTR-3B can be ground for GST Registration Cancellation

RJA 30 Sep, 2022

Continuous Non-Filling of GSTR-3B a Ground for Cancellation of GST Registration: CBIC Notifies Amendment to GST Rules As a consequence of the Central Board of Indirect Taxes and Custom (CBIC) amending the CGST Rules, individuals who fail to file their GST (Goods & Services Tax) reports risk having their ...

ROC Compliance

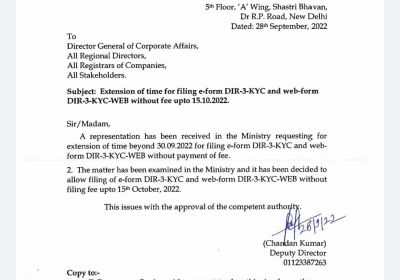

Is Dir 3 KYC date extended for FY 2022?

RJA 28 Sep, 2022

Is Dir 3 KYC date extended for FY 2022? For FY 2022-23 - all the individual who has been allotted “DPIN/DIN” on or before 31.03.2022 & status of such Director Identification Numbers is 'Approved', needs to file form DIR-3 KYC to update KYC details in the MCA system on ...

Chartered Accountants

Implications on statutory Auditor if mistake in Schedule III Format

RJA 25 Sep, 2022

What are the implications for statutory auditors in case a mistake happens Schedule III Format? No reporting or qualification in his statutory Audit Reporting with respect to mistakes or omissions in the audited financial statements vis-à-vis format specified by Schedule III of Companies Act, 2013 is being taken as ...

INCOME TAX

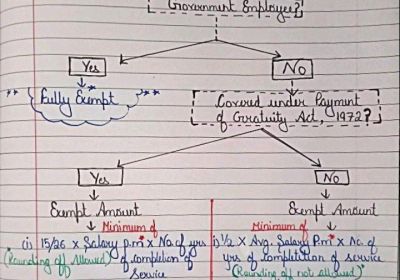

How to calculation of the gratuity amount exempted from income tax ?

RJA 20 Sep, 2022

How to calculation of the gratuity amount exempted from income tax ? When a monetary reward provided by the employer but not included in the employee's regular monthly salary is known as a gratuity. The Payment of Gratuity Act, 1972 regulates the gratuity provisions, and it is paid upon the occurrence ...

COMPANY LAW

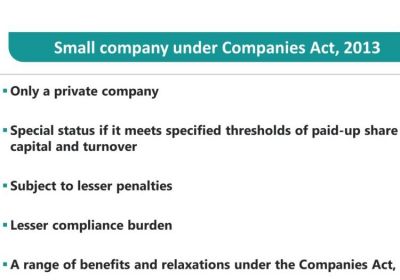

What is Change in threshold limit of small company definition?

RJA 16 Sep, 2022

What is Change in threshold limit of small company definition? Small Company many advantages over mediam & large companies, a small business promotes entrepreneurship, employment, and jobs while also being simpler to manage. Change in definition of a Small Company via Increased paid-up share capital & turnover ...

INCOME TAX

Timeline For Filling Form 67 under Income tax

RJA 15 Sep, 2022

What is Timeline For Filling Form 67 under Income tax act ? FTC would be claimed only if income tax Form-67, along with the required documents, was filling within timeline date for filing original Income-tax return in India, As per Latest amendment Income tax taxpayer restricting ability of claiming Foreign ...

GST Consultancy

GSTN Guidelines issued for prosecution in GST

RJA 07 Sep, 2022

GSTN Guidelines issued for prosecution in GST- Key Points The Central Board of Indirect Taxes & Customs has issued instructions for the Goods and Services Tax investigation officers which are to be followed while launching any prosecution proceedings exhibiting criminal charges against any person. Central Board of Indirect ...

COMPANY LAW

Tax & Statutory Compliance Calendar for Sept. 2022

RJA 01 Sep, 2022

Tax & Statutory Compliance Calendar for Sept. 2022 S. No. Statue Purpose Compliance Period Due Date Compliance Details 1. Goods and Services Tax. GST Form No GSTR -7 Tax Deducted At Source return under GST August-2022 10-Sep-22 GSTR-7 is a return to be filed by the persons who are required ...

GST Consultancy

Reopening of TRAN 1 & TRAN 2 Forms is a One-Time Opportunity

RJA 01 Sep, 2022

CBIC Guidelines on Reopening of TRAN 1 & TRAN 2 Forms is a One-Time Opportunity Central Board of Indirect Taxes and Customs has issued the guidelines in terms of the order passed by the Supreme Court in the case of UOI vs. Filco Trade Centre Pvt. Ltd. has provided the following ...