Functions & Features of Wholly Owned Subsidiary in India.

Functions & Features of Wholly Owned Subsidiary in India, Minimum criteria Pre-Conditions of 100% Wholly Owned subsidiary, Incorporate Wholly Owned Subsidiary in India,

Read MoreDigital Certificates is a description of your personality which is valid officially. Many Applications necessitates verification of the authenticity of the person e-filing. Digital Signature is identical to electronic format paper certificates. Driver’s license, membership cards or passports accounts to some of the physical certificates which serve as an identity proof for any specific purpose or designation. It guarantees you free hand to initiate any activity under lawful guidance. It is presented electronically for rightfully accessing the information on the internet. Government issues unique identity to everyone as a citizen of a country. For complying with online filing, it is mandatory to own a digital certificate from the respective body in power.

We provide digital signature certificates for different purposes:

MCA 21 accounts to an e-governance program launched by Ministry of Company Affairs. Under the said MCA21 program, new e-forms have been notified vide GSR No. 56(E) dated 10.02.2006 and statutory filing, in the office of ROC would be based on the new e-forms only. Digital Signature Certificate issued by E mudra or TCS is required in order to make these new e-forms legally recognized and authenticated. These Digital Signature Certificate used for e-forms has legal recognition and validity same as handwritten signatures. Elaborated MCA21 program is available at www.mca.gov.in.

A digital Signature certificate authorizes the sender’s identity by documentation filing through internet which cannot be opposed by the sender. A Digital Signature Certificate is not only a digital equivalent of a hand written signature but also it adds extra data electronically to any message or a document where it is used to make it more accurate and more reliable. It is as an assurance for no data tampering after the document has been signed digitally. Renewal of DSC is required after the validation period of 1-2 years.

MCA is accepted by the industries and other professionals as an effective e-government project. It is completely an online process. New set of e-forms are especially designed for this project. These e-forms are available in different file formats and can be easily downloaded from the MCA Website, www.mca.gov.in, which is approachable round the clock i.e. 24x7 hours making filing of the e-forms also possible at any time of 24x7.

INTEGRAL PARTS OF A DIGITAL SIGNATURE CERTIFICATE

USE OF DIGITAL SIGNATURE CERTIFICATE

Digital Signature Certificate can be utilized to enter secured zones of web sites where member login is needed, surpassing the requirement of mentioning the user name and password. It insures by means of verification and validation that the user is the one whom he/she claims to be. This is processed by amalgamating the user credentials to digital certificate and the method uses one point of authentication. Digital certificates ensure confidentiality and that the messages can only be read by the recipients which are intended and authorized. These certificates verify date and time to escape the dispute of reception and sending of the messages.

SOFTWARE REQUIRED FOR RUNNING OF DIGITAL SIGNATURE CERTIFICATE

E-filing makes it compulsory to obtain a class 2 Digital Signature Certificate and a computer system which runs the following software given the internet access:

TYPES OF DIGITAL SIGNATURE CERTIFICATE

Digital Signature Certificates has 3 categories namely Class1, Class 2 And Class 3

PROFESSIONALS WHO REQUIRE DIGITAL SIGNATURE CERTIFICATE

Signing of the manual documents and returns by the authorized signatories filed by ROC is required to obtain Digital Signature Certificate (DSC) under MCA21 provision. The following department has to procure Digital Signature Certificate:

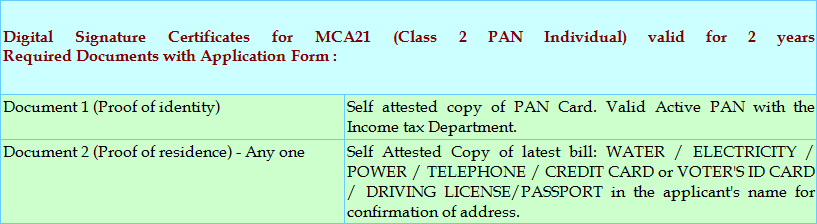

CREDENTIALS REQUIRED WITH APPLICATION FORM

SENDING DIGITALLY SIGNED MAIL

You can use Digital Signature Certificate for signing your e-mails sent through Outlook Express / MS-Outlook. It authenticates your identity along with assuring the receiver that the mail is received from you only. It also ensures that the content of the mail is not manipulated in transit and the mail received by the receiver is the same what you have sent.

WHY USB E-TOKEN?

You can locate the information about Digital Signature Certificate (DSC) in the certificate section of internet options in your computer. But storing the DSC details on computer system is subjected to the following demerits:

We provide expert digital signature certificate services, which includes:

200+

550+

2009

700+

All the information related to any client is considered confidential and never be disclosed to anyone.

Having years of experience in respective areas and backed by skilled and experienced workforce keep us ahead.

We believe in the building the good relationship with the clients that ensures the great impression.

If you are not happy with our services then you can request a refund within 30 days.

We provide 24*7 supports through phone, email and live chat.

You can pay online through EMIs, PayPal, net banking, debit card, credit card and more.